I believe the sovereign debt problems will steadily escalate and turn into a global crisis later this year,

and that a downgrade of Britain, sometime this summer, will be the tipping point. England is going broke.

A domino effect of nation states defaulting on their obligations will lead to deleveraging and outright deflation.

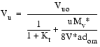

The signs are here allready; recent increases in broad money supply have wound up as the big banks' excess reserves,

which have increased close to 1,2 trillion in less than two years. Velocity is dropping, and the multiplier is now at ~ 0,8.

The post 1971 Bretton Woods era, with loose fiscal policy and ever increasing leverage, is coming to an end. We have reached debt saturation.

Leviathan is slowly commiting suicide, like a parasite killing it's host, bringing down the unsustainable nanny state. The moochers will riot, as in Greece.

When the next real buying opportunity comes along, perhaps in late 2012, the old adage “Buy when there’s blood in the streets” will again be literal.

Deflation is in reality a bullmarket in money itself, and few assets will be able to appreciate under such circumstances. Gold will hit $740 and SPX at least 580.

The US Dollar will again be king, again going beyond parity with the Euro, and Treasuries maybe make new all time highs in the initial stages of of the crisis.

CRB failed to take out the 2001 low during the crash of 2008-9, but this time will make it down to ~170, while Copper finds it's way back to the base at $80.

Crude too will make new lows, with $24 as a minimum, but could even drop well below that. One exception is Agriculture, which has strong fundamentals.

German Bunds and Swiss Francs should also be amongst the winners next couple of years, when quality bonds and currencies will be the easyest to trade.

Quality is here meant in a relative sense, they are all more or less flawed. The safest bet is to go with increasing spreads between the bad and the ugly.

The good will come later, gold and silver should pick themselves up after the implosion, when the inevitable writeoffs are done and leverage become sane.

More charts here, including BRICs and PIIGS.

China too is on the verge of a spectacular collapse, and is in no position to surpass US as the leading economy.

Never bet against America!

Edited by liberatorium, 26 April 2010 - 06:39 AM.