The most reliable fib ratio between swings, is not 0,618 - it's 0,786 (0,786x0,786=0,618) and 1,272 (1,272x1,272=1,618)

The 78,6% retracement level is also usually where corrections end, so this is a classic and by itself a warning that the 2009-2010 move is ending.

However if we compare other important swings we find other, very precise, indications of the same.

Below we are retracing the down swing 200% up and that level ends at the precise top.

Retrace swing C - same thing!

If instead of using the DB bearmarket for fib retracements -we use AB, and see that the fibratios of that swing - retraced catches top 1 and bottom 2 perfectly - so that is probably the melody the market is playing - therefore we take note when the market hits the 0,707 ratio, which is where the old bottom E is. Another precise way of defining the resistance above SPX

The 61,8% retracement of the bearmarket is not precise (probably to fool the majority..), but close enough to make sense.

The ewave chart is fascinating.

Check out W4 and W2, they are exactly equal!

And W5 is 38,2% of W1 and 50% of W3

Expand W1 and you end up at the top of W5!!

Another precise way of defining the resistance above SPX

A time study does not make things less interesting

We are looking at three fib cycles, where we are using the 1974 bottom - 1987 bottom - 2002 bottom and 2007 top.

The most important trendchanges in the time span from 1974 up until now.

The April high is connected to all of them in a fibonacci way, indication that that the April top is just as significant as the other trendchanges.

Hence what we will see is probably not just another small correction

Trendlines is telling just as much as fib studies, and what we see here is how the breakdown of the 23 year long line is now tested from below in a typical wedge fascion on lower volume (high the last three weeks=distribution)

Another curious thing about this chart is the time factor.

Often you can use the connection points on the trend line of a pattern, for time studies.

Here in he blue wedge, I use the1987 bottom and the break of the upper line, where the "upcrash" starts. That cycle repeats exactly, catches the 2002 and the April 2010 high, indicating that the top is of high of importance.

Things often repeat in the market - in the same manner - but the other wayaround (just to confuse).

Hence the up crash after the break of the blue wedge could indicate a down crash after break of the red wedge.

The most obvious thing we see in these important charts, is how ALL of the indexes are just below an important fibonacci level, indicating resistance.

But the charts also show why I for a long time thought we would test the 2007 top or break it.

If we compare the bottoms of the different charts we see a gigantic bull divergence.

Only SPX and DOW broke the 2002 low. Nasdaq and Russel 2000 did not. Nor did Europe.

In 2003 there was even a bulldivergence between NDX and Nasdaq Comp.

These failure breaks usually takes you above the old top.

In this case (2007).

That scenario is however now in danger.

Which makes the fib levels we now see in the markets VERY important. If they break on the upside (not probable on this first try), we will probably see stocks above the 2007 high (but that is another analysis, another time...).

But RIGHT NOW they indicate that the market will go no further - up.

Furthermore, if we look at this chart, we can conclude that what we are seeing is the top of a correction (at "TEST"), since we are testing the 73 year long trend line from below - after breakdown through the line in 2002.

And if you look at the break - it's not a feeble one - two bars, and it's done.

And the break test is just as swift.

This is a textbook break.

And so is the SOX break of the Head and Shoulder pattern (data until Friday) at the same time it breaks TWO trendlines.

This happens after the index fails to follow through after a powerful break away gap!

The gap level is tested three times and SOX falls through the 4th time (just like Gann told us)

The H&S pattern in this DOW chart has not broken yet.

But if it does, then we we also break below the trend line that has been touched 8 times - that is serious.

I would say that also the Europeans will stop buying US stocks for a while.

This is NDX priced in Euro

Let's look inside the market.

If we presume that it was the risk of the financial system that brought the stocks down from the 2007 top. Then the financials would be following the the main indexes up, right?

However, looking at BKX and XLF, we see that they have only reached the 38,2% retracement level, while Nasdaq and SPX are at 78,6% and 61,8%. A weak comeback in other words, so financials are still vulnerable.

And it is in that context to note that gold is in new high

While dollar in NOT falling

Another safe haven is the SWISS.

Comparing Euro and Swiss, we can see the obvious strength in the (Safe) Swiss currency.

But it is the spread Euro_Swiss that is really scary. We are now at a new SEVEN year closing low (well the week is not over yet..) and in the process of breaking a gigantic H&S pattern

Cycle study:

What we see in this chart is:

1: The blue line= the anual cycle since 1950

2: the red line, the composite of the 5 strongest cycles (fourier analysis).

What is interesting, is that they both are falling in harmony into the May 23rd weekend.

When different cycles move the same way - pay attention!

Best case scenario in my view (but perhaps not the most probable), would be to find support crossing of the trendlines in this chart - that way we would not break the bullish implications fo the move from March 2009. (like the5 wave Elliot pattern in Chart 4 )

Interestingly we have a powerful aspect cluster on the 23rd.

Jupiter Saturn opposition (very powerful)

and

Venus Pluto opposition (Venus could be the trigger for a bottom)

My Fearless forcast would therefore be that we will be falling into the Weekend of may 23.

But how far?

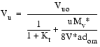

The largest correction in the 2002-2007 swing (

However using fib 23,6/38,2/50% retracement, we and up the levels below and they are all larger than the "B" correction.

Check ou the volume pattern at the top - looks like distribution.

cc