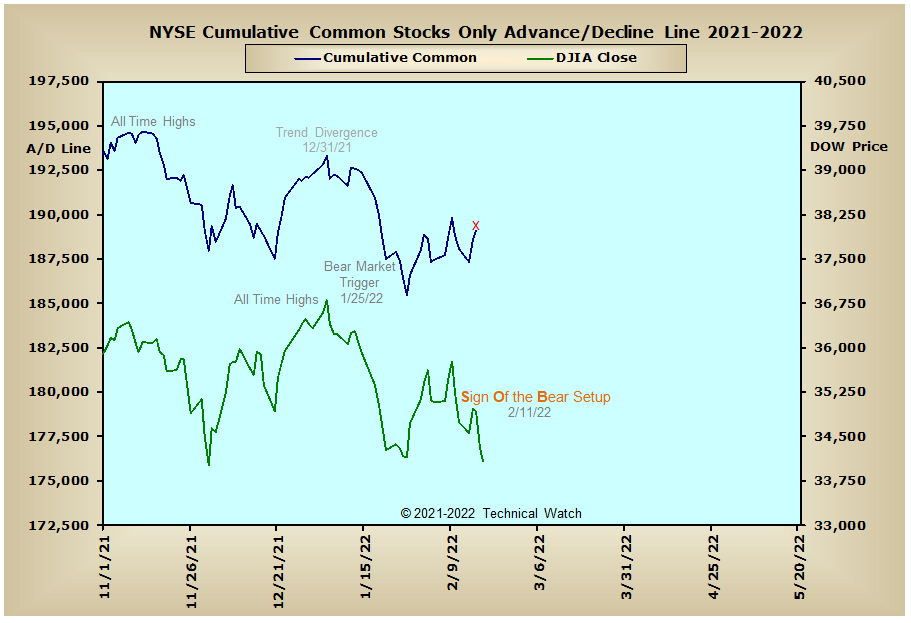

Stock prices in the United States drifted lower this past week as they finished on Friday with an average loss of -1.28%, with the Dow Jones Industrial Average leading the retreat with a loss of -1.90%.

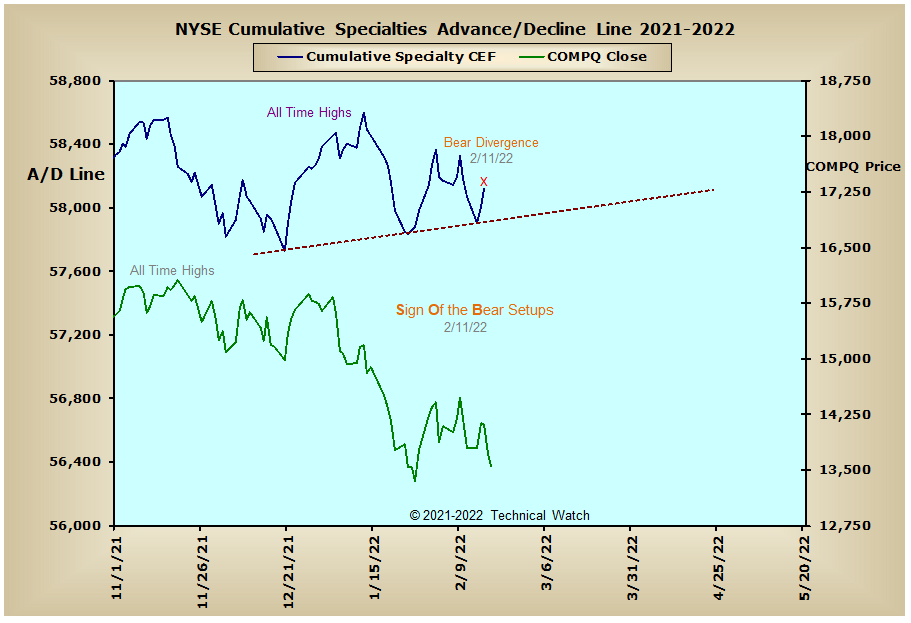

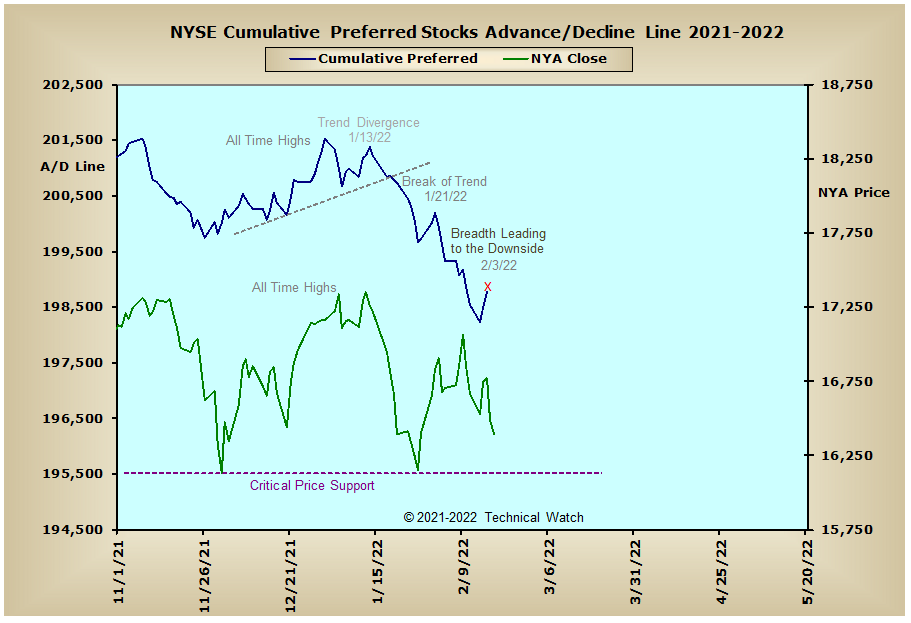

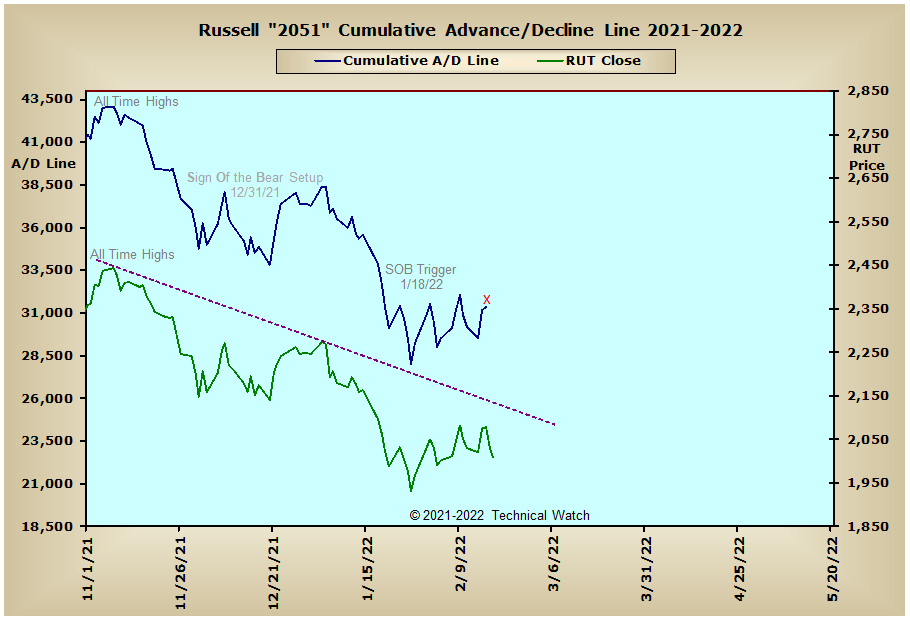

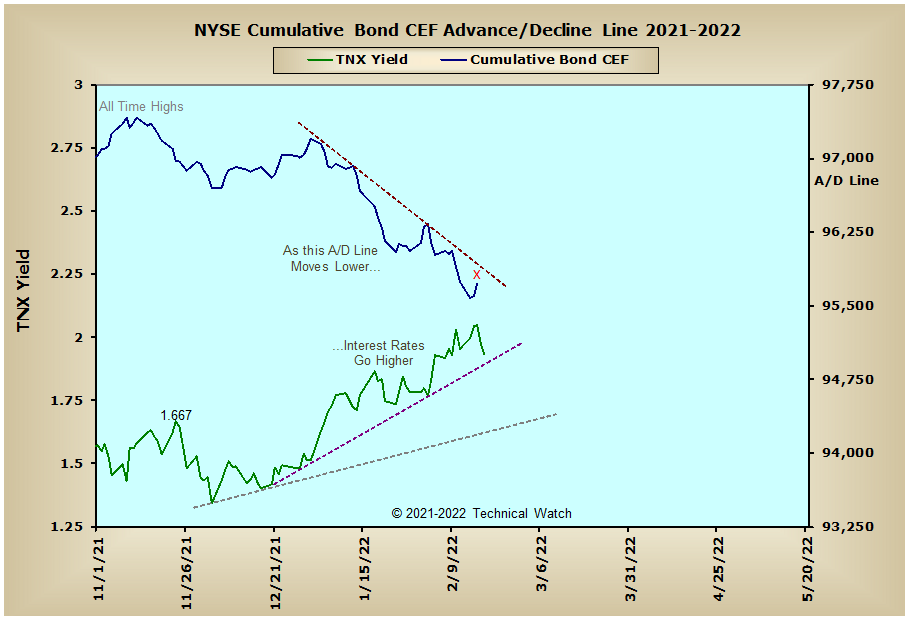

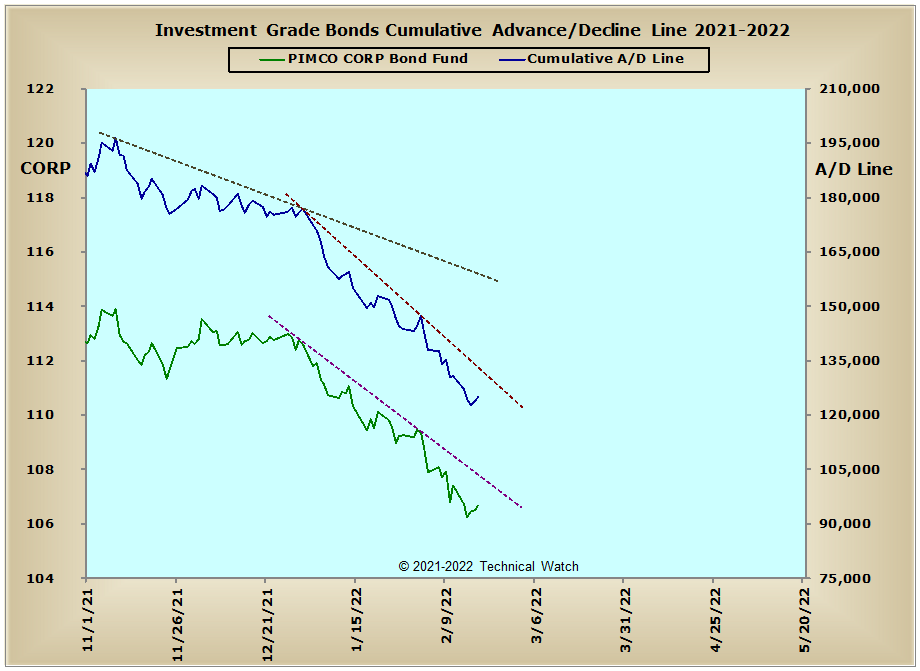

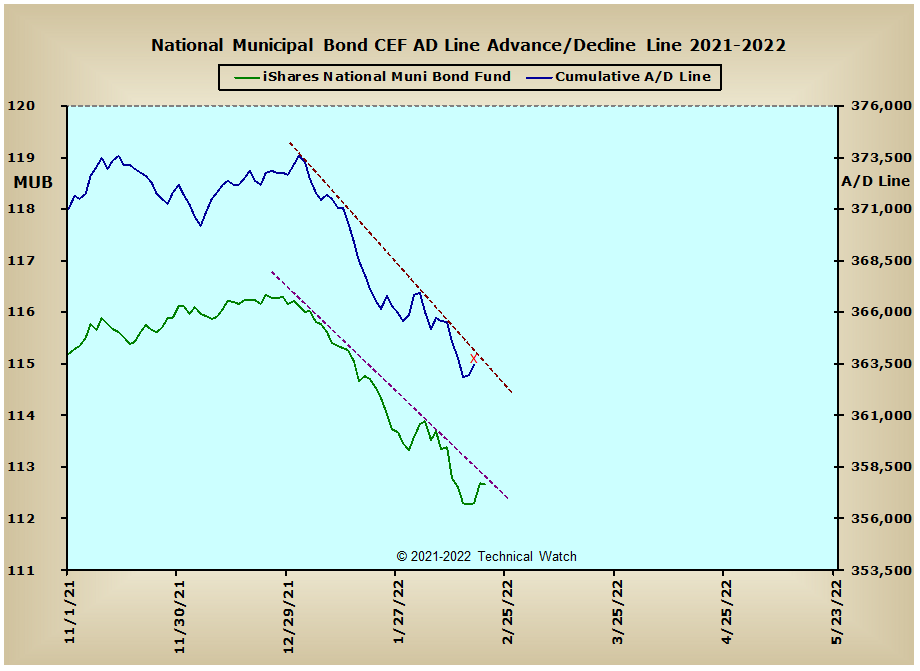

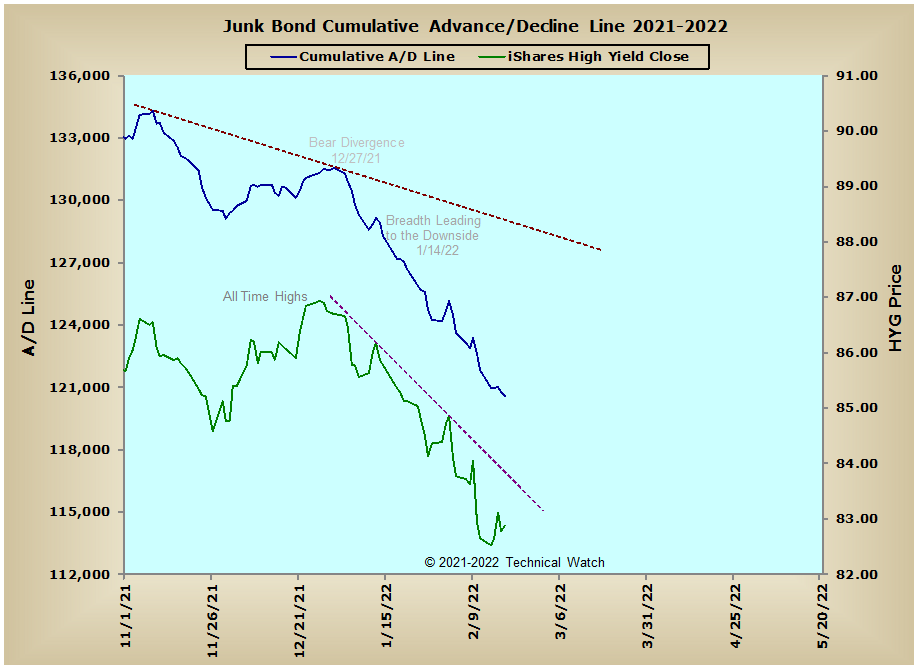

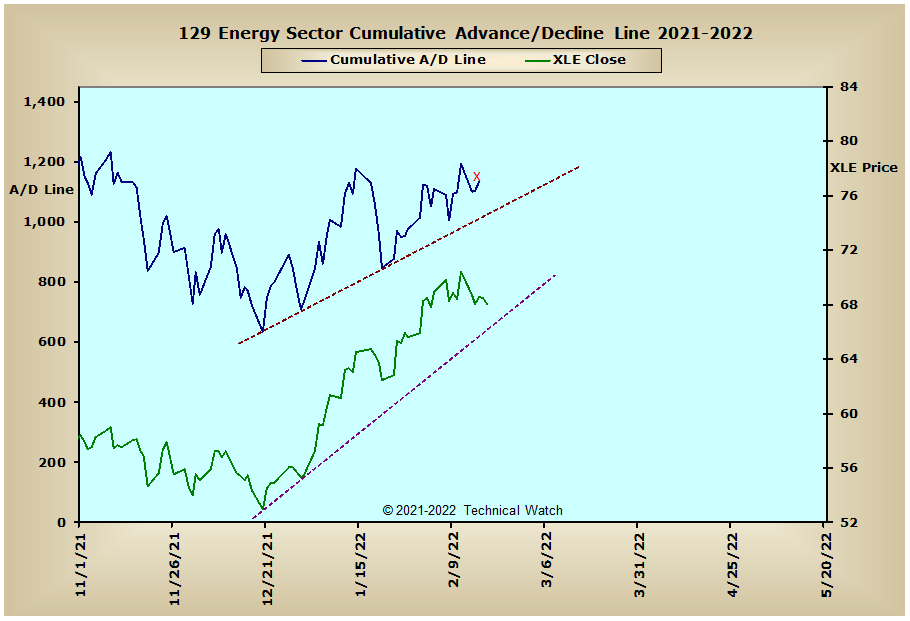

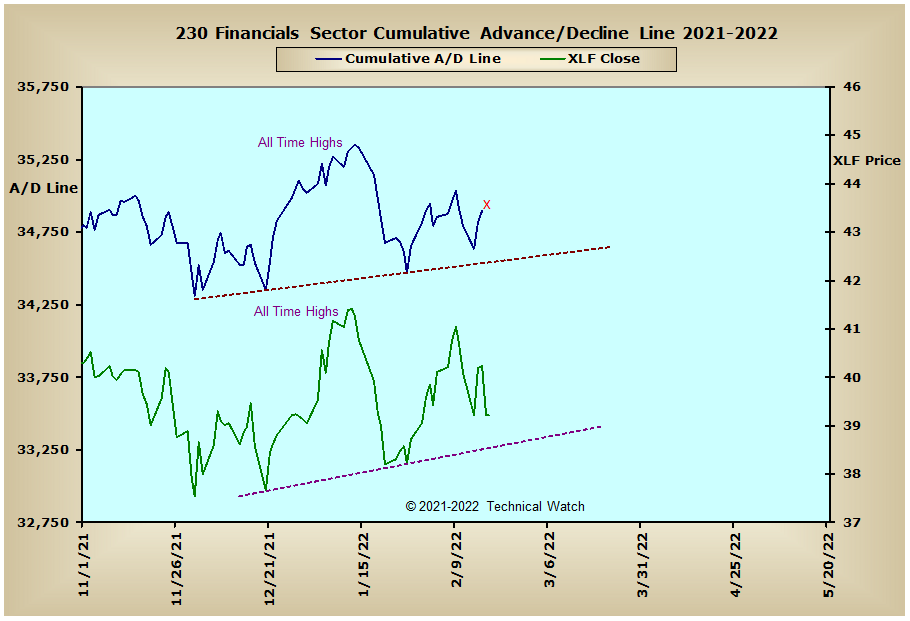

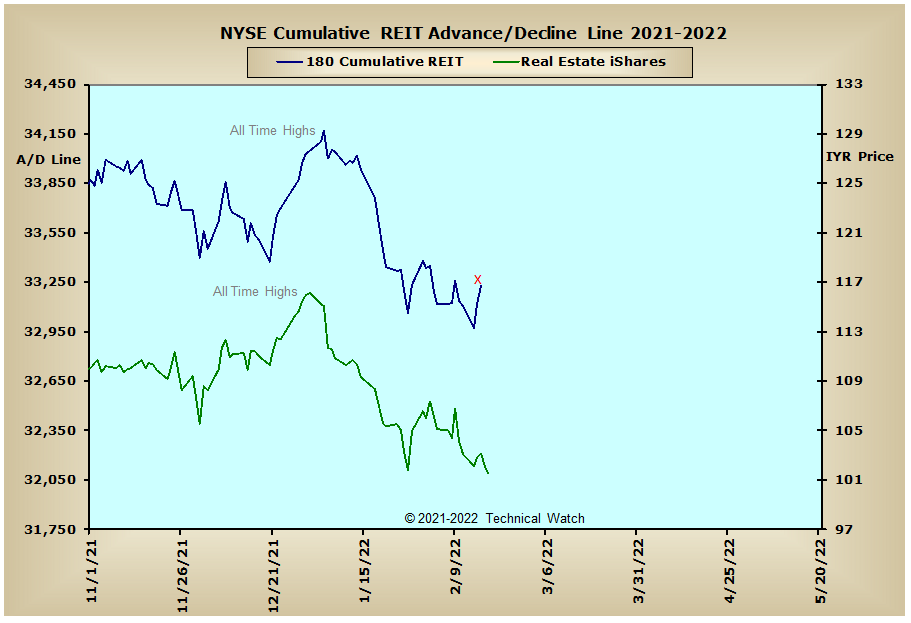

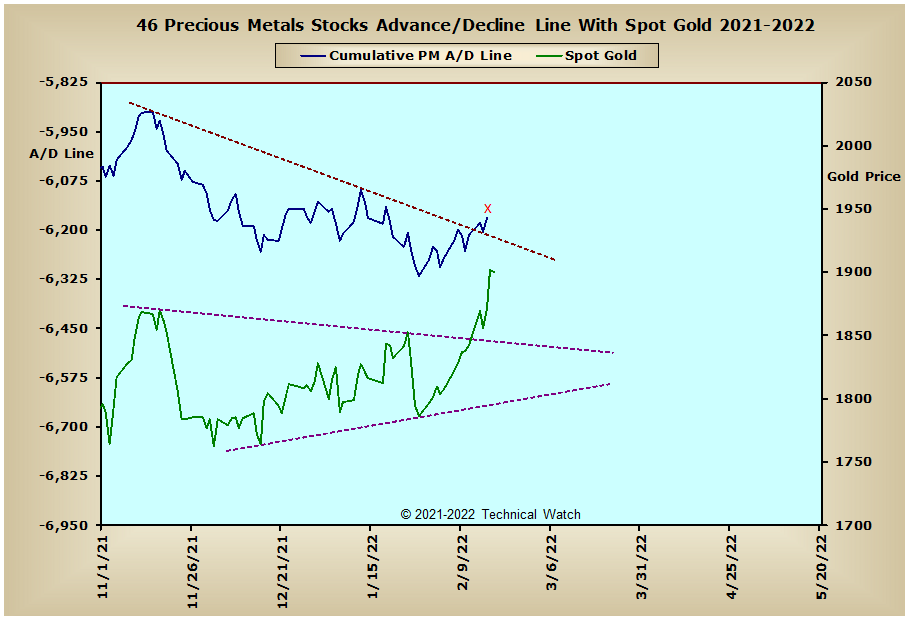

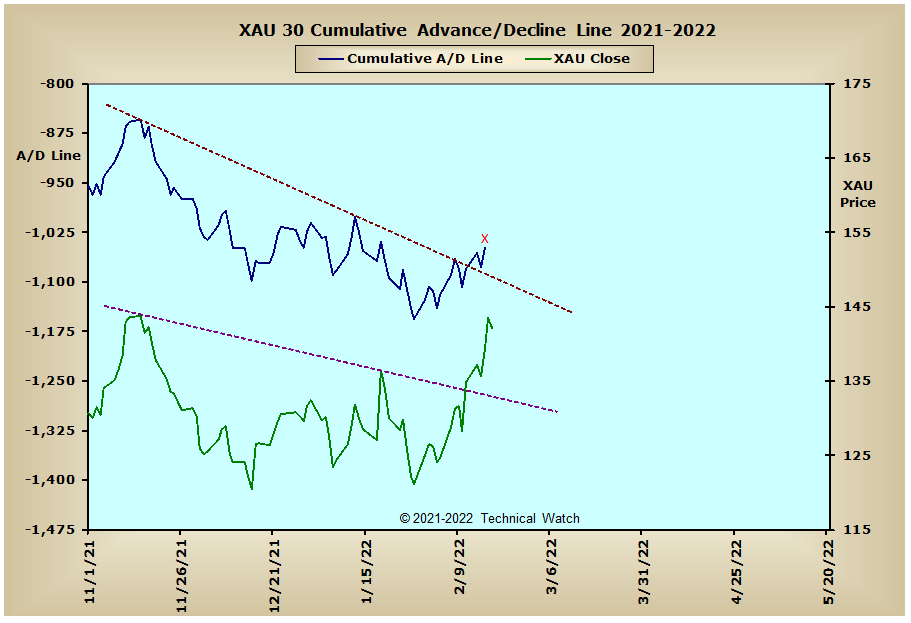

As we begin this week's review, please note that there was a problem with the Python data collection app on Thursday, so we don't have complete data in many of the U.S. charts. Those charts that are marked with a small red X are missing Thursday's and Friday's breadth data, but all of the prices have been updated through the end of the week. The developer thinks he knows what the problem is, but with the 3 day holiday weekend, it might be some time this coming week before the problem is fixed. If it's corrected on Tuesday, the charts will be updated and posted at that time (the red X will no longer appear). Please note that all of the international charts are updated through Friday, as well as, the Investment Grade and Junk Bond advance/decline lines.

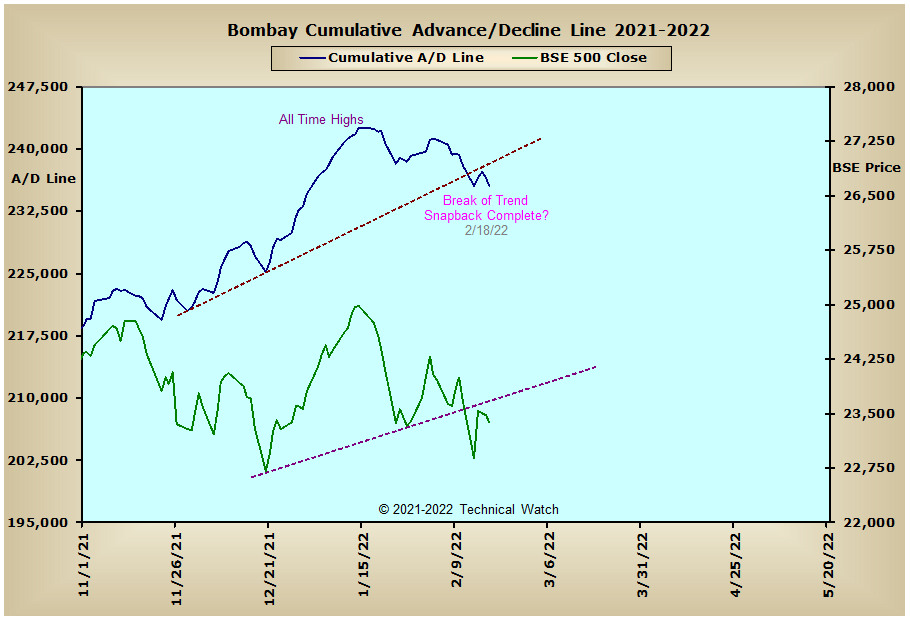

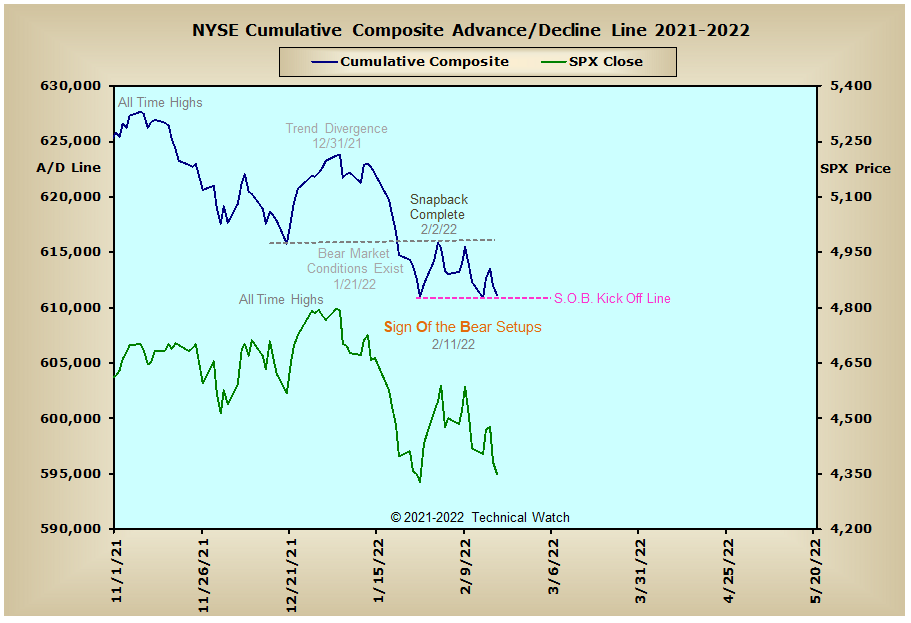

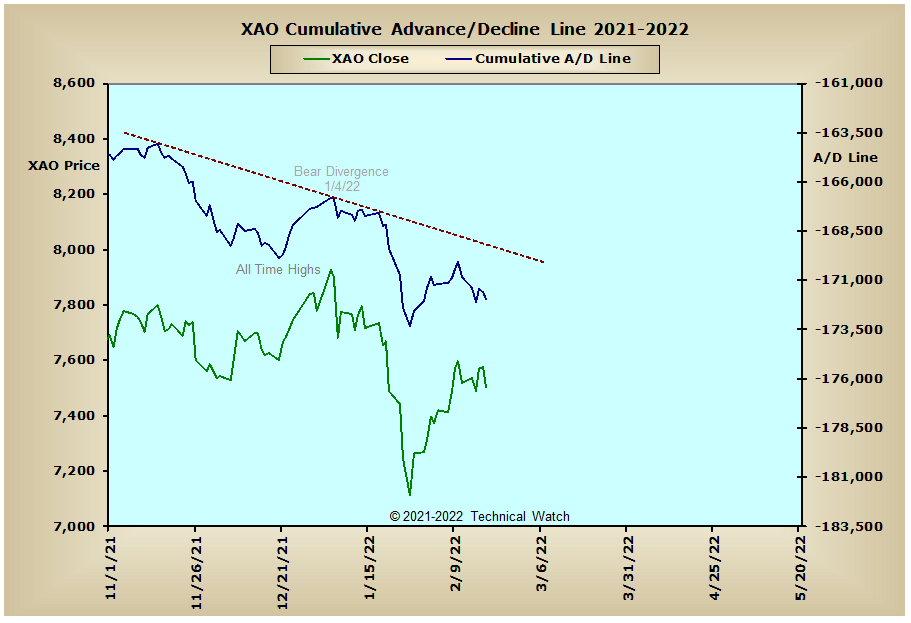

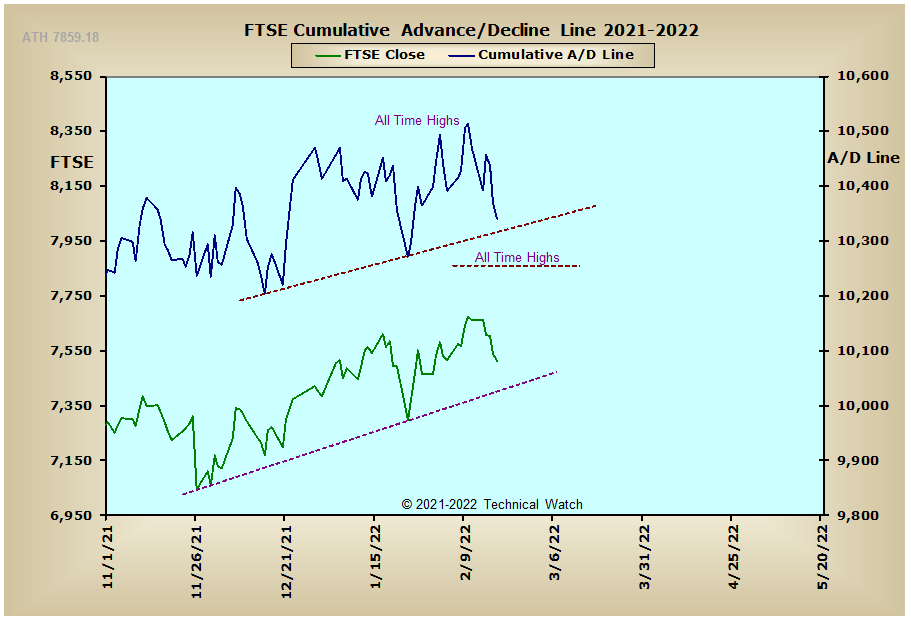

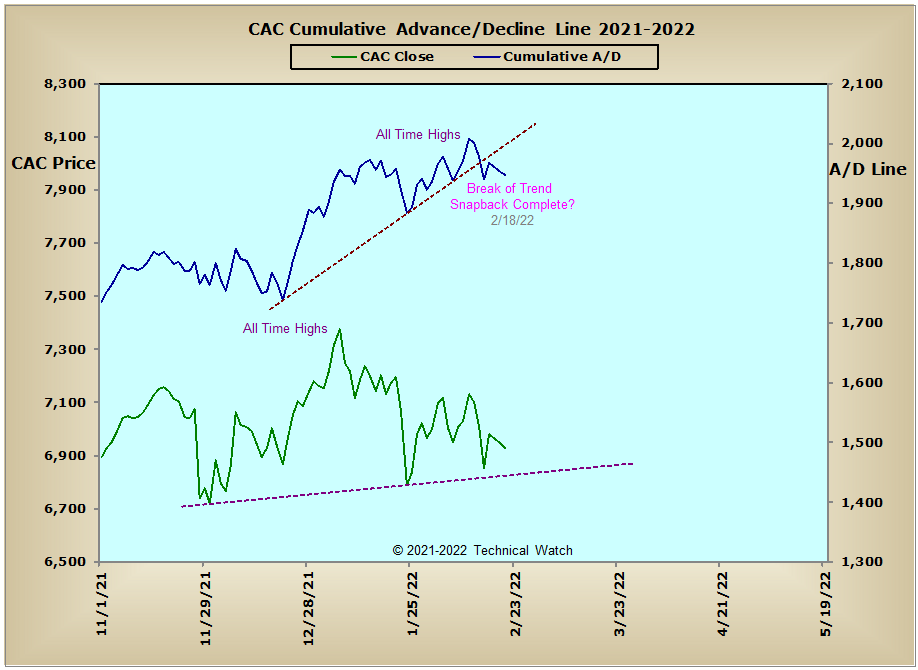

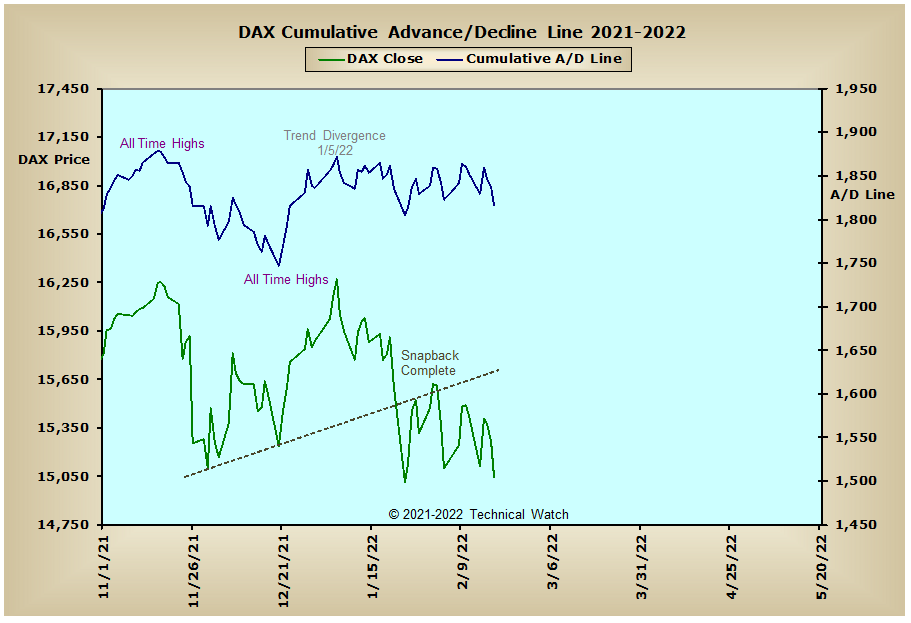

Looking at this past week's array of cumulative breadth charts and we see that the NYSE Composite advance/decline line bounced off of its S.O.B. trigger point on Tuesday and then finished on Friday back at this critical line of bull market support. Meanwhile, the Junk Bond advance/decline line continues to make new lows as liquidity levels continue to recede at an accelerated rate. Looking overseas, and we see that weakness is now starting to show up in the European markets, while the Bombay advance/decline line broke below, and then snapped back to, its multi month trendline of support. With the drums of war as a backdrop, the price of gold broke out to the upside to touch the $1900 level, while silver and platinum were pulled up by their bootstraps in following gold's lead. Although the Precious Metals and XAU advance/decline lines saw upside breakouts above their respective intermediate term declining tops lines with this gain in the metals, they both remain well below their high points of last November providing inadequate underlying price support. Only in the fullness of time will we be able to know how important this is given the current existential circumstances.

So with the BETS moving sharply lower to a reading of -40, investors can once again re-initiate short positions, with protective stops, in areas that continue to show weakness. With the exception of the SML breadth and volume McClellan Oscillators, all of the other MCO's begin the week in negative territory with the many of the volume MCO's leading the breadth MCO's to the downside...with all of the breadth and volume McClellan Summation Indexes now in negative territory. Both the NYSE Open 10 TRIN (1.07) and the NASDAQ Open 10 TRIN (1.00) were minimally "oversold" on Friday, with very little movement in the 10 day average of put/call ratios despite the price weakness going into February OPEX. With market vulnerability increasing quite a bit over the last week, the path of least resistance continues to side with the sellers as trading begins on Tuesday. Given what we have to work with then, and with a firm understanding of the current (emotional) geopolitical climate, investors can once again trade with a negative bias as we start the holiday shortened week ahead, with traders taking a more aggressive stance with any newly opened short positions.

Have a great trading week!

US Interest Rates:

US Sectors:

Precious Metals:

Australia:

England:

France:

Germany:

India: