Don't Like It

#1

Posted 10 December 2011 - 11:35 AM

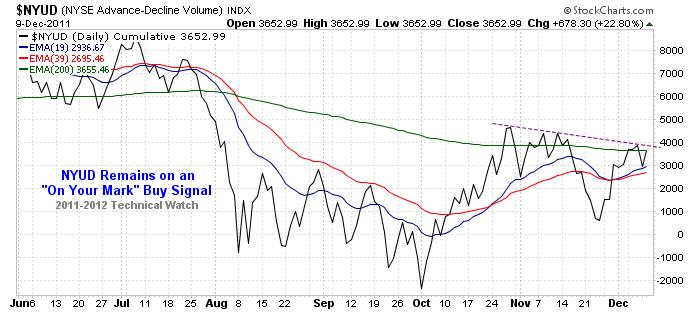

But look at this chart:

http://stockcharts.com/c-sc/sc?s=$SPX&p=D&b=5&g=0&i=p85171602053&a=74576416&r=7615.png

We're already above the 200-day ema. The 21 and 50 are beneath and close together which is usually good support. The 200-day ema is up-trending and that's a sign for many of an ended Bear Market. Worse, the cumulative A/D volume is quite positive here. Christmas is coming, too. Now, what happens if we break out of this pattern? That's right. The 200-day SMA goes. That's what happens. How many Bears will cover when that happens? How many times will we threaten to break out of this pattern but fail to do so?

Now, just think on it. What would cause the largest number of people the most consternation while benefiting the largest amount of money?

Draw your own conclusions.

Mark

Mark S Young

Wall Street Sentiment

Get a free trial here:

http://wallstreetsen...t.com/trial.htm

You can now follow me on X

#2

Posted 10 December 2011 - 11:53 AM

OK, sure, the momentum is still down and so is Selecto's indicator too. Plus we have an options oscillator Sell.

But look at this chart:

http://stockcharts.com/c-sc/sc?s=$SPX&p=D&b=5&g=0&i=p85171602053&a=74576416&r=7615.png

We're already above the 200-day ema. The 21 and 50 are beneath and close together which is usually good support. The 200-day ema is up-trending and that's a sign for many of an ended Bear Market. Worse, the cumulative A/D volume is quite positive here. Christmas is coming, too. Now, what happens if we break out of this pattern? That's right. The 200-day SMA goes. That's what happens. How many Bears will cover when that happens? How many times will we threaten to break out of this pattern but fail to do so?

Now, just think on it. What would cause the largest number of people the most consternation while benefiting the largest amount of money?

Draw your own conclusions.

Mark

si as in uno-dos and uno-dos and then tres of tres norte. now who really believes that could happen? IMO almost no except which is why old codger Senor thinks it just may happen

BSing away

Senor

#3

Posted 10 December 2011 - 12:00 PM

(I covered that short Thursday.)

Tactically, it makes zero sense to let it go at this stage, just one more BS news and one more pump to go to finish the year. Feels and looks like 2007 even with the last minute Nov rally...

I'm looking at that downtrend line, knowing that "they" are too.

But it was too tempting to not short with the low trin warning at such resistance.

This "should" be dead here.

But I don't trust 'em.

http://stockcharts.com/c-sc/sc?s=$VIX&p=D&yr=0&mn=11&dy=0&i=p24254219869&a=179964330&r=4659.png

Edited by Rogerdodger, 10 December 2011 - 12:03 PM.

BIGGEST SCIENCE SCANDAL EVER...Official records systematically 'adjusted'.

#4

Posted 10 December 2011 - 12:02 PM

#5

Posted 10 December 2011 - 12:07 PM

Richard Wyckoff - "Whenever you find hope or fear warping judgment, close out your position"

Volume is the only vote that matters... the ultimate sentiment poll.

http://twitter.com/VolumeDynamics http://parler.com/Volumedynamics

#6

Posted 10 December 2011 - 12:16 PM

Careful.Worse, the cumulative A/D volume is quite positive here

Fib

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

#7

Posted 10 December 2011 - 12:28 PM

One possibility is a 2004/2005 repeat where price holds to year's end.

Just my thinking out loud BS at this point.

http://stockcharts.com/c-sc/sc?s=$VIX&p=D&st=2004-12-01&en=2005-02-01&i=p18700805739&a=72107875&r=9845.png

http://stockcharts.com/c-sc/sc?s=$SPX&p=D&yr=0&mn=9&dy=0&i=p86417550408&a=234727006&r=522.png

Edited by Rogerdodger, 10 December 2011 - 12:30 PM.

BIGGEST SCIENCE SCANDAL EVER...Official records systematically 'adjusted'.

#8

Posted 10 December 2011 - 12:51 PM

FIB, I assume you (and other internals people) are happy with NYA stats

to divine the SPX. I ask, because half the issues on the NYSE are fixed

income plays. I note some interesting discrepancies also. For instance

BPSPX mo gives me a "sell" Friday (and was down), while BPNYA is merrily

trucking along (and was up).

Edited by selecto, 10 December 2011 - 12:55 PM.

#9

Posted 10 December 2011 - 01:06 PM

#10

Posted 10 December 2011 - 01:17 PM

OK, sure, the momentum is still down and so is Selecto's indicator too. Plus we have an options oscillator Sell.

But look at this chart:

http://stockcharts.com/c-sc/sc?s=$SPX&p=D&b=5&g=0&i=p85171602053&a=74576416&r=7615.png

We're already above the 200-day ema. The 21 and 50 are beneath and close together which is usually good support. The 200-day ema is up-trending and that's a sign for many of an ended Bear Market. Worse, the cumulative A/D volume is quite positive here. Christmas is coming, too. Now, what happens if we break out of this pattern? That's right. The 200-day SMA goes. That's what happens. How many Bears will cover when that happens? How many times will we threaten to break out of this pattern but fail to do so?

Now, just think on it. What would cause the largest number of people the most consternation while benefiting the largest amount of money?

Draw your own conclusions.

Mark

If I look at your blue and green curves (21 and 50 days mas) going back to July 18th I see the same that I' m expecting here, down to 1220.......bounce on the intersection of the two curves.......... up to 1255 and then.............plunge

forever and only a V-E-N-E-T-K-E-N - langbard