Partial Quote from the Previous Week:

Being that that we have quarterly, quadruple OPEX coming at the end of the week, along with many of the MCO's moving up and through their respective zero lines with little in the way of back and fill texture, the technical expectation will likely see prices moving lower overall in what will be snapback efforts to or toward any price breakouts that were made at the end of last week. With the NYSE Open 10 TRIN remaining at "oversold" levels (1.11) in spite of last weeks advance, this will also help to buoy any price pullback that we may see in this same effort.

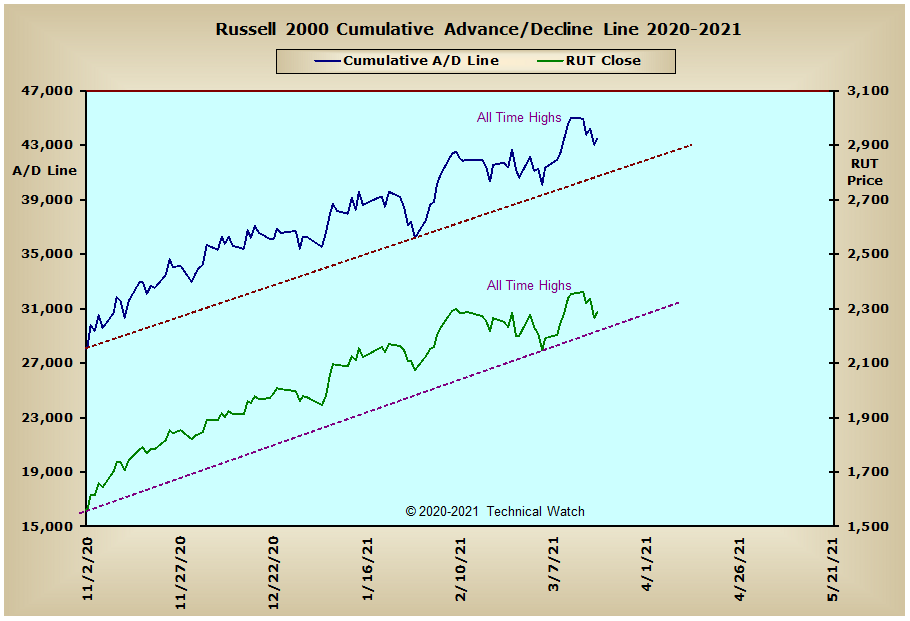

After starting off the week on a positive note, U.S. markets turned mixed and then lower into Friday's close with the major market indices finishing with an average loss of -1.21% as pullbacks into Friday's quarterly OPEX period were somewhat balanced with the exception of the S&P 600 Small Cap Index which weighted this same average score with a loss of -3.05%.

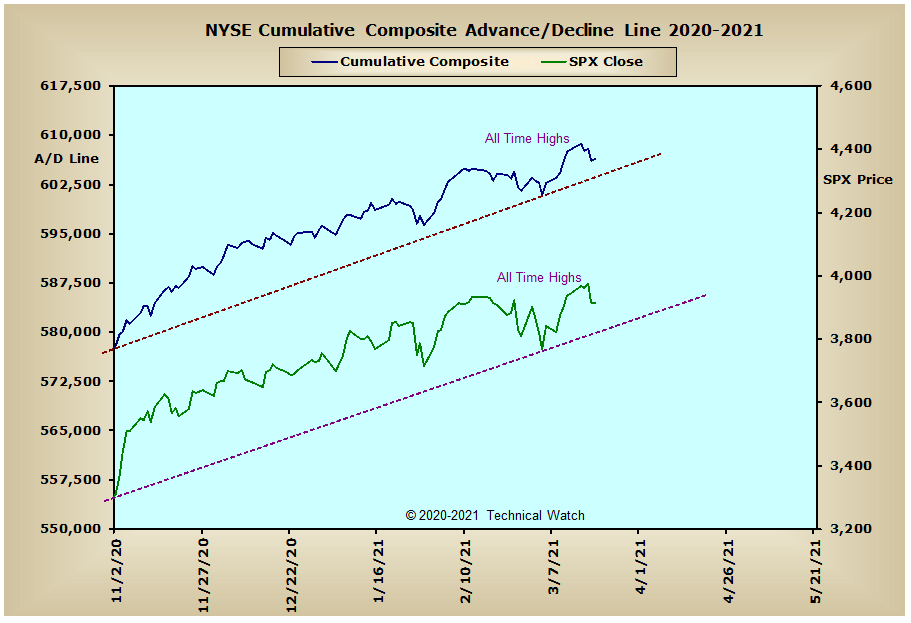

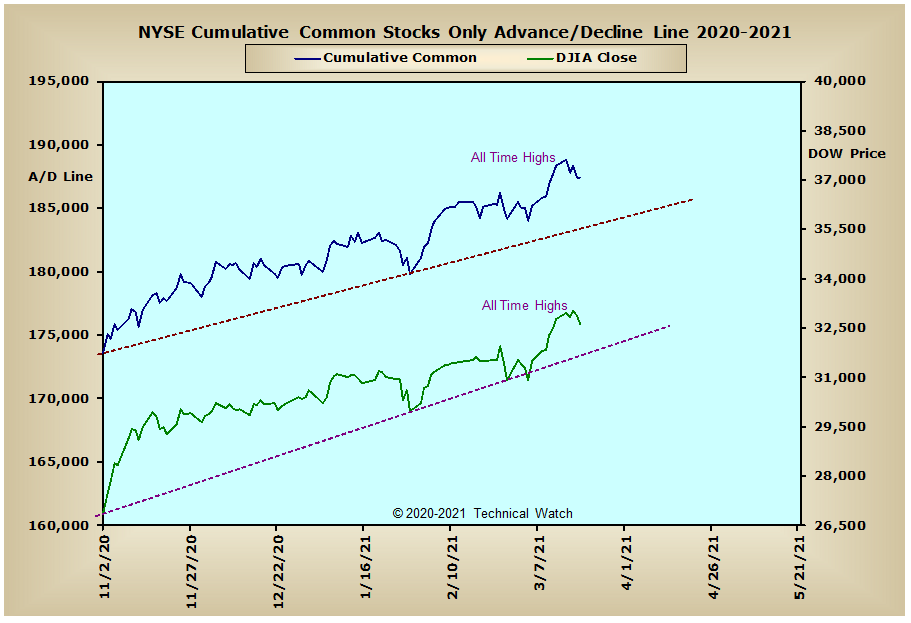

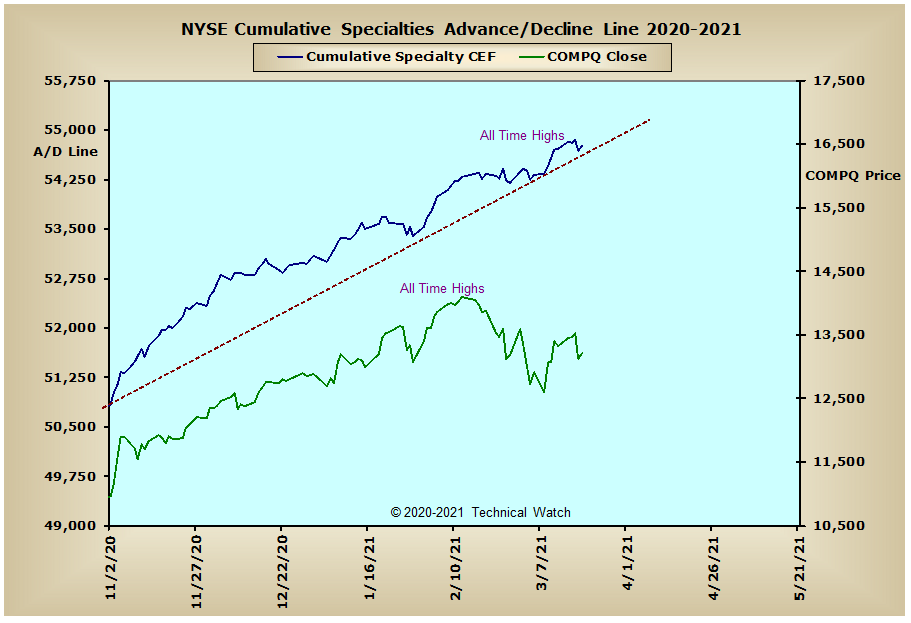

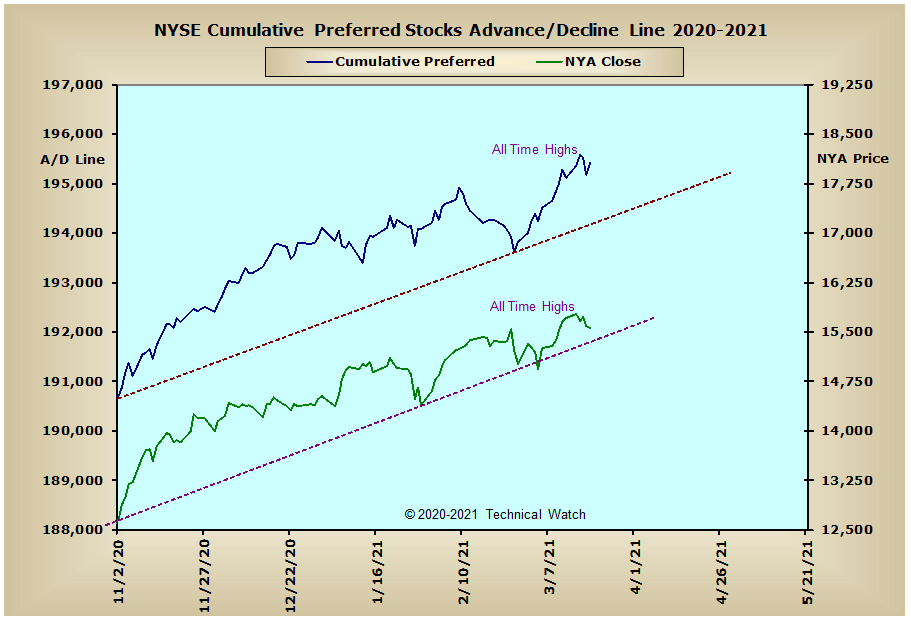

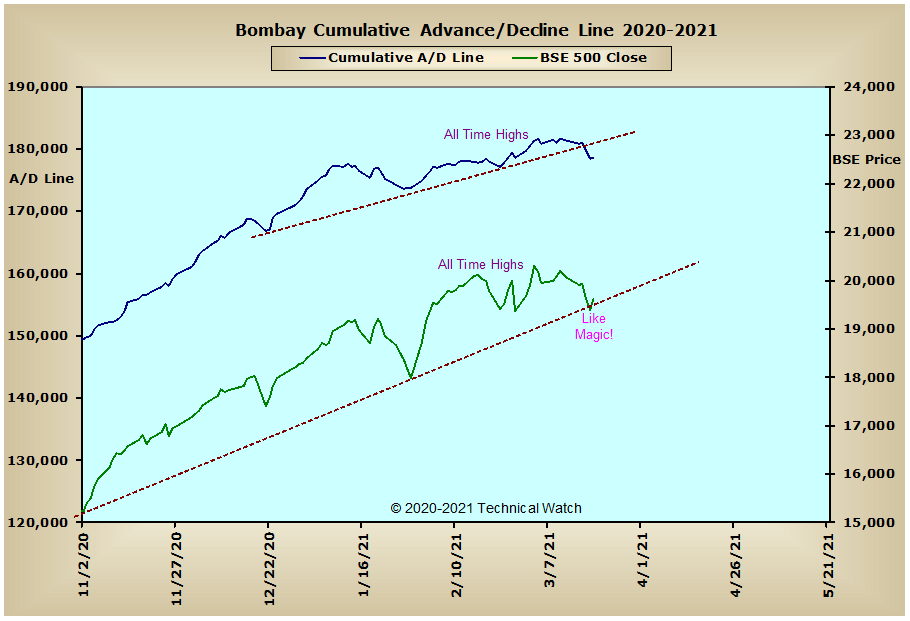

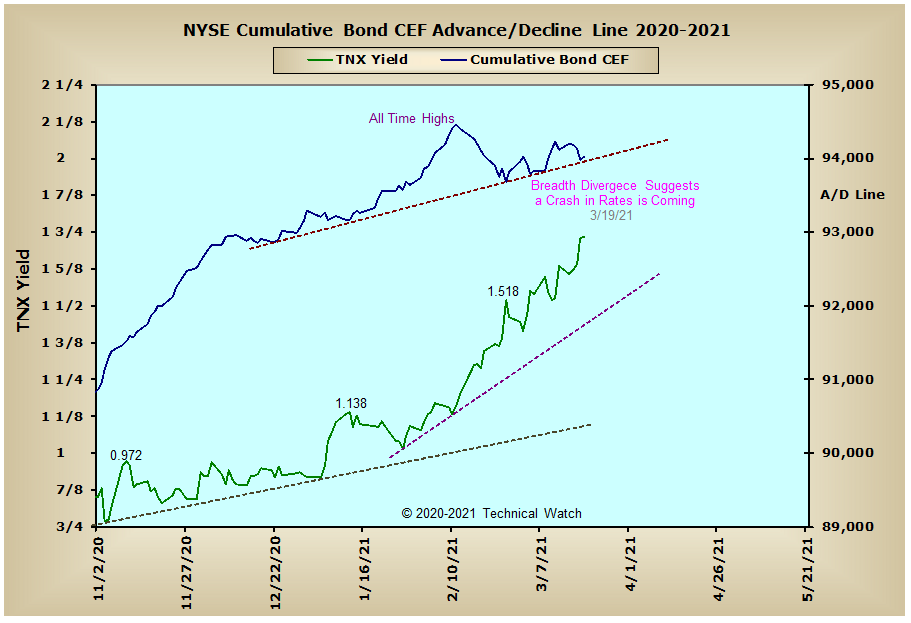

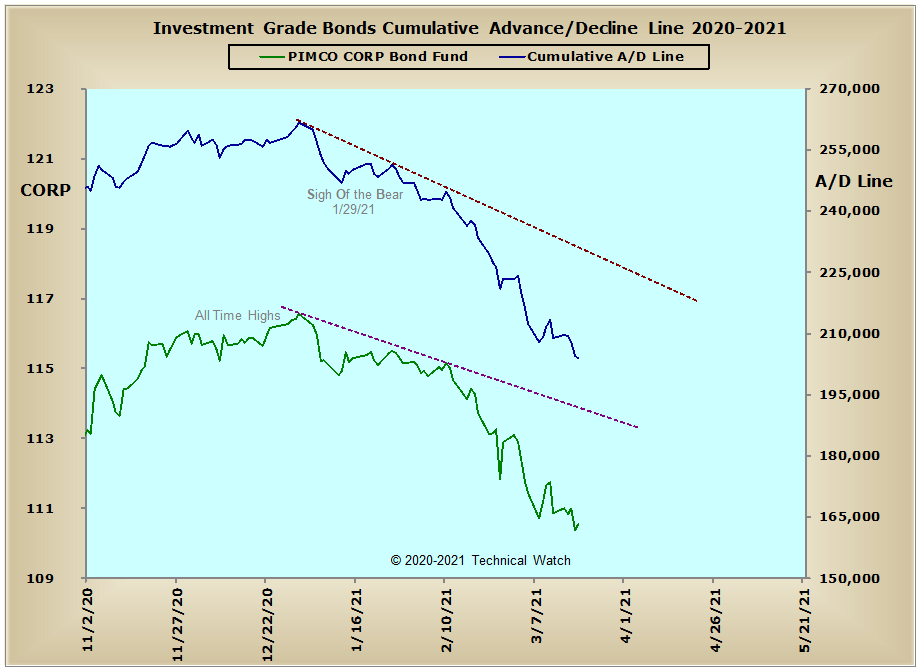

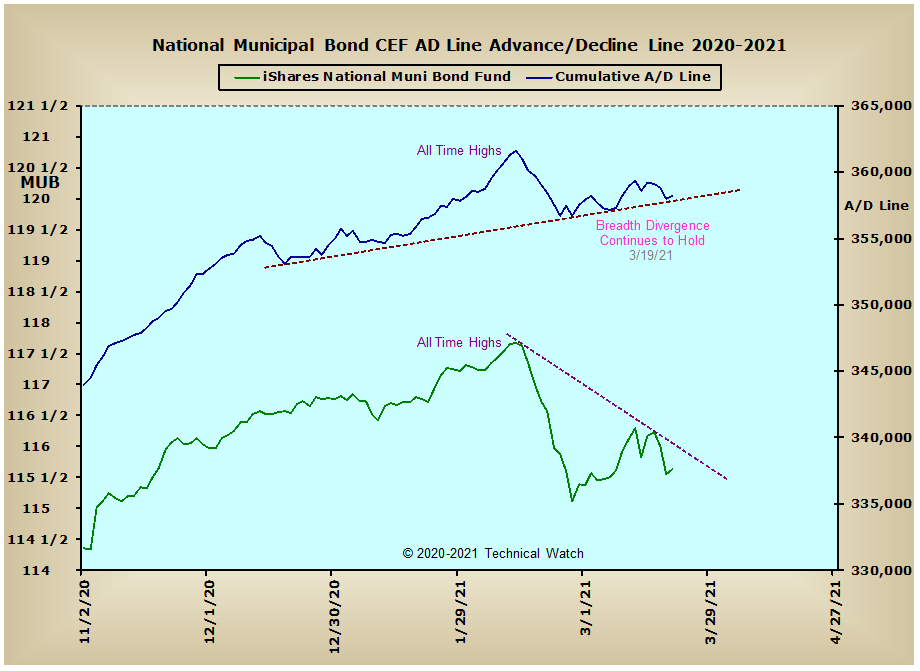

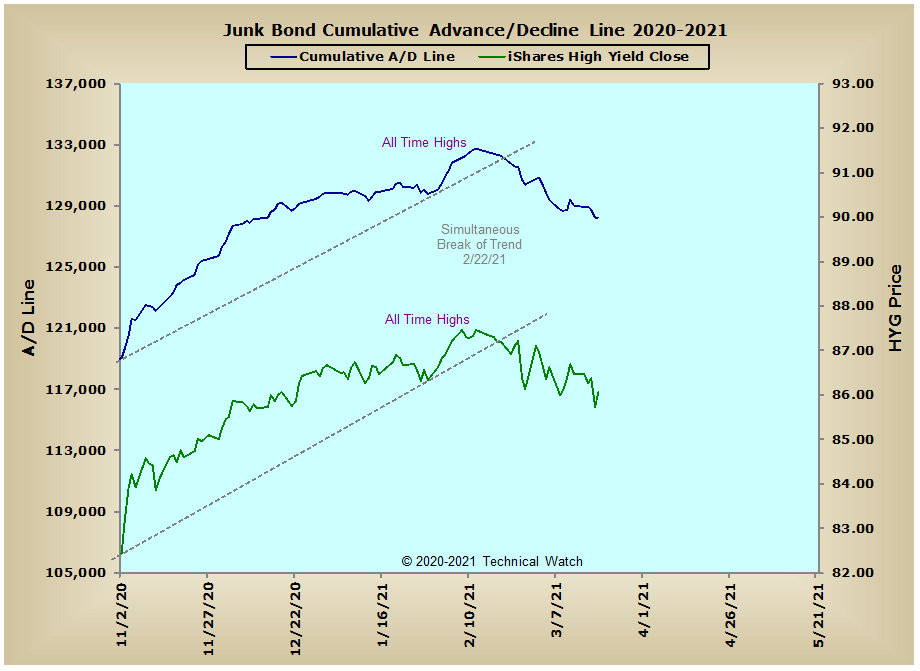

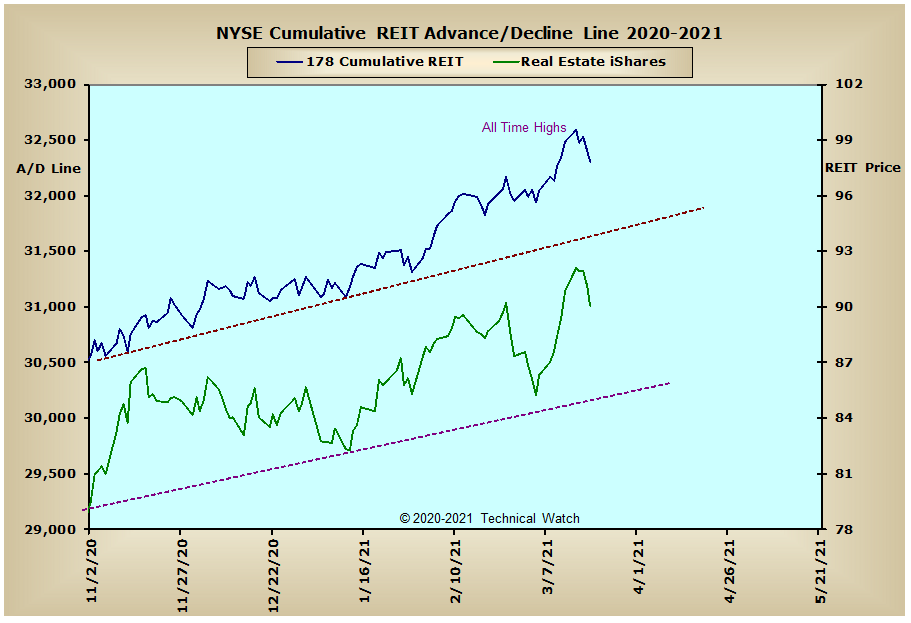

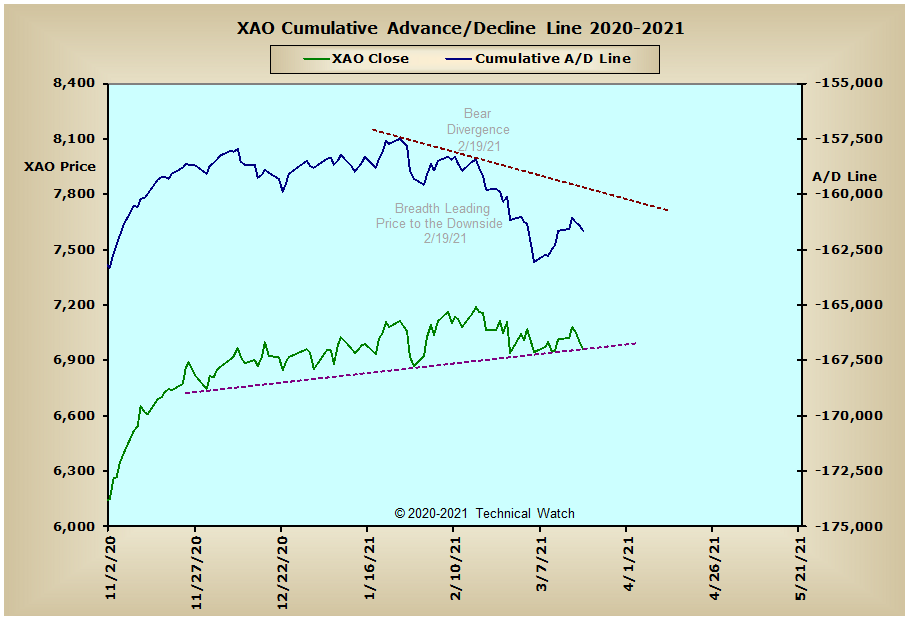

