After seeing a nice continuation rally to start the week, the major market indices drifted sideways to lower to finish out the year as U.S. markets settled on Friday with an average gain of +.96%. For the month of December itself, we saw an average gain of +4.15% with all of the index components finishing at new all time highs on a monthly basis. This then brought the average gain for the fourth quarter of 2021 to a more than respectable tally of +7.58%, and for all of the 2021, the average gain was an eye popping +22.28% with the S&P 500 index leading the pack as it added a resounding +26.89% to its value. In fact, the SPX beat both the Dow and NASDAQ by the widest margins in 24 years...only the 6th time in history when this has happened, with the previous occurrences taking place in 1984, 1989, 1997, 2004 and 2005. Even further, according to Truist Advisory, over the last 18 times since 1950 when the SPX saw a gain of at least 25%, this was then succeeded 82% of the time in the following year with an average gain of 14%...the largest of which came in the year 1955 as the index added another 32% to its value!

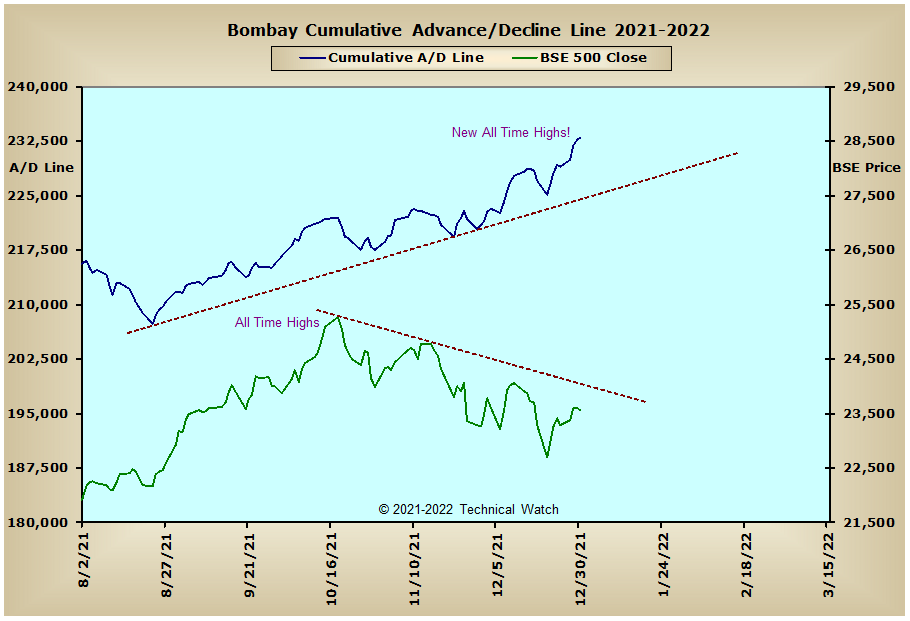

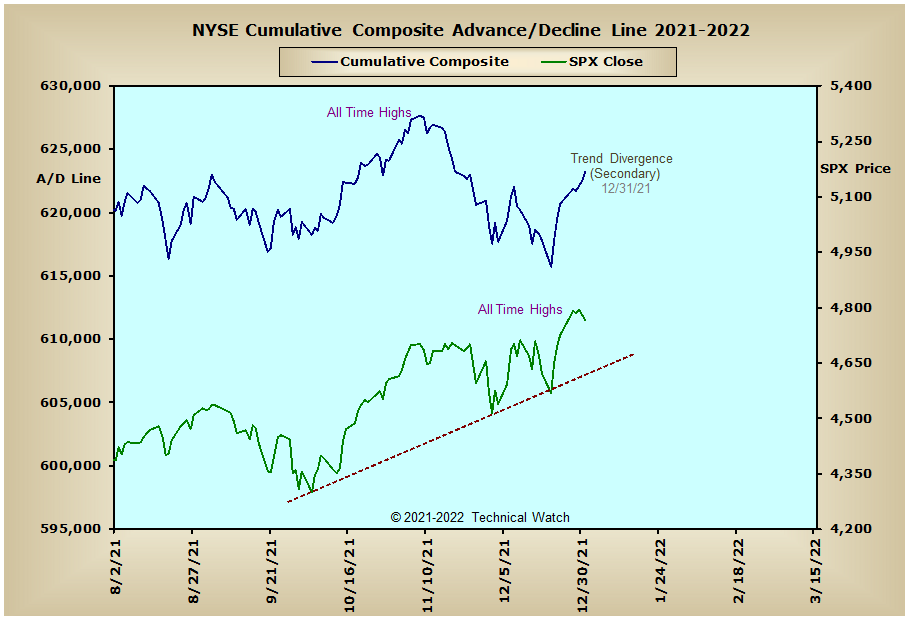

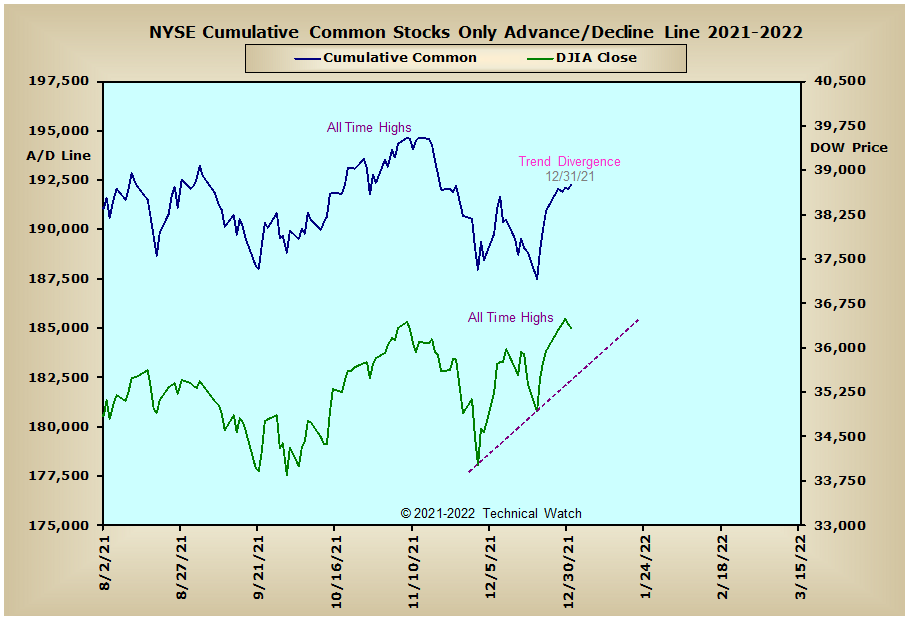

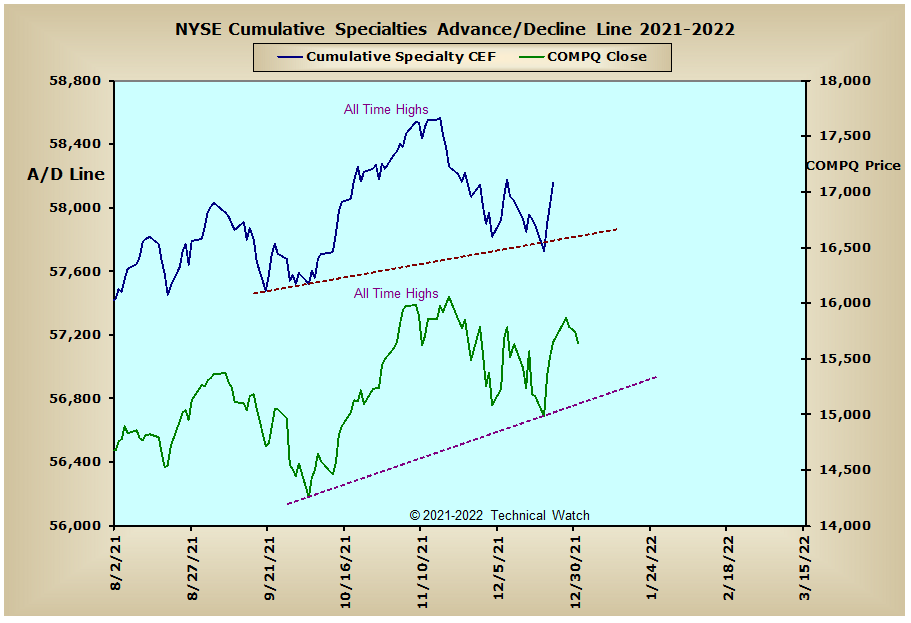

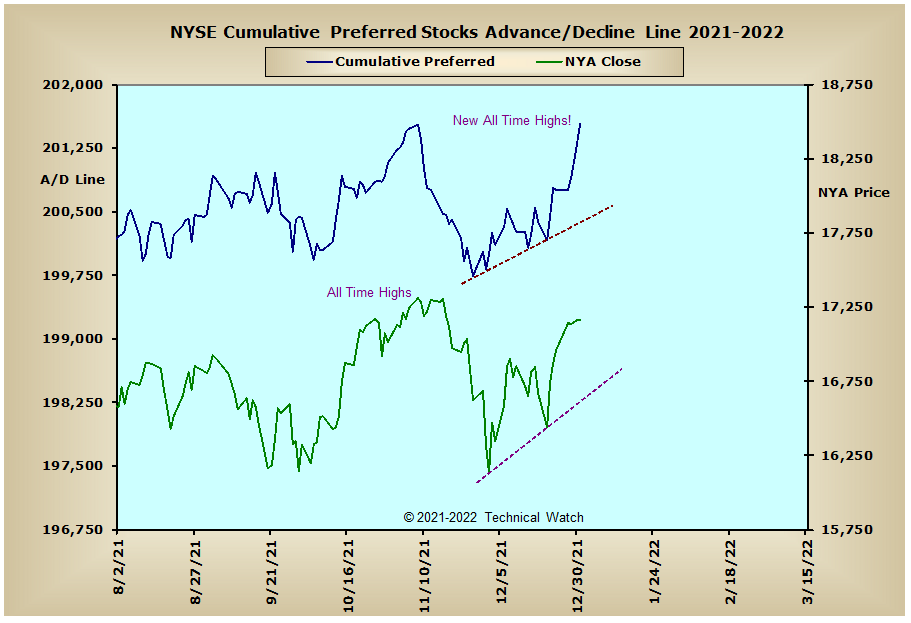

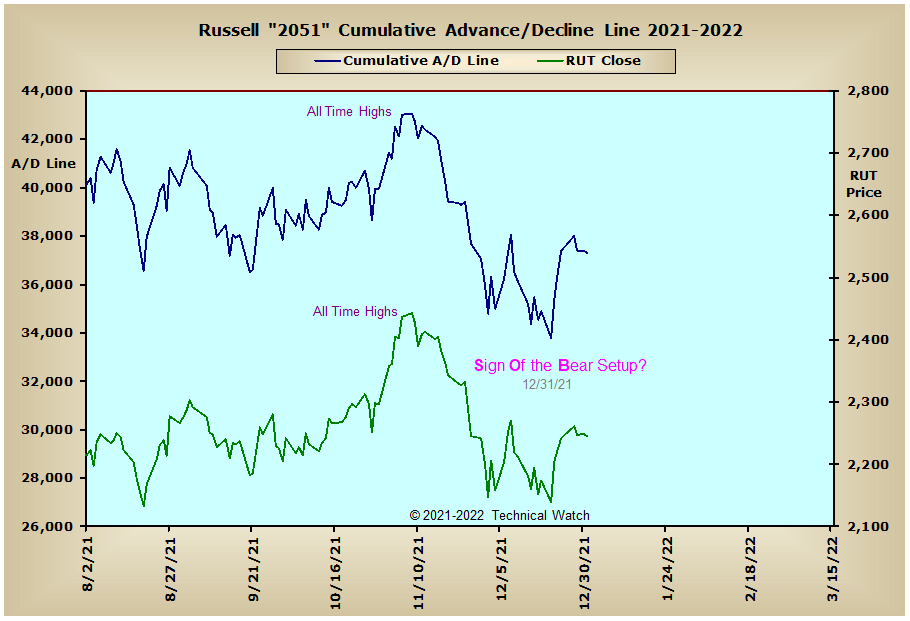

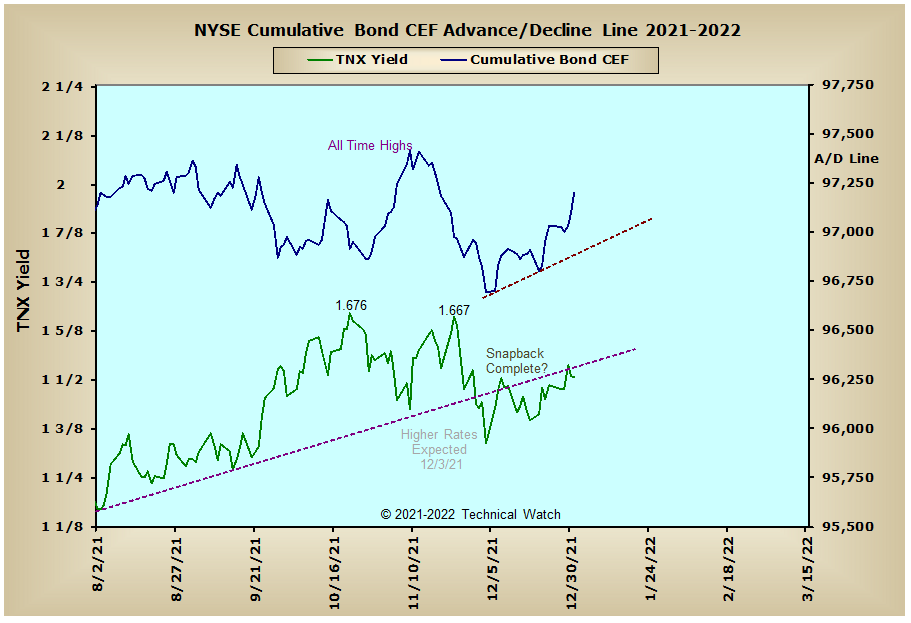

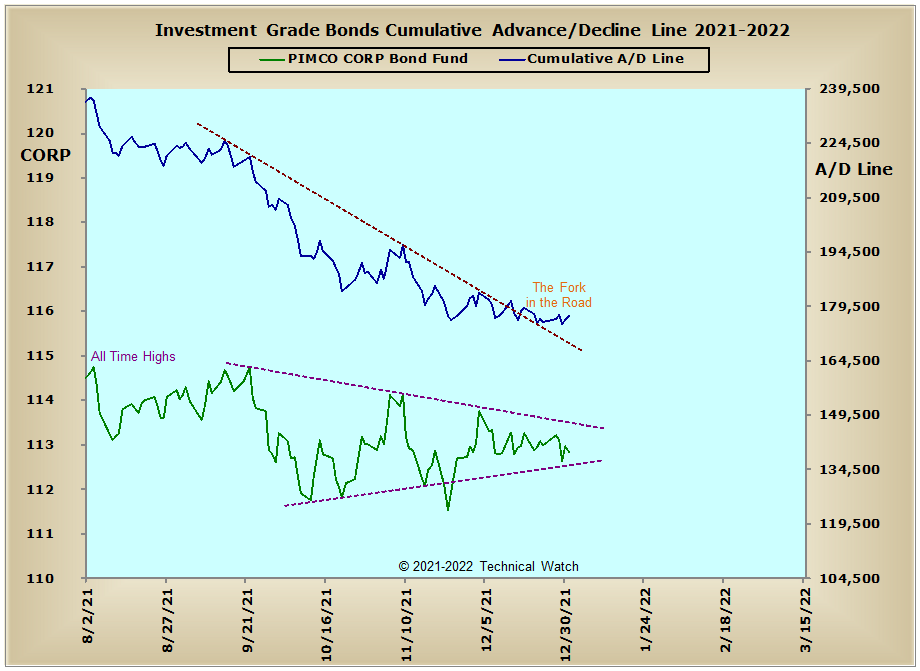

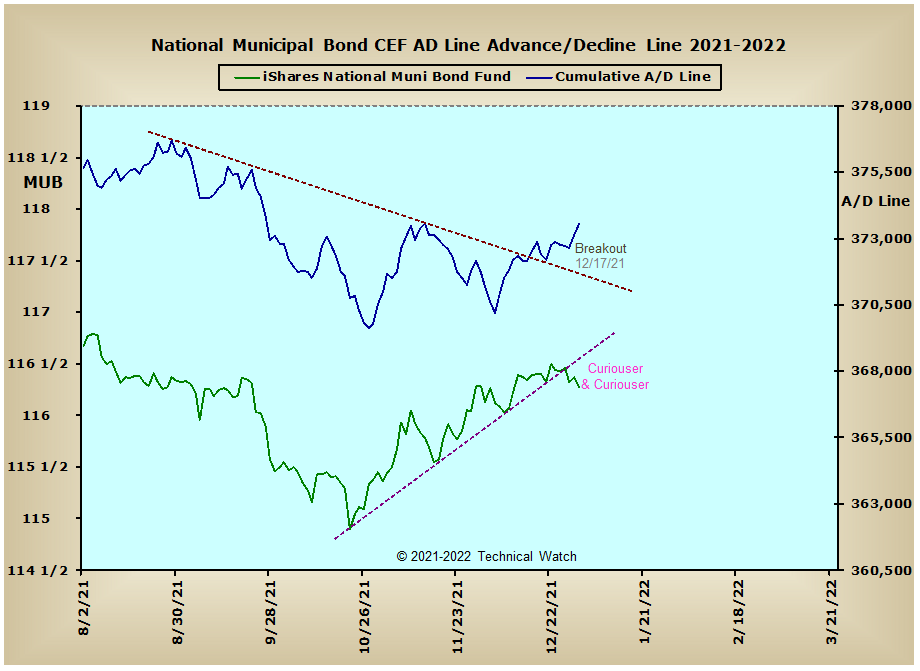

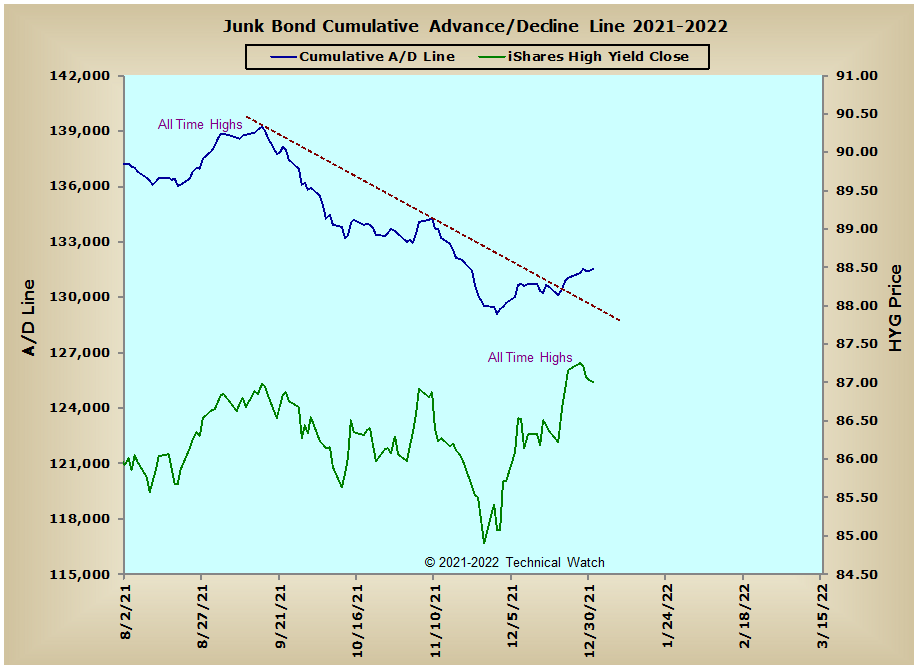

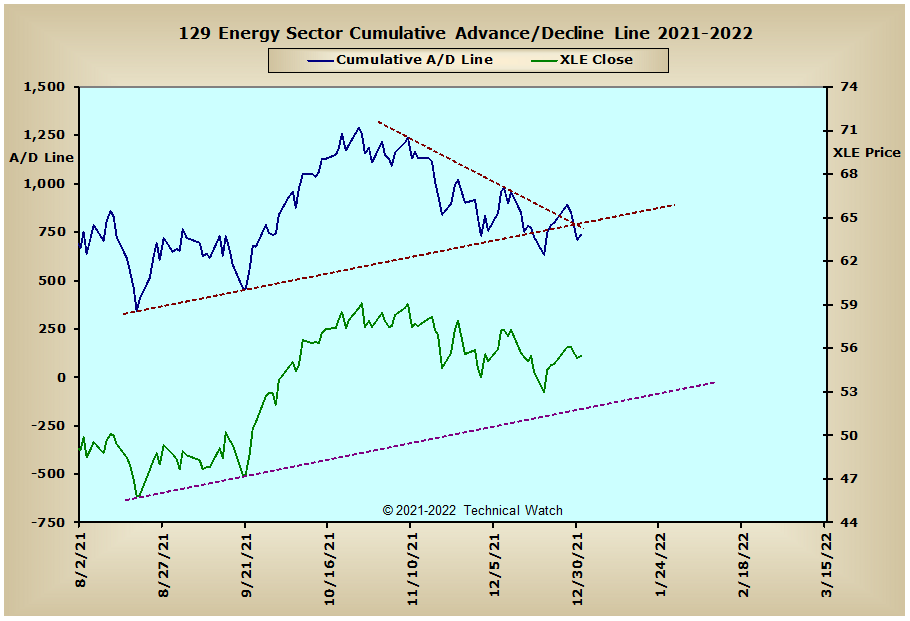

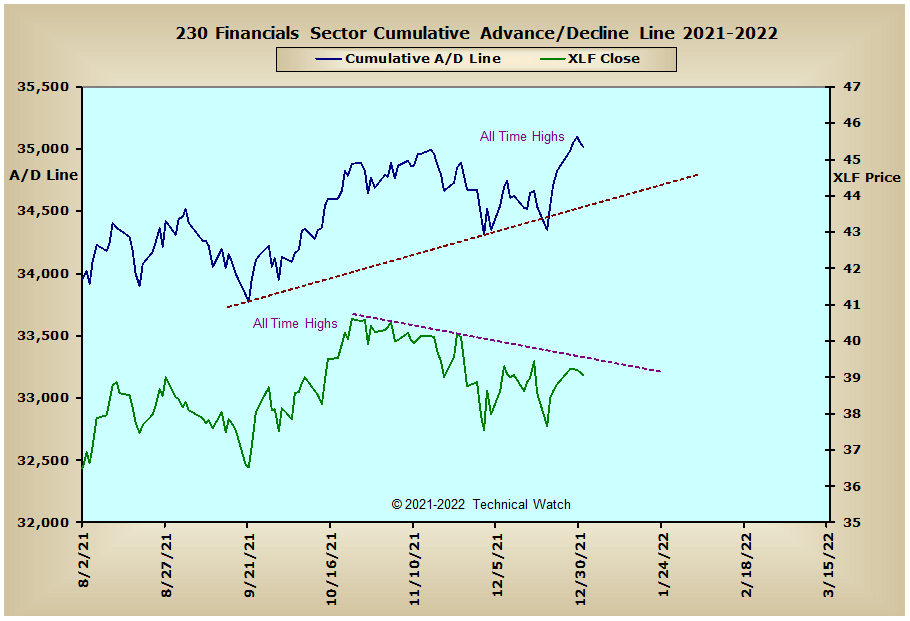

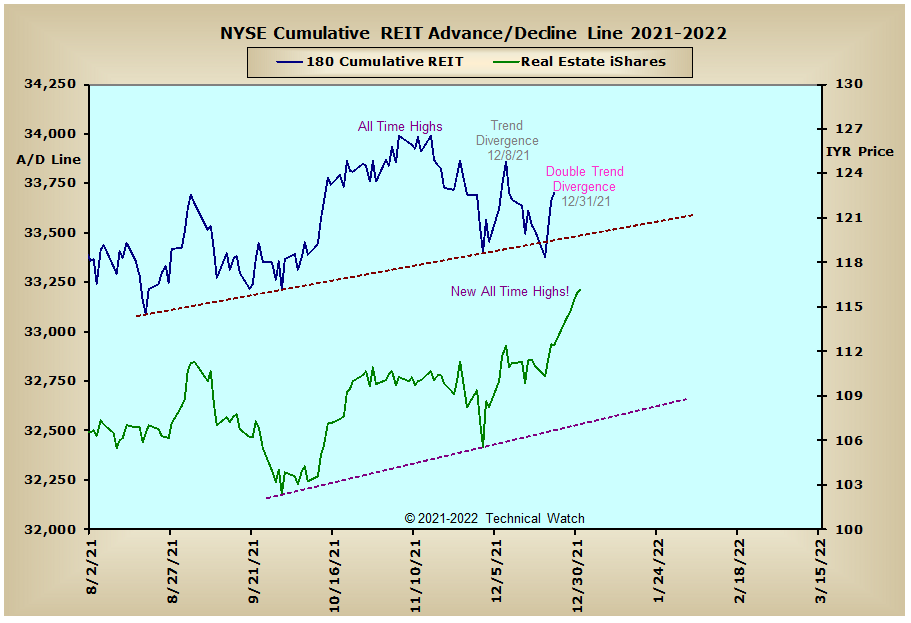

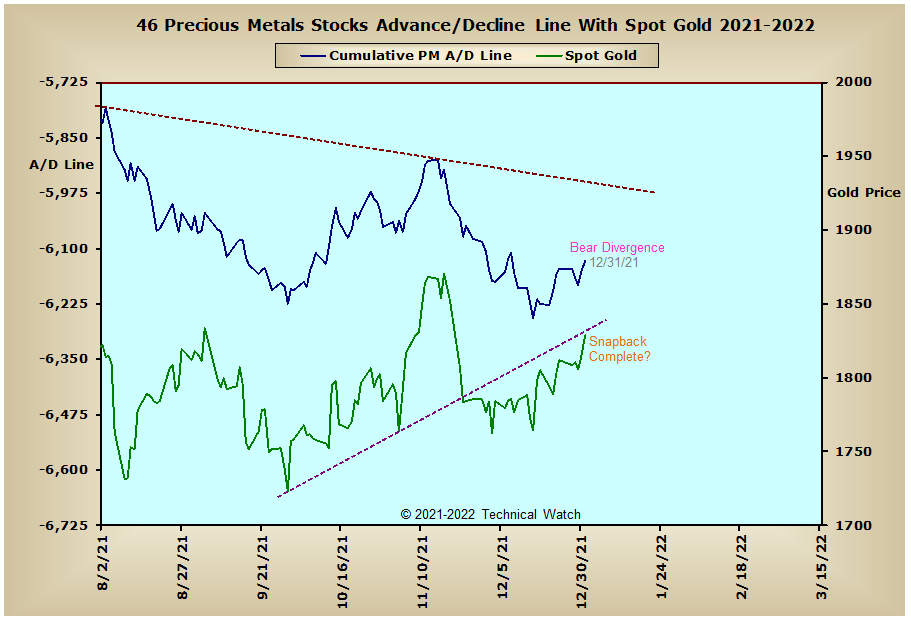

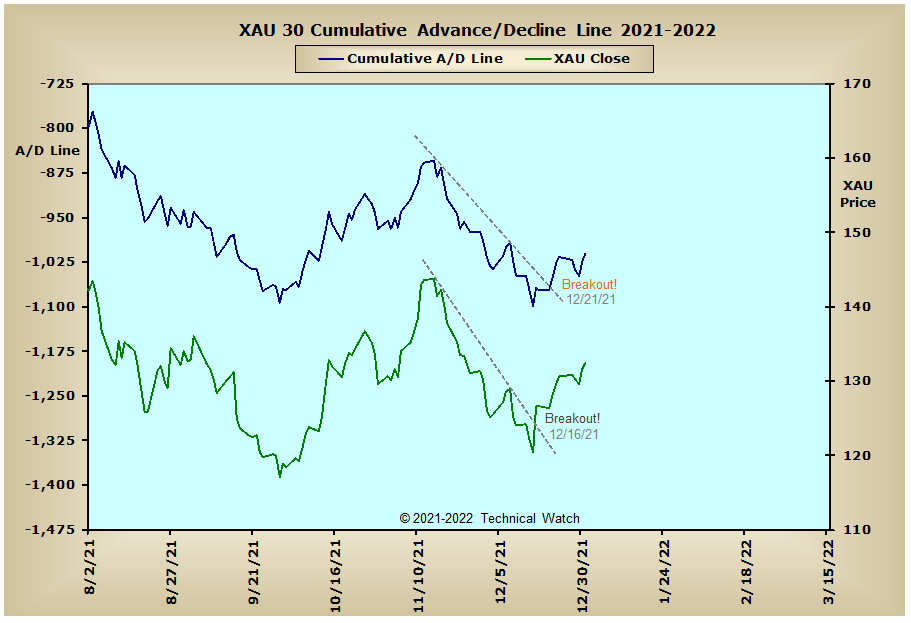

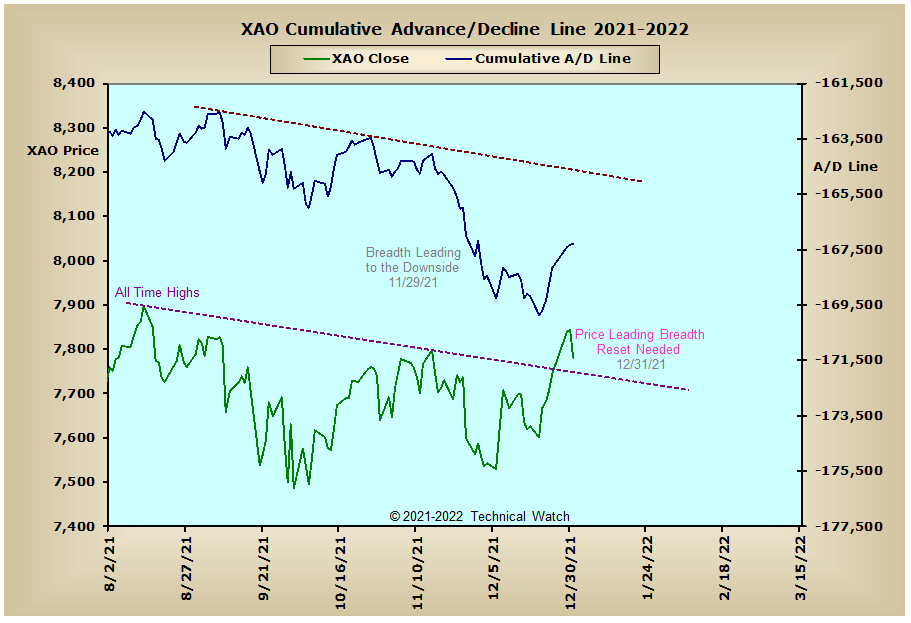

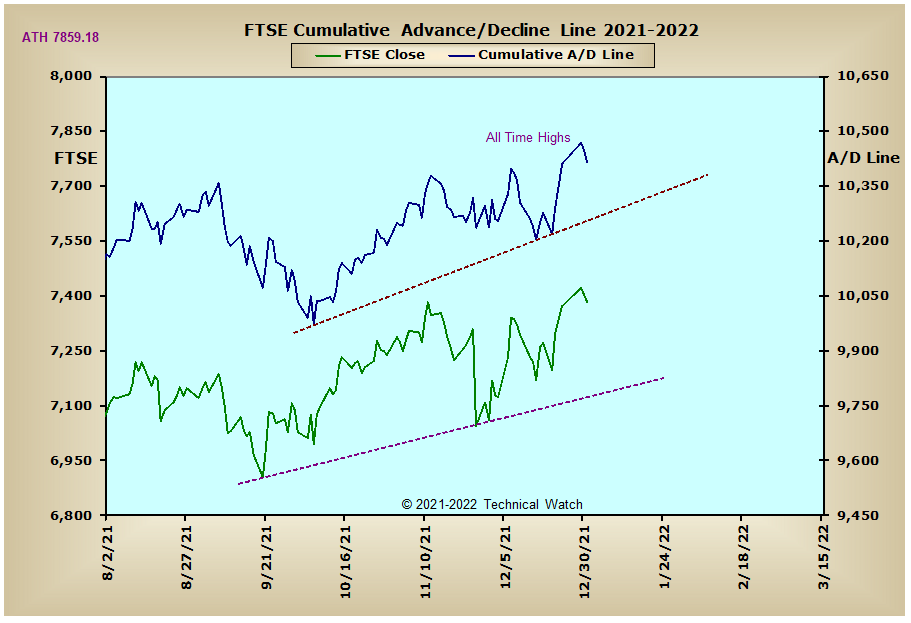

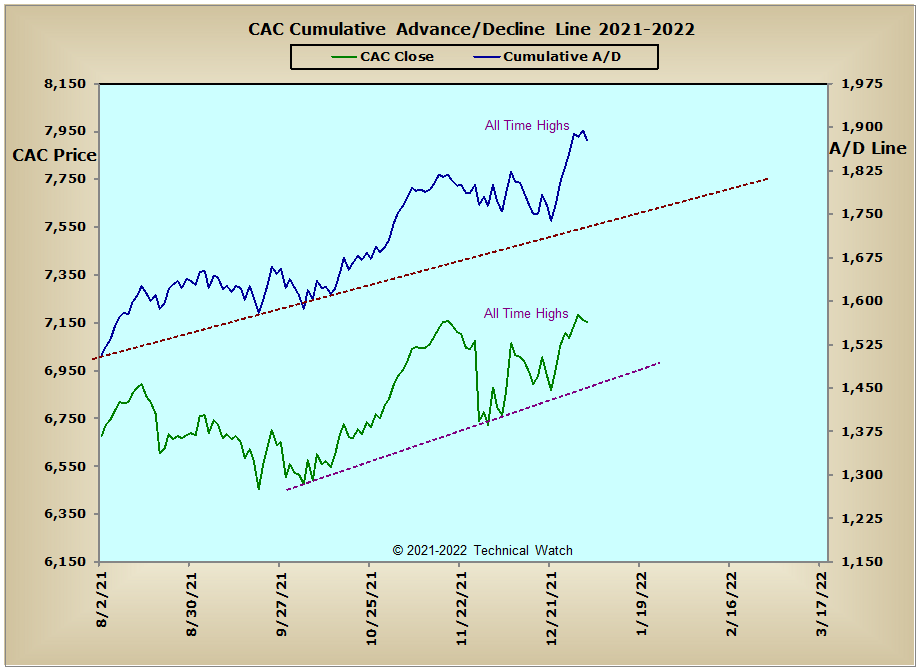

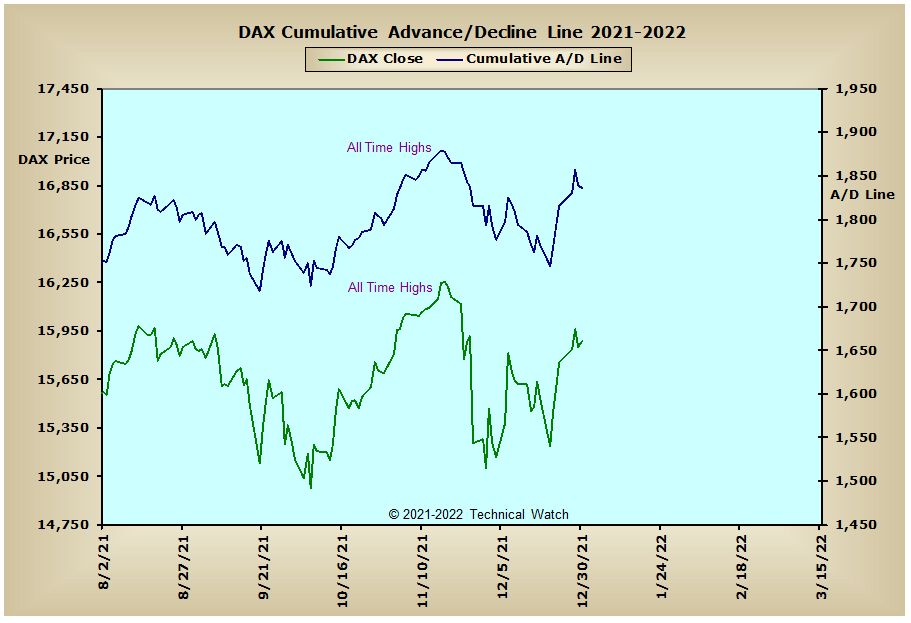

Looking over our usual array of cumulative breadth charts as we start off 2022 shows quite a bit of technical pushing and pulling going on right now making it somewhat difficult to confidently forecast on a longer time scale between the major asset classes here in the United States. The biggest problem continues to be in the interest rate sensitive areas of the marketplace where all continue to struggle in finding investment capital, although, the NYSE Bond CEF advance/decline line has shown a nice bit of resiliency over the last couple of weeks. This ongoing negative action in such areas as the Investment Grade, Municipal and Junk Bond advance/decline lines is now having its influence on both the NYSE Composite and (now) the NYSE Common Only advance/decline lines which are both showing "trend divergence" compared to the recent new highs in the price action. This dichotomy between debt and equity can, of course, continue for a while before we actually see equity prices begin to move lower in unison as less and less liquidity is available to be put to work...especially since our starting point was (and continues to be) at record levels both domestically and globally. Higher interest rates also hurt the precious metals markets as liquidity continues to be drained from the system. It is not too surprising then to see both the Precious Metals and XAU advance/decline lines struggling higher and are now, in fact, showing bearish divergences between the price of gold and the XAU index itself. We also see this bearish divergence showing up in the Aussie advance/decline line where 18% of the Old Ordinaries Index is made up of Earth related materials. All that said, however, the Bombay, CAC, and FTSE advance/decline lines continue to look in good shape as they persist in making new all time highs over the last couple of weeks, with the DAX advance/decline line only 44 net advancing issues from joining the group.

So with the BETS moving up to a reading of -5, investors continue to be on the sidelines watching the action. The strong breadth thrusts we saw in the McClellan Oscillators during Christmas week trading were a nice shot in the arm for the markets overall, but we're now starting to see some non confirmations in the volume data...especially in the NASDAQ and NDX volume MCO's which both begin the year in negative territory. The NYSE Open 10 TRIN finished in "oversold" territory on Friday with a reading of 1.12, while a huge spike up in the NASDAQ daily TRIN on Friday of 1.68 was finally able to move the NASDAQ Open 10 TRIN into minimal "oversold" territory at 1.02...the first time above 1.00 since April of last year. The 10 day average of the CBOE and Equity Put/Call ratios eased off significantly with the Christmas week rally, and with this past week's Wall Street Sentiment Survey coming in with a lopsided 15% bulls and 62% bears, it looks as though we're going to start the week ahead on a high note. Taking everything into consideration then, let's change our trading blueprint a bit and look for the markets to continue using up the momentum created by the October breadth thrusts into January OPEX on the 21st, while paying special attention to both the interest rate sensitive and growth areas of the market as to any kind of rest period that will be needed once various upside price objectives given last year, such as SPX 5000, are finally met.

Have a great trading week!

US Equity Markets:

US Interest Rates:

US Sectors:

Precious Metals:

Australia:

England:

France:

Germany:

India: