After moving sharply higher to start the week, the major market indexes then gave it all back before finishing on Friday with a nearly unchanged average weekly gain of +.08%, with the NASDAQ Composite and NASDAQ 100 providing the largest tallies at .65% and .72% respectively.

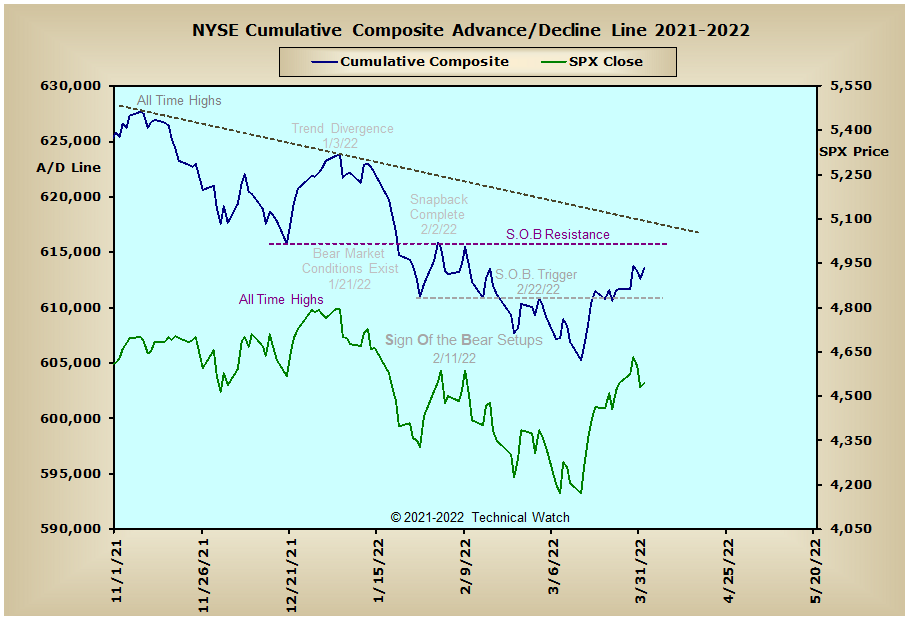

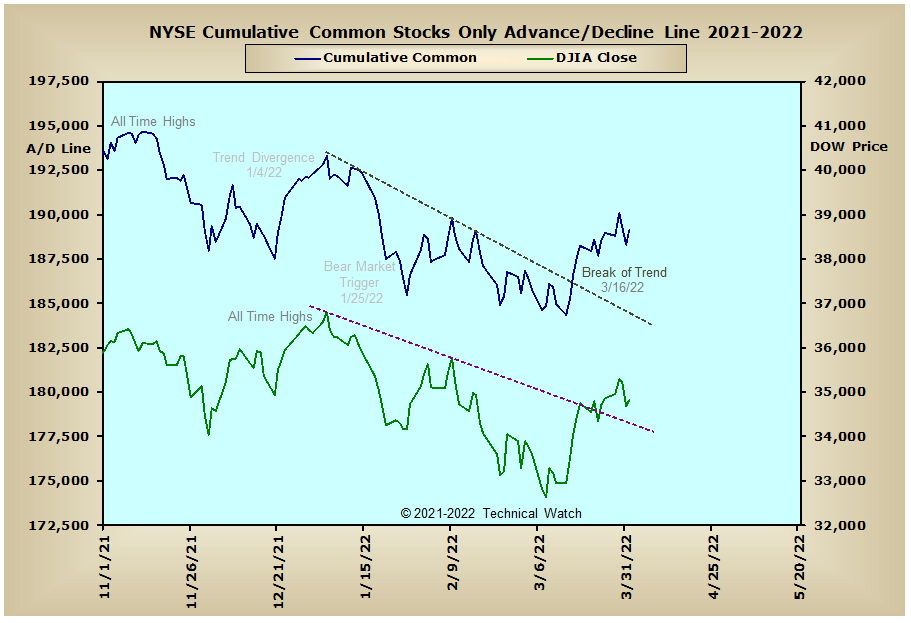

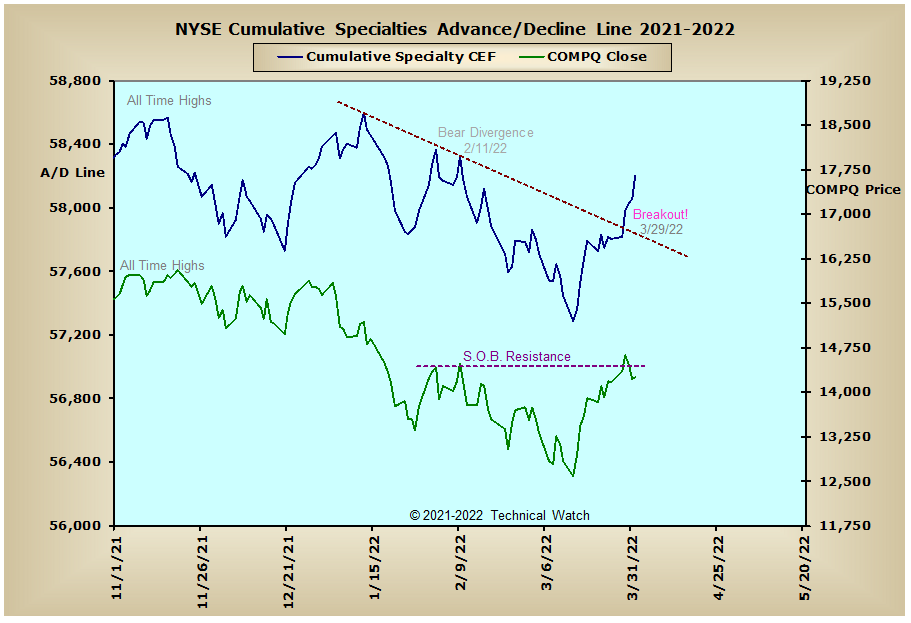

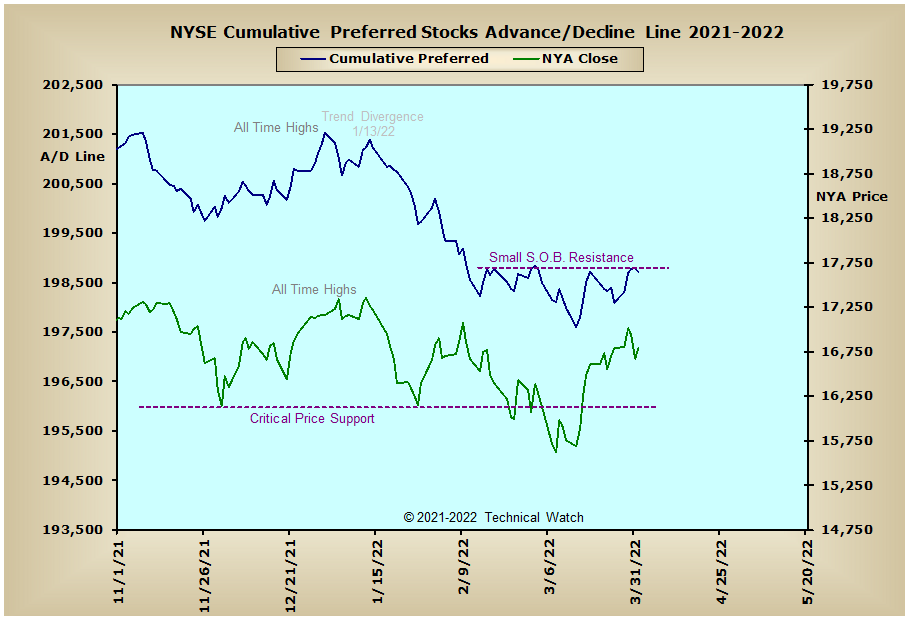

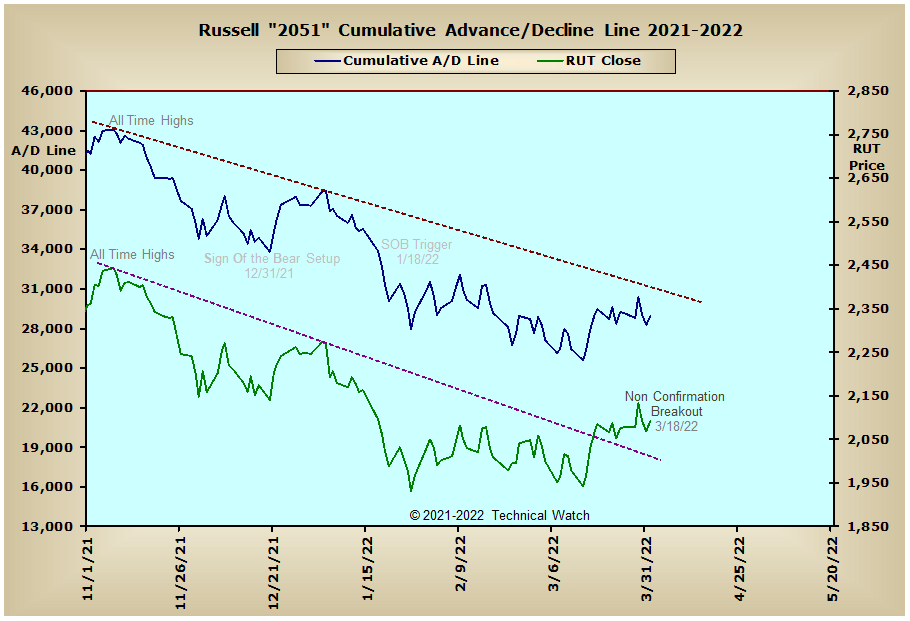

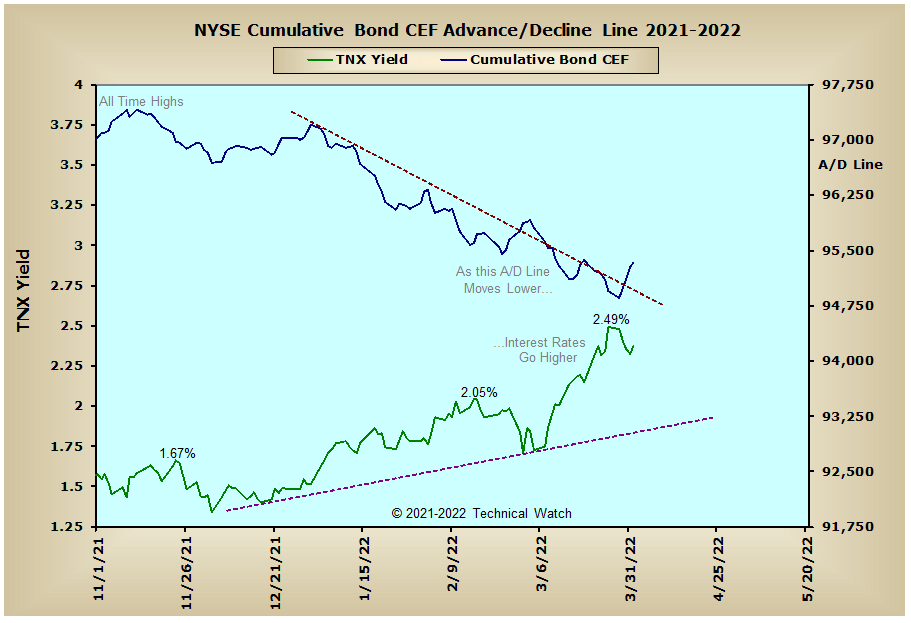