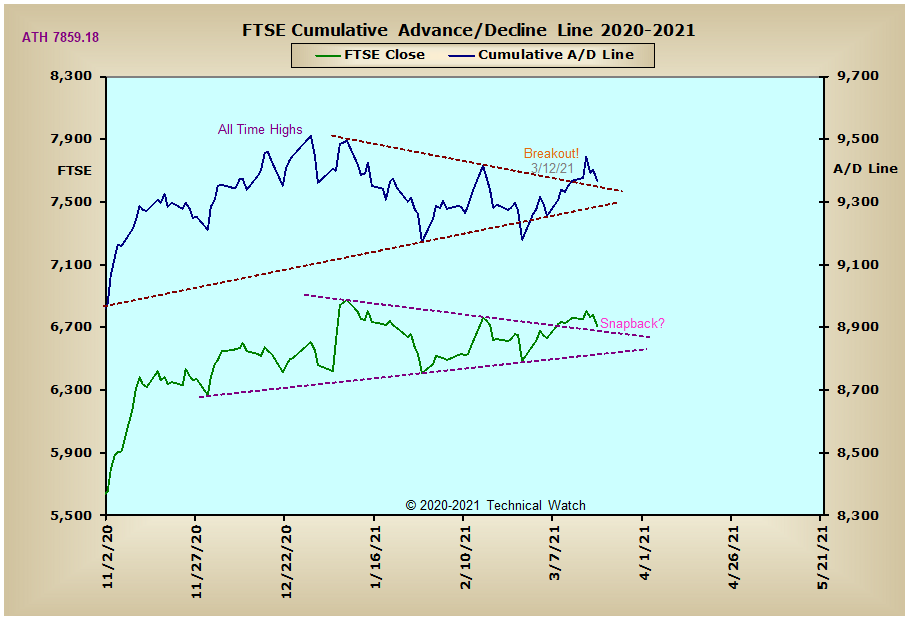

A cursory view of this weeks usual array of cumulative breadth charts shows very little in the way of analytical changes from the week before as all of the NYSE related advance/decline lines continue to trend higher on an intermediate to longer term basis. This observation also includes the NYSE Bond CEF advance/decline line which continues to diametrically oppose the trend of rising interest rates as the 10 year note finished at 1.73%...the highest levels since February of last year. This acute dichotomy between this A/D line moving higher while interest rates also moving higher will eventually have to be corrected...with money flow usually being the victor in such discrepancies. Maybe this time will continue to be different in this relationship given the historic extremes of global liquidity, but something will have to give here fairly soon...either the A/D line will break support and follow the lead of the Investment Grade advance/decline line to the downside - or - a crash like event in interest rates will have to do to clean up this technical inconsistency. Stay tuned.

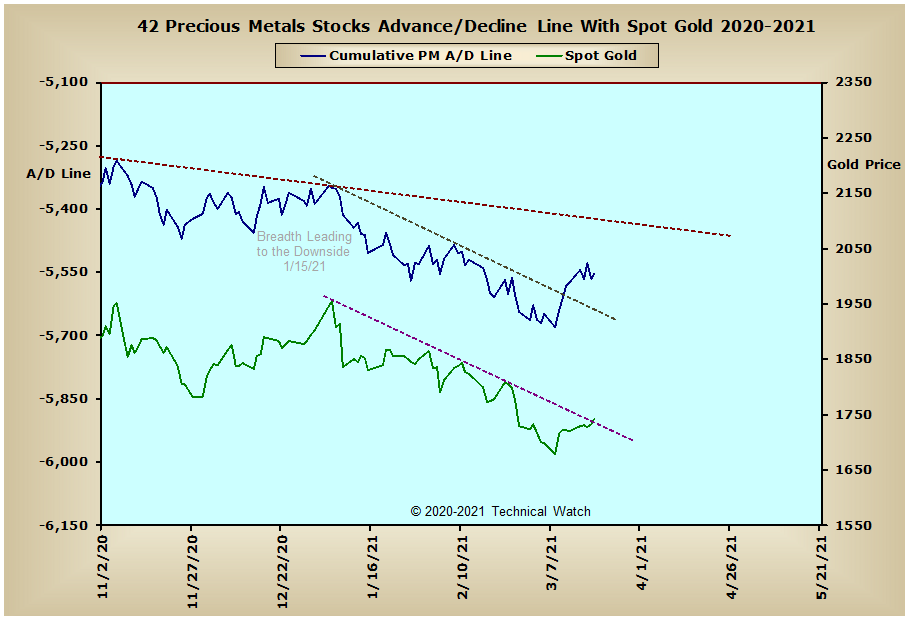

Meanwhile, with our tradable bottom in April being just around the corner, both the Precious Metals and XAU advance/decline lines have both broken above their accelerated declining trendlines over the last two weeks. This is a good start in providing the proper internal platform for this asset class to capitalize on this previous forecast. These breaks of these same trendlines also take the selling pressure off the metals in general sense, but there's still quite a bit of work still yet to do by the bulls if this cyclical related idea is going to come to fruition next month. With the outside chance of a crash in interest rates being considered here, this would also be great news for the gold bugs to help this idea along. Again, stay tuned.

So with the BETS actually moving 5 points higher in the face of the markets finishing lower to a reading of +80, this would suggest that it should be a bullish week ahead for the equity markets. As it was noted last weekend, the markets this week also start with a small point change in the NYSE Composite breadth McClellan Oscillator, so let's expect a dramatic move in the major market averages in the next two trading sessions. The NASDAQ 100 index is also at an interesting juncture as the NDX breadth and volume McClellan Summation Indexes are both continuing to hold at their respective zero lines, and if this level holds, the anticipated rally for the coming week will likely come from the technology/internet arena of issues that have been correctional focus since the beginning of February. The 10 day moving average of put/call ratios continue to be on a screaming sell signals with call buying at historic levels, however, but this has only (so far) slowed the rate of ascent on the price charts. But as we know all too well from past experience, as long as the breadth and volume MCSUM's remain above their important +500 escape velocity levels, it will continue to be difficult for the sellers to mount up any kind of negative action in their favor. So with this weekly analytical checklist in hand, let's once again continue to walk the bullish path of least resistance for the week ahead as we continue to look for our next possible change in the longer term uptrend to come about sometime in the first half of April.

Have a great trading week!

US Interest Rates:

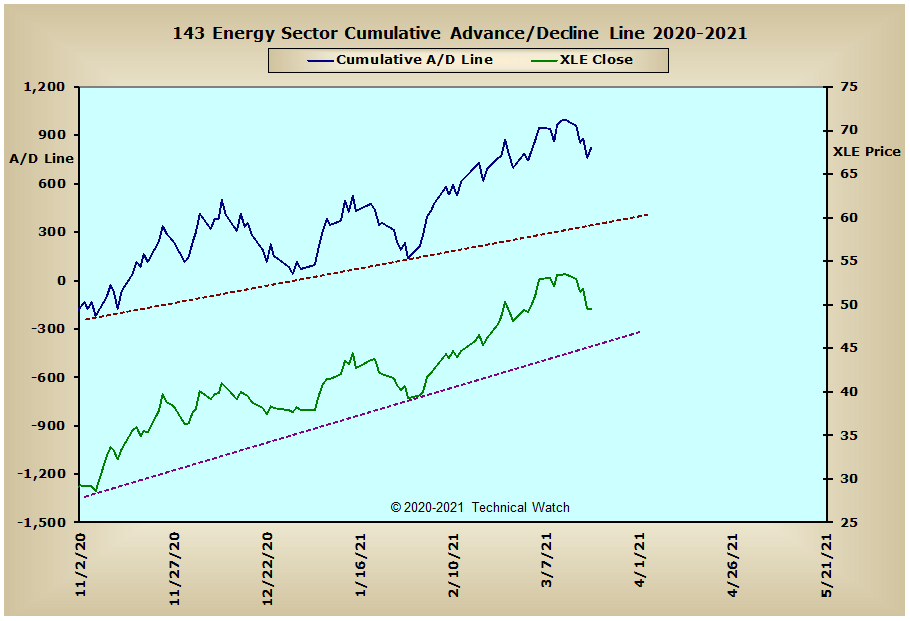

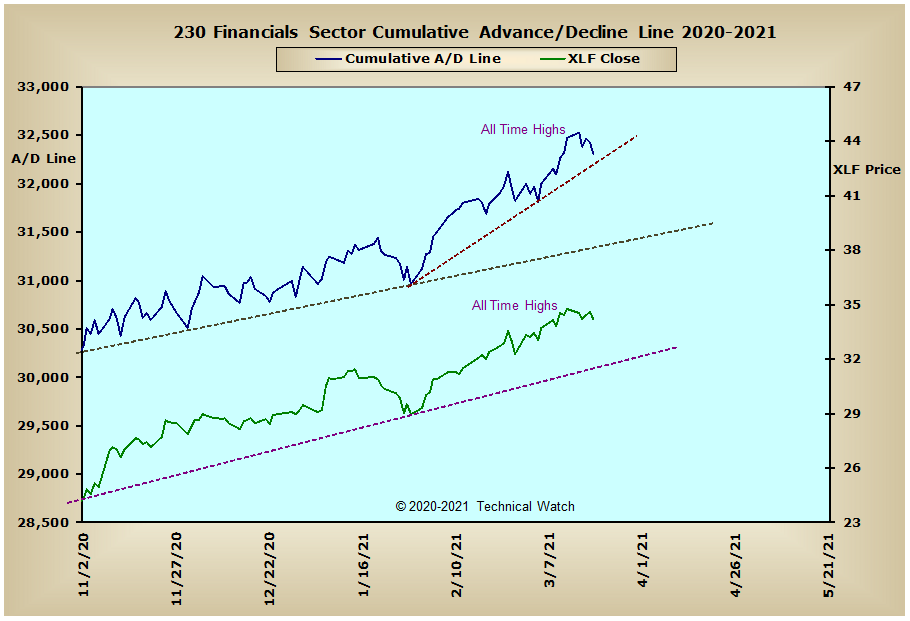

US Sectors:

Precious Metals:

Australia:

England:

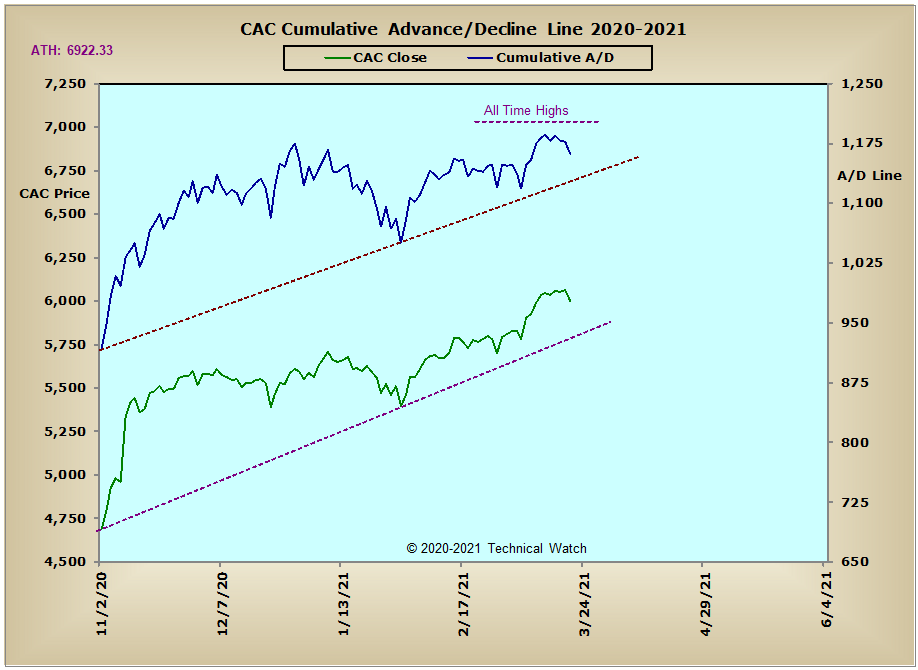

France:

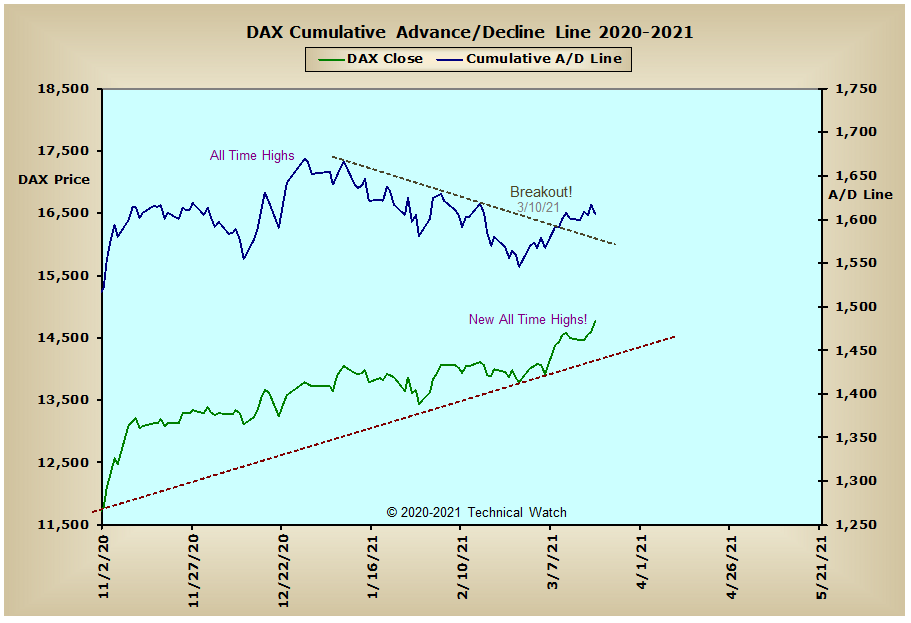

Germany:

India

Edited by fib_1618, 25 March 2021 - 02:03 PM.