Edited by linrom1, 06 July 2008 - 07:22 PM.

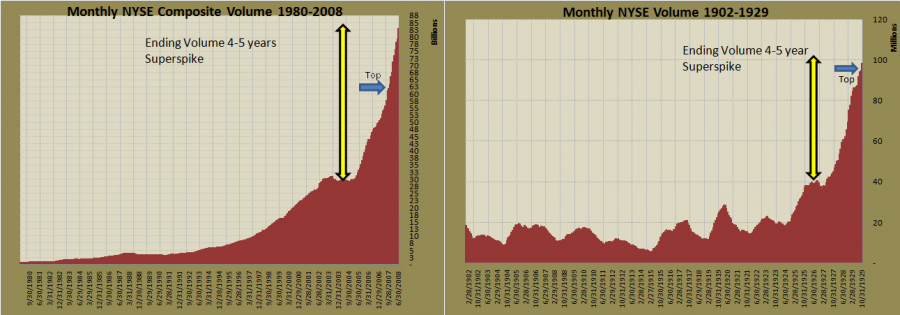

1902-1929 vs 1980-2008

Started by

linrom1

, Jul 06 2008 07:17 PM

3 replies to this topic

#1

Posted 06 July 2008 - 07:17 PM

The end of the bull market in 1929 did not come with a whimper, it came with a roar. Volume proceeding the September 1929 top was building up for several months( it was unusually heavy in October and November of 1928) prompting NYSE to close down for several days to allow clerical staff to catch up with tape. From Jan 1921 monthly volume has increased from 16 million to over 100 million shares traded in September 1929.

When the Crash of 1929 came, October 1929 closed down on record monthly volume of 142 million: a total that was not surpassed until Sept 1965. In the following months, volume began to drop and prices continued to tortuously fall. When the stock market finally bottomed in June 1933, the total monthly volume tally stood at barely 23 million shares--a level not unlike trading volume of a decade ago.

In the end, the volume formed a typical Λ pattern and the market just whithered for lack of volume(buyers.)

Since the current October 2007 market top, volume continues to increase. In fact, only once in December 2007( Holiday month) volume was lower than October 2007(top). This build up in volume is unlike the top in 1929, it is more like 2000-2003 bear market when volume continued to increase and was at highest during July and October 2002 washout months(bottoming attempts.) Will it repeat? Unlikely!

First, the heaviest volume came during January 2008 panic selloff; second the sheer quantity of volume along with rapid price decline point to entirely something different and indicate further build up in volume until: a voluminous climax like in October 1929, after which it could revert to follow the Λ volume pattern--perhaps!

Regardless, the parabolic rise in volume can't continue. The current decade began with 21 billion shares traded during Jan 2000. In Jan 2008, 103 billion shares changed hands.

Volume will come down even if it is because Investment Banks simply don't have enough capital to push stocks. But there is even something more true--and that is, arithmetic of math. Volume is peaking!

The key observation from 1920s bear market was that lower volume beget lower prices---a destiny to befall this market in my opinion.

#2

Posted 06 July 2008 - 07:42 PM

Looks a lot like the arithmetic of meth also.

#3

Posted 06 July 2008 - 07:50 PM

This should be immediately forwarded to the PPT (In Washington at the Treasury AKA" The Special Working Group", circa 1999).

They will know what to do with this, you only wasting time on this board.

Best, Islander.

#4

Posted 06 July 2008 - 08:36 PM

Exactly. The volume has peaked. And lower volume will lead to lower prices.

Banks are unable and unwilling to extend leverage to each other, hedge funds, etc.

Individuals have no excessive savings to put into the market, and what is worse they will be draining the existing savings and retirment accounts to cover living expenses, now that the housing ATM is gone.

There is no money coming to push stocks higher.

PEs will contract to single digits.

The time is coming when a 10 PE stock will be considered expensive.

Corporations will be forced to give out more dividends. And SPX dividends will return to historic norm of 5+ % from current 2-3 or so.

Times they are changing...