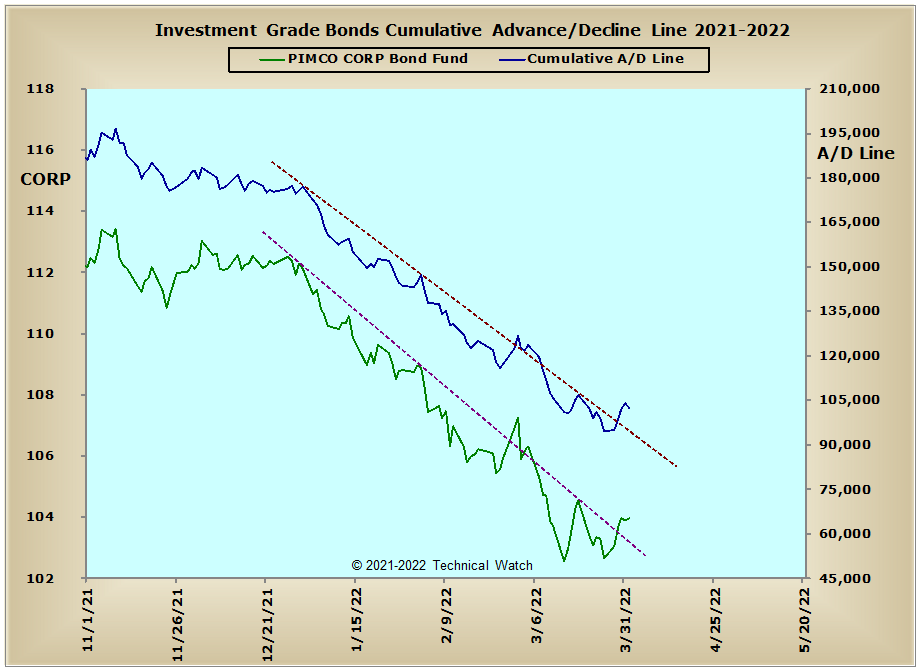

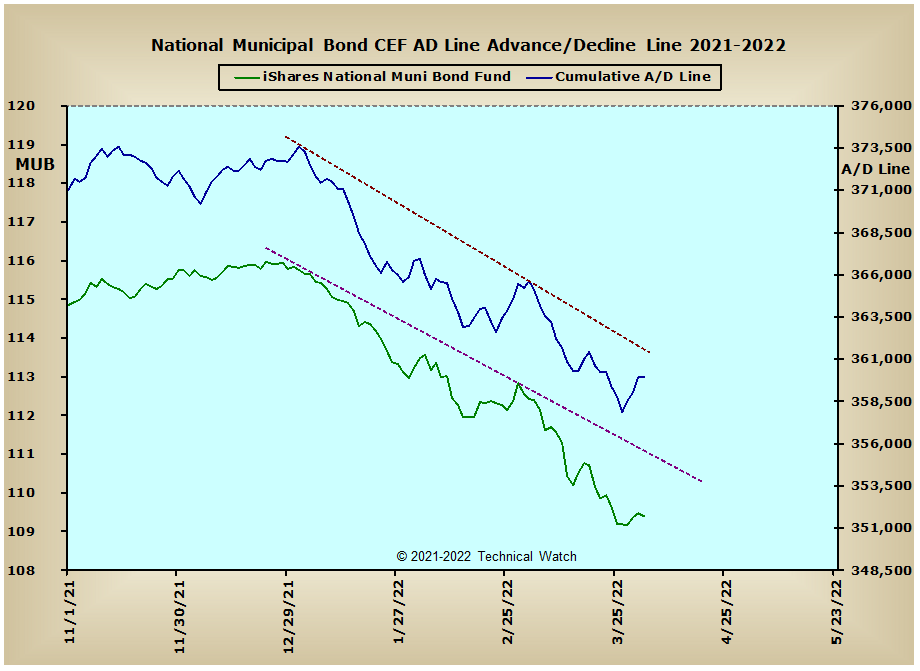

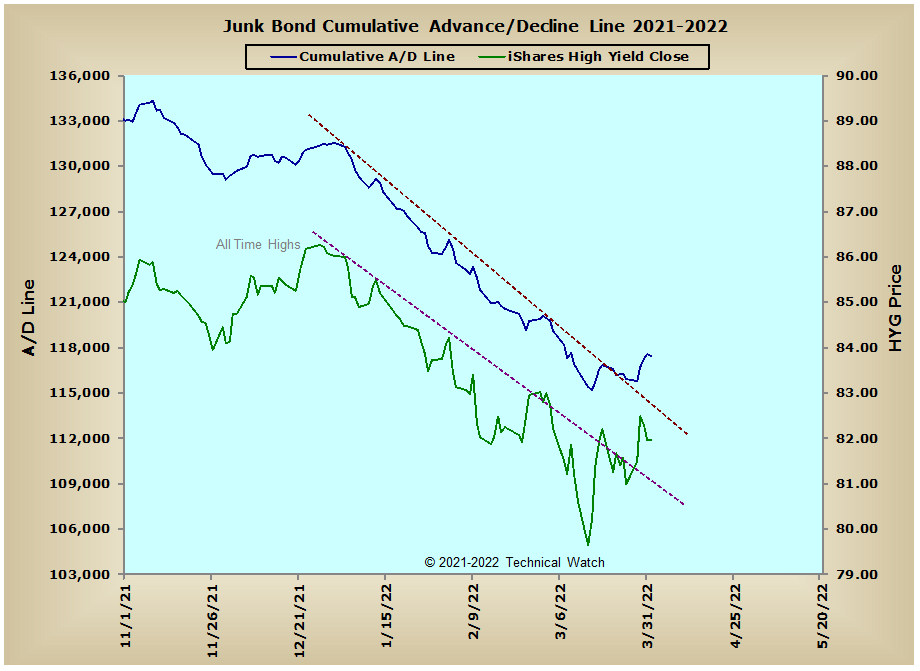

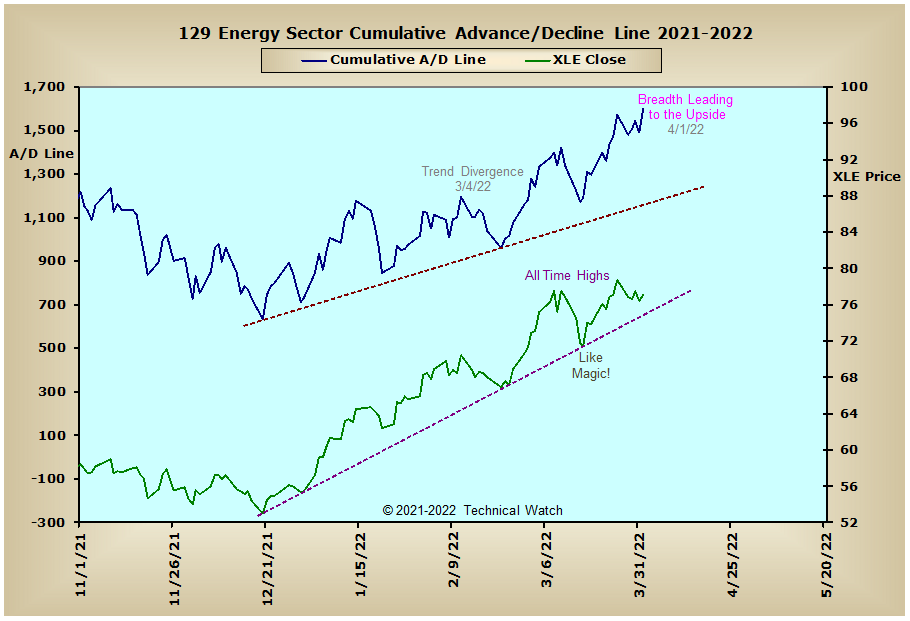

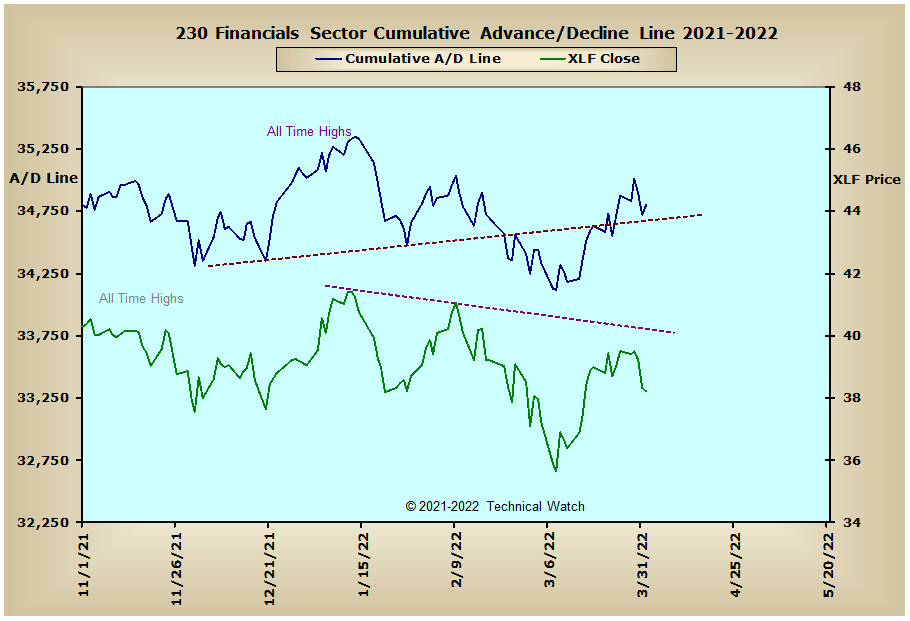

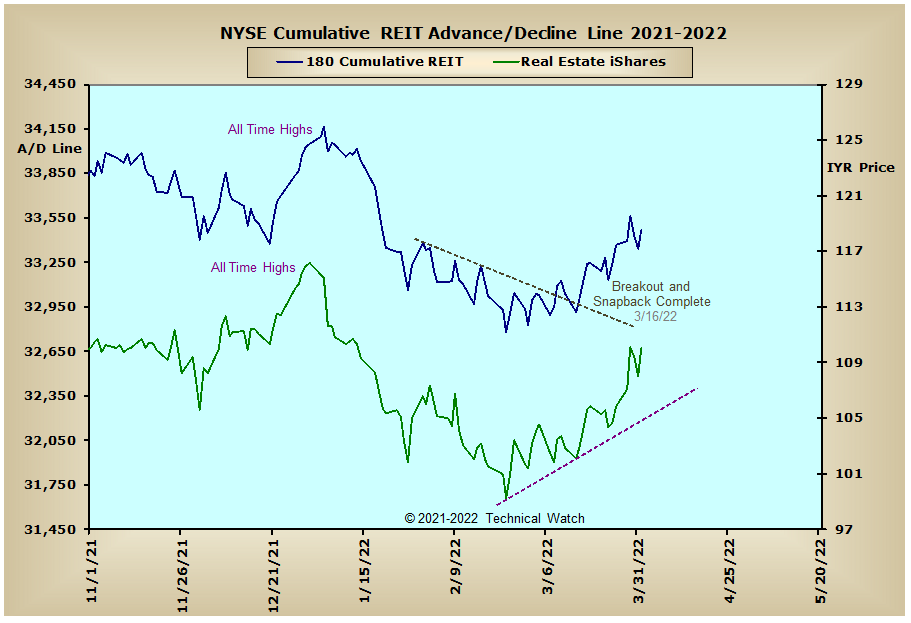

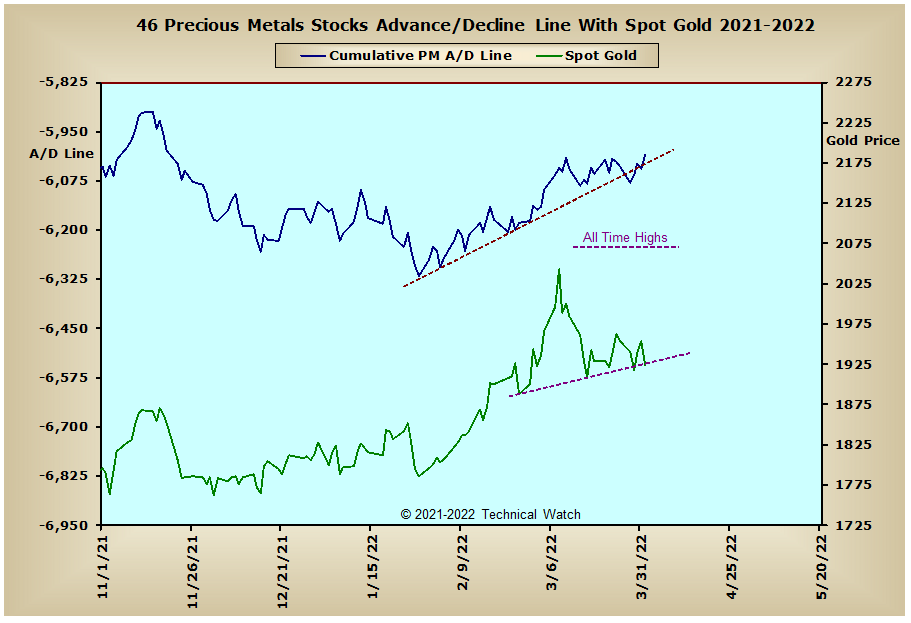

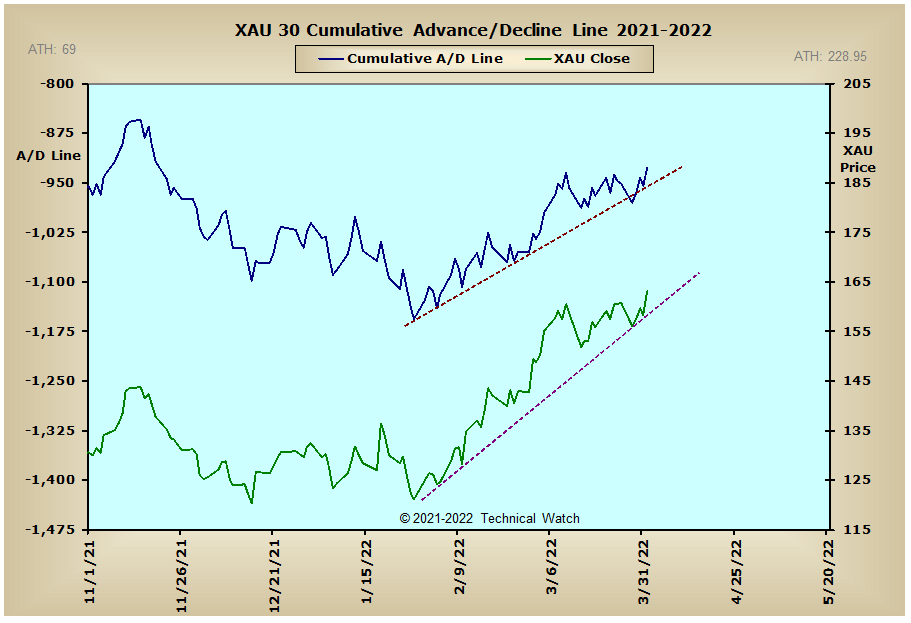

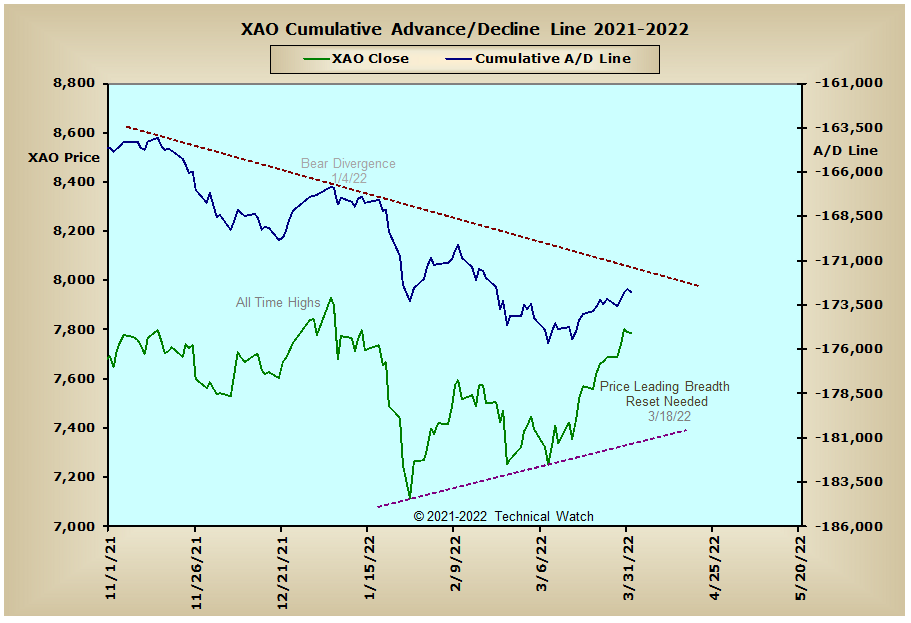

Looking over our standard array of money flow charts for this week shows that we're currently working with mixed market conditions as the interest rate sector is still