The Fed's Secret Plan

#1

Posted 20 January 2011 - 08:09 PM

Mark S Young

Wall Street Sentiment

Get a free trial here:

https://book.stripe....1aut29V5edgrS03

You can now follow me on X

#2

Posted 20 January 2011 - 08:17 PM

#3

Posted 20 January 2011 - 08:28 PM

#4

Posted 20 January 2011 - 08:38 PM

The Fed will then orchestrate a more serious decline

Thanks Mark, the only part I disagree is that Fed cannot orchestrate anything but inflation. Almost all of their inflation and monetary control mechanisms caused severe recessions and stock market crashes including last May's. It is not possible to deleverage naturally out of the current situation and it is badly needed in the long term. This simply means we will continue to add more and more unproductive debt and collapse the economy under its own weight. Fed will be unsuccessful, if this happens.

The only way out of the current situation is they delay the inevitable long enough and a REAL growth emerges to take the stock market and optimism to a new bubble. But unfortunately, that's about it [I mean the debt or at least its interest will have to be still paid]. Without a new growth wave out of the American economy, Fed and bankers are toast, it will all come around a full circle back to them as a forceful deleveraging at that point. Hope that the real growth returns by a real growth sector, I don't see it yet, maybe nano-machines, maybe bio-tech, maybe some other means that can benefit the consumer and make the businesses more productive to defeat the weight of the unproductive debt, otherwise the bankers cannot print THEIR way to prosperity, certainly NOTHING for the productive labor...

Andiron, actually Fed is printing the reserve currency AND manipulating the world economy to some extent, actually to a great extent. It simply means, if the American economy cannot come ahead, it is likely to fall back and loose that reserve currency status. US being the most militarily strong country cannot still though handle fighting the entire world, but nuke them. As this is not possible, it is likely that US will be forced to fizzle and suck more pain up and default [or Treasuries will be treated as if a default] in that case. If the American economy can grow again, then she will remain as the king of the world, but always more and more weight of the unproductive debt on its back...

The world business people will eventually recognize the true value and move beyond the bankers, if the bankers let them. Until then, the bankers are looking to continue to remain as the tick sucking the world resources behind their backs into their accounts ANY WAY they can. Their game is not about fair and efficient resource allocation, their game is about survival after the mess they got themselves into by layers and layers of exotic debt and leveraging that they cannot get out of...

Edited by arbman, 20 January 2011 - 08:47 PM.

#5

Posted 20 January 2011 - 08:45 PM

#6

Posted 20 January 2011 - 09:00 PM

Richard Wyckoff - "Whenever you find hope or fear warping judgment, close out your position"

Volume is the only vote that matters... the ultimate sentiment poll.

http://twitter.com/VolumeDynamics http://parler.com/Volumedynamics

#7

Posted 20 January 2011 - 09:09 PM

#8

Posted 20 January 2011 - 09:29 PM

Regarding unemployment I've noticed recently that virtually anyone who has taken the time to develop skills has more work than they want. Truthfully, any skilled person willing to work can just about name their price - and they do. Construction is in terrible shape, right? Try and hire some skilled renovators to work some projects at your home and see what their hourly rate is. Same is true for almost every other trade.

We don't have a shortage of work or opportunity in this country. What we have is 43 million people on food stamps and millions more who have been conditioned to believe that it is completely honorable to sponge off of their neighbors. How pathetic!

BW

I think you hit it one the nose about "skills". But right now what has happened is that a lot of younger people in my generation have been suckered to believe that education = a skill. That a college degree sets you on the path to a higher quality of lifestyle/earning power/options. I think that was true 20 or 30 years ago, but I do not now. For those who are 35-60 years old and have a college degree and some sort of specialized skill set and credited "work history" doing those skills, I think are still doing well. This fact trickles down to their children and grandchildren so they can buy them I-PHONES, etc. The other group, the group you referenced, are those who possess a specialized skills or trade. Yes they are doing well. A directional driller on a gas rig, a skilled mechanic, etc. But we have told a generation of the best and brightest that that wasn't good enough and typically those who entered these professions at a young age were those who didn't necessarily have the aptitude or other options to continue higher education.

Yes, we do have millions and millions who are lazy and unwilling to work. I have said this before -- you cannot be at the margin anymore. A guy came in the office the other day and was talking about a wielder -- apparently not even a very good one -- who was busy making cattle guards for an oil field services company here in the Eagle Ford. They have to have them b/c they cut the fences to get the rigs, equipment into the well site. Guess what he's making per guard? $2500 a cattle guard, takes him a couple days to do one, and the funny part is that they come over and pick them right up without him having to do the install! Crazy, OTOH, I know young lawyers waiting tables, others that can't get jobs, crushing debt. These kids are smart kids, good schools, did things right or so they thought, they would break their neck for you for 50K a year, 10 hour days, a lot of these kids are smarter and more talented than tons of people lost in these bureaucratic organizations making a living wage -- but they have "no skills" or so it is perceived.

I was at dinner alone the other night and talking to this guy 45-50, said he managed a number of "Love's" brand travel stops, said that he always wanted to be a lawyer, wasn't smart enough, couldn't get in anywhere, etc. But he told me he broke $200K last year, that was America, you were willing to work and hustle and you could make a come up, things would fall into place for you. This aspect of America is declining rapidly. It is sad but true.

#9

Posted 20 January 2011 - 09:38 PM

The big assumption you make is that the Fed is competent and knows what it thinks it wants.

I've read their papers. They're a bunch of genius' in their own mind.

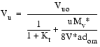

1. Let me tell you what they did with QE1. They wrote a paper and realized that when they bought the toxic assets, when payments were being made, they retired said assets to take it off their books. Well when Fed retires assets, they DESTROY MONEY. So in essence they wanted to put money into the world, but the world was paying them interest rates and they were destroying that interest payment. In essence, they were sucking money out of the world. They wrote a paper about this in august when they finally realized it. That is why you see them putting the interest payments back into buying in QE2.

2. Did you ever read the paper written by Benny and that kid from MIT on the plan for QE2 back in 2004? I did. You know what their main thesis is? Japan didn't work because people didn't believe what the Fed said it wanted to do. That's right, that's their entire thesis for why they thought QE failed in Japan. Ben is so big on what the market thinks and how he can lead it with statements so the participants go in the direction the Fed wants it to go. The entire paper is based on how they would tell the public what the Fed wants to happen, then the Fed would monitor to see if the participants worked in that direction. It is absolutely childish for these guys to throw trillions on a simple stupid concept like these. Is this the best that my country has to offer?

I'm a big believer in predestiny. This is not happening because of Ben or Geithner or any individual. They are all self-reinforcing and their choices are limited. They made those choices because THEY HAD TO. Anyone in their place would've made the same choice or they wouldn't be in their position. History wants a name and a face, but in reality, it is the entire nation/generation or whatever that's driving things.. and in my theory of grand super organism, we as humans are in the winter stage.. but out of it will come spring eventually. Assets must change hands to people with new ideas, attuned to the new realities and technologies.. get rid of the old farts with rotting ideas.. they were good when they were young, but get their finger nails off the power switch and let young guys buy up the assets at a discount and we will revive.

awesome post.

#10

Posted 20 January 2011 - 09:42 PM