Stock market indexes started out the week by rallying sharply to just over 6% to relieve their deeply "oversold" conditions from the week before, but then found strong resistance at their respective 20 day and 200 week EMA's, before closing Tuesday's pattern gaps to the upside with Friday's sturdy jobs report. When the dust finally settled on this highly volatile week, the major market indices still finished with an average weekly gain of +2.04% as the NASDAQ Composite Index turned out to be the weakest link as it settled with a gain of only +.73%.

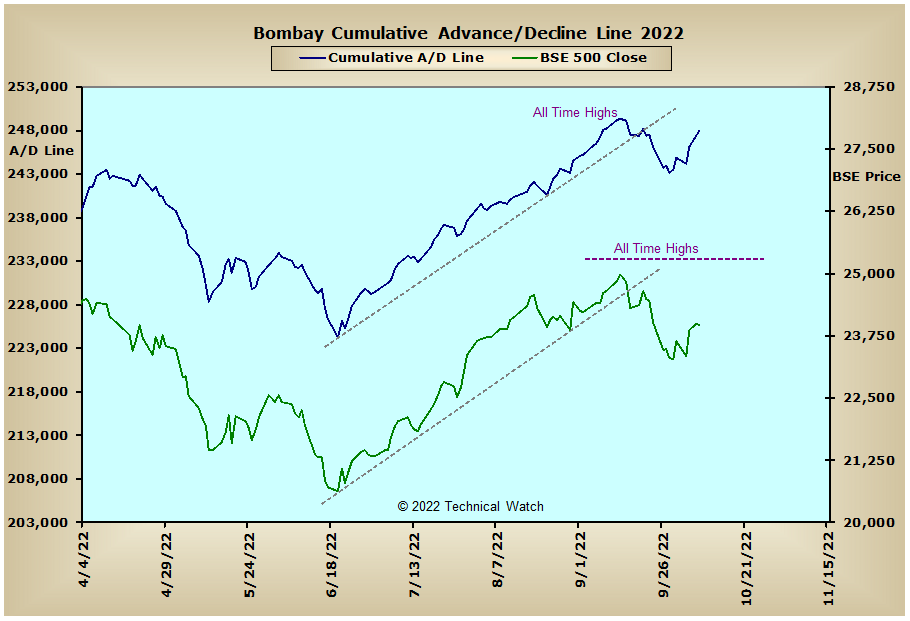

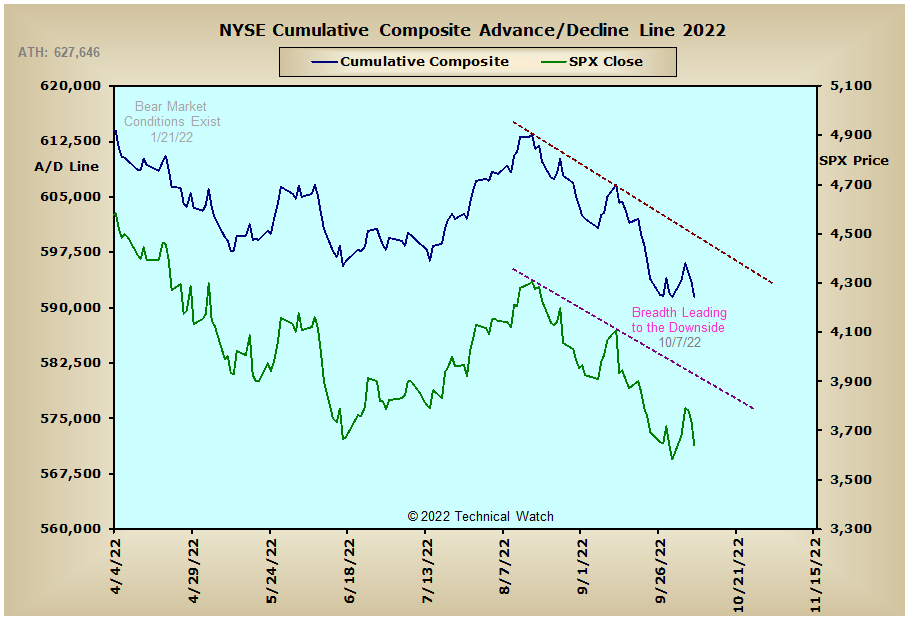

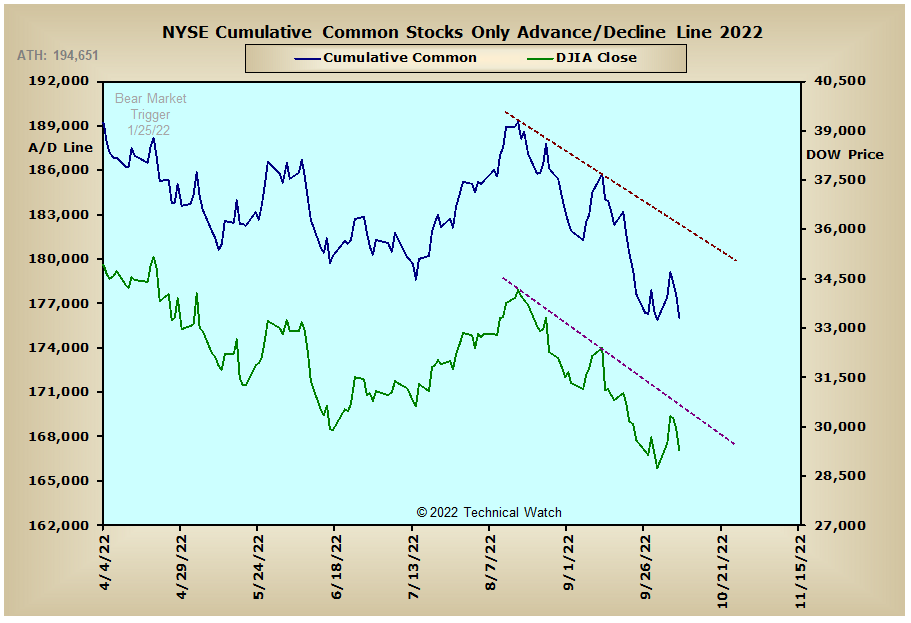

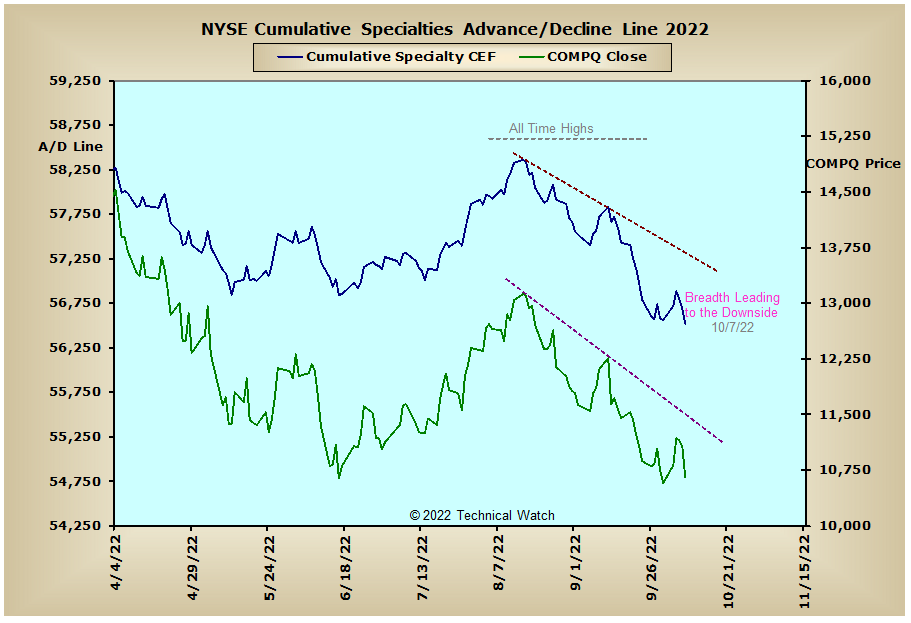

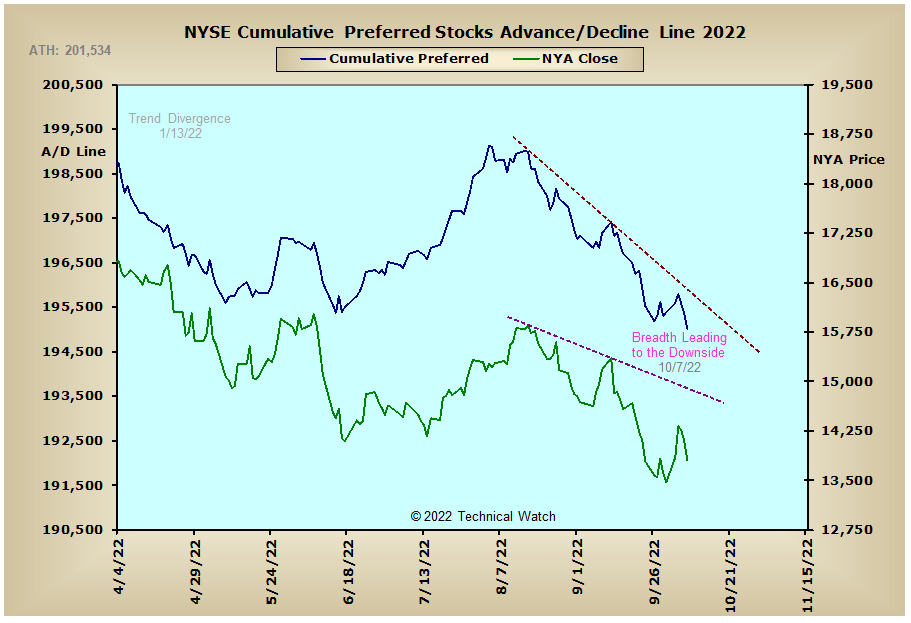

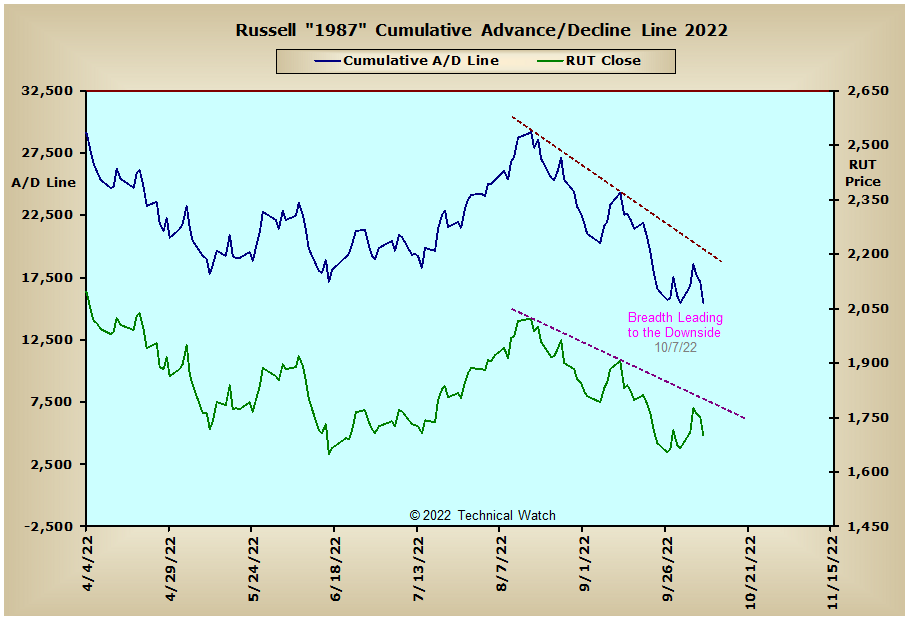

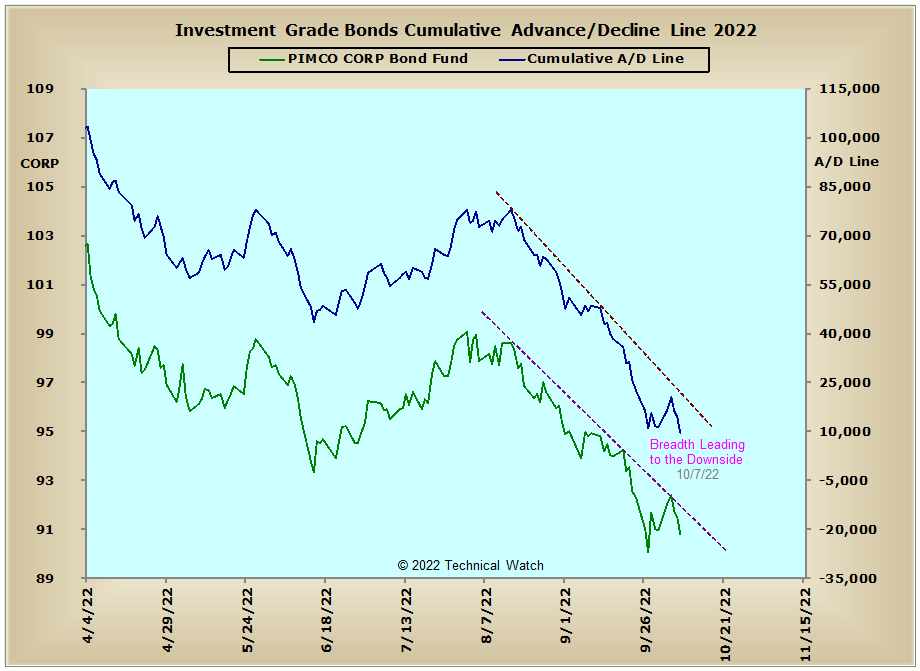

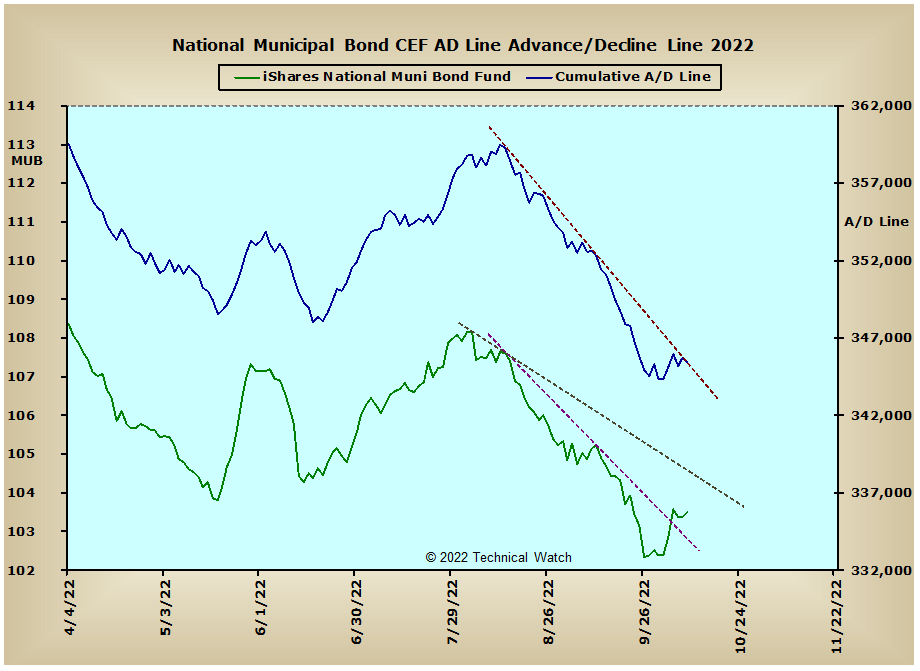

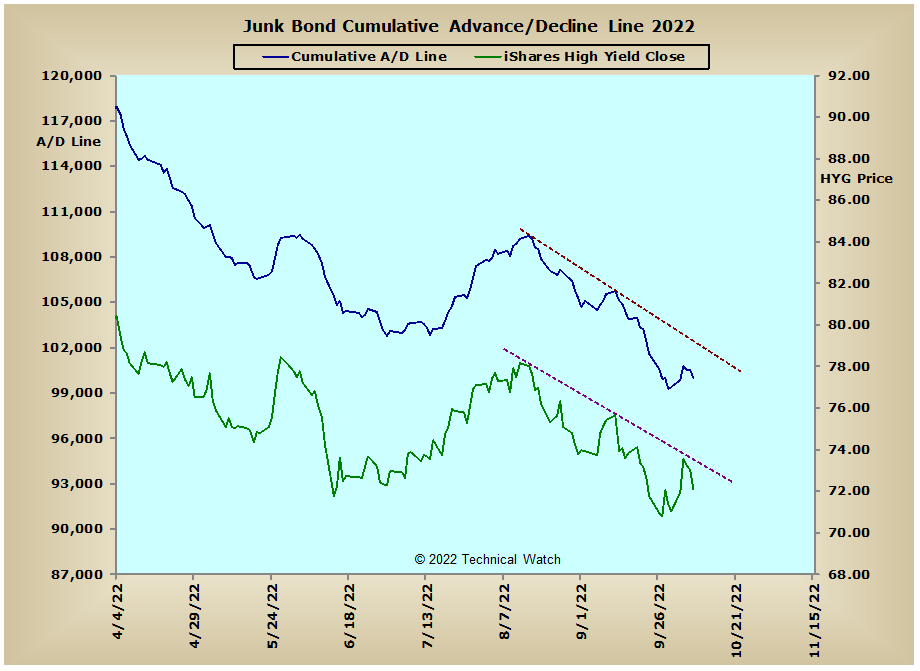

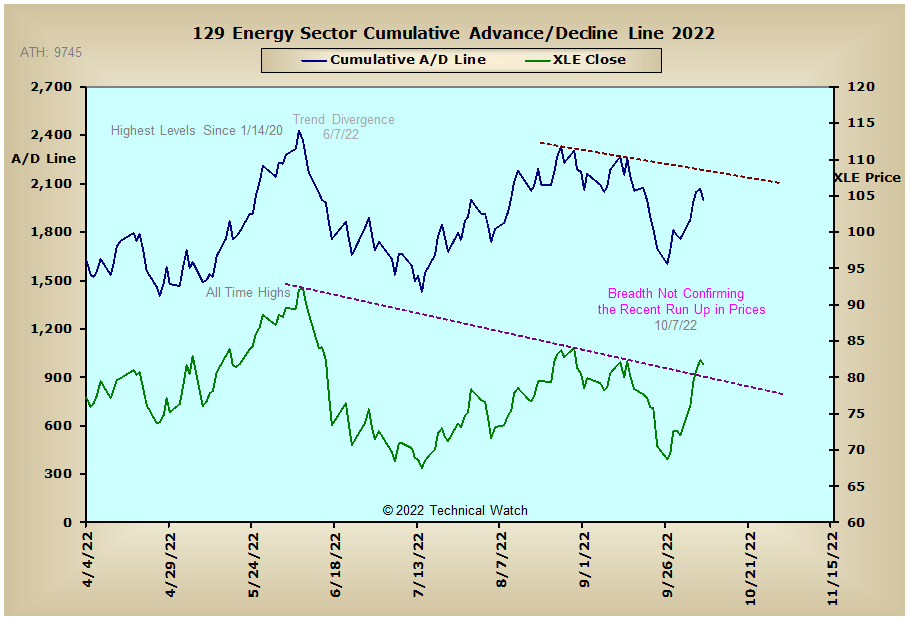