applying the proverbial thumb on the bearish scale as to seeing better times ahead. That said, there does seem to be an effort now to provide a cumulative bottom in the NYSE Bond CEF, Investment Grade and Junk Bond advance/decline lines, but it's really too soon to tell if this attempt will hold or not...especially with the NYSE Preferred Stock advance/decline line having difficulties negotiating back above its S.O.B. resistance line. Both the Precious Metals and XAU advance/decline lines finished at new reaction highs on Friday which might be a whisper that the debt asset class just may indeed be in the process of finding a foothold after many months of decline. The Energy Sector advance/decline line continued to make new reaction highs last week in spite of the large tumble in the price of West Texas Intermediate Crude Oil as it lost -12.84%. This would suggest that we're still likely to see at least a challenge of the recent highs made at the $130 level before the longer term rally from the COVID crash lows will be over. The NYSE REIT advance/decline line is maintaining a pattern of higher highs and higher lows, while the international markets persist in being mixed at this time as Europe looks to the east for future economic guidance.

So with the BETS losing 5 points to a reading of +10, investors are still waiting for an "all clear" signal before becoming more aggressive bulls. As we start the week ahead, we see that all of the breadth and volume McClellan Oscillators are in positive territory with only the NASDAQ breadth MCO still waiting for a crossover buy signal on its components to make it unanimous. With the NYSE TRIN finishing at 2.87 on Thursday, we know from past experience that readings above 2.00 have shown a historic tendency that an important price bottom may not be to far behind. Options are giving mixed signals right now as the 10 day average of Equity and CBOE put/call ratios continues to show too much call buying at this time, while put premiums still remain elevated...as if traders have one foot out the door, just in case. With this month's OPEX coming one day early due to the 15th being Good Friday, the expectation for the week ahead is for prices to remain choppy with any pattern bias toward the upside. Based on all this then, investors should continue to do their homework in preparation of any upside acceleration from current levels, while traders remain steadfast in using "hit and run" trading strategies until one side is declared the one in control on an intermediate term basis.

Have a great trading week!

US Interest Rates:

US Sectors:

Precious Metals:

Australia:

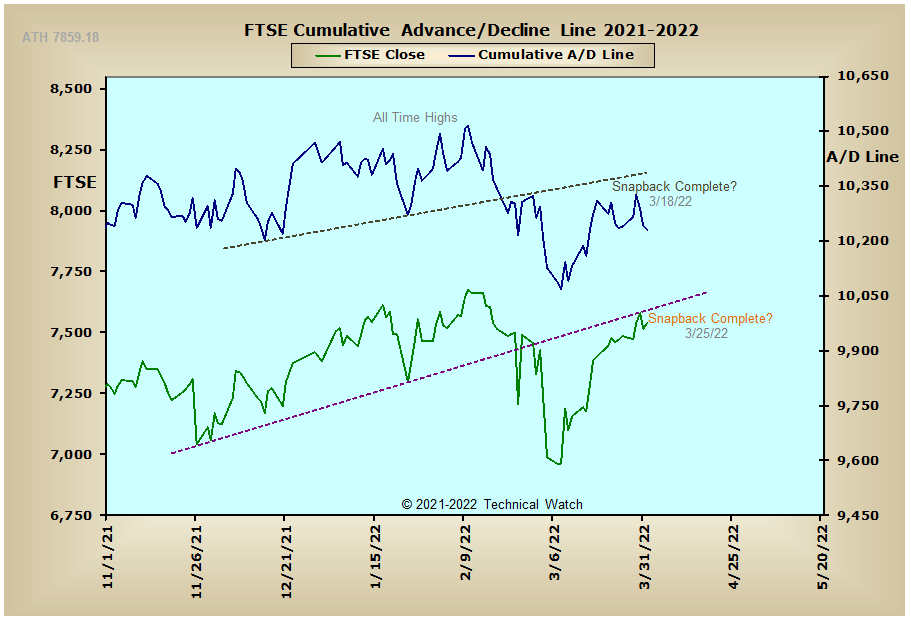

England:

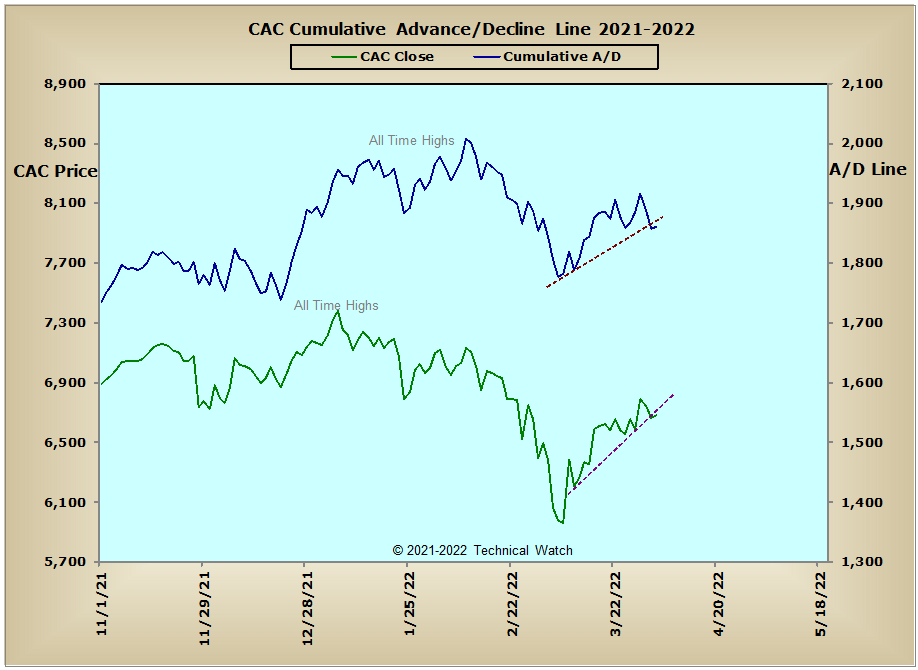

France:

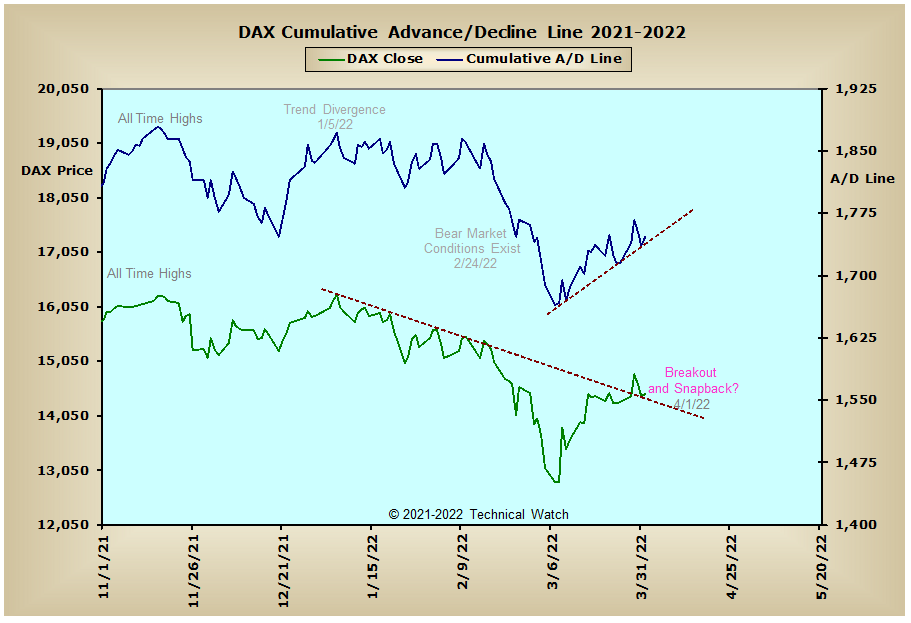

Germany:

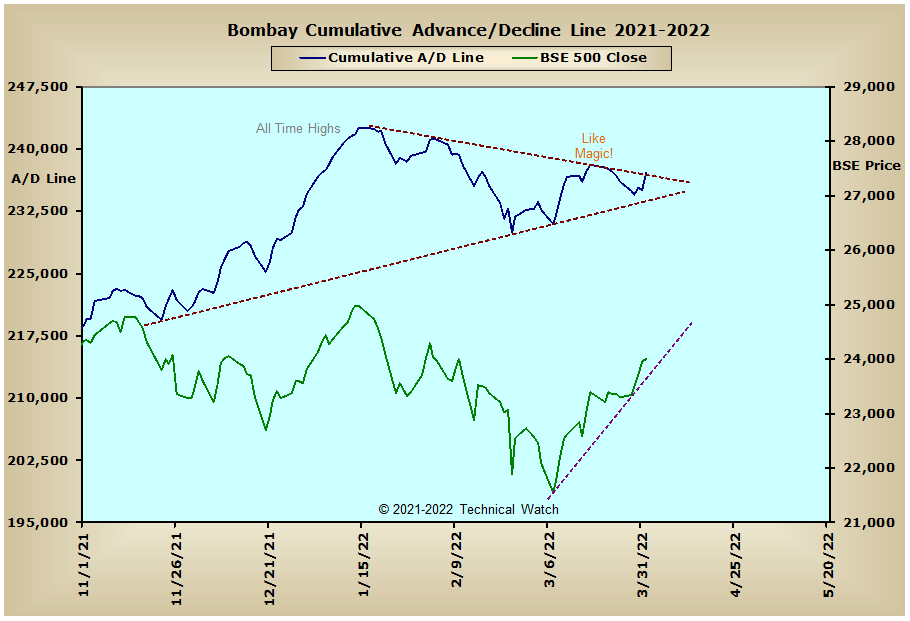

India: