Right now, I do think a case can be made for a completed top of significance on July 24. Could have ended the run up from the February, 2014 low, and possibly even the move from the 2011 or 2009 lows, although such a thing remains to be seen, i.e. that would be a bigger deal, and as of now - who knows? Beyond that, the bull market from the 1970s or 1980s, or even earlier, well, wouldn't that be something?

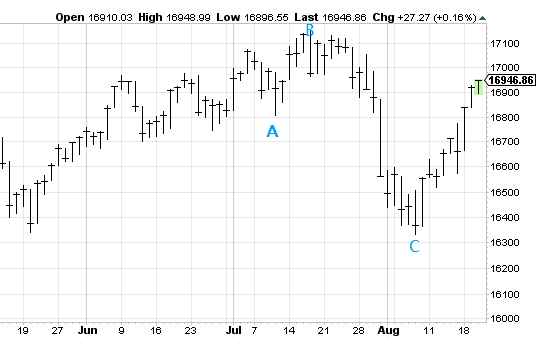

A vigorous launch from the 2009 bottom. Since the 2011 low, a pretty calm and orderly uptrend.

So now we have a very clean 5 waves down, and we would be in a counter-trend bounce from the August 7 low.

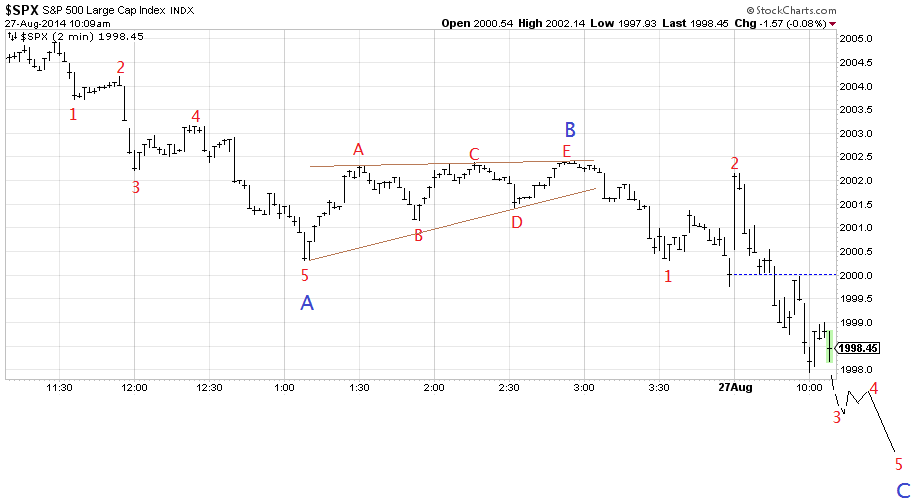

While it's possible to count a five-wave advance from yesterday's low, which conceivably could be "C" of an ABC from the August 7 low, that would give us a comparatively short C wave. Looking at percentage retracements of the move down from the July high, there's certainly a good bit of room overhead, yet. The action from today's high looks like a meandering fourth wave correction, at this point, to me, and in any case I would not be picking tops here, but rather would wait for 5 waves down to confirm a trend change.

The market could confound my bearish wave count by going above 1973, which would be more than a .786 retracement of the move down into the August 7 low.

It could make a more complex up/sideways correction from the August 7 low, too.

Regardless, I think that fairly soon there will come a low-risk shorting opportunity. 5 waves down from the July high, then at some point we think we have a completed correction, whether it's "ABC" or something more complex from the August 7 low. Then, we get 5 little waves down - which presumably would then begin an overall larger decline, equivalent in degree to the decline from the July high, and potentially a third wave in a larger decline. During a corrective move up or sideways after those 5 little waves down, there's a low-risk short, with a stop above the recent high at that point - what we would be calling the end of the rally from the August 7 low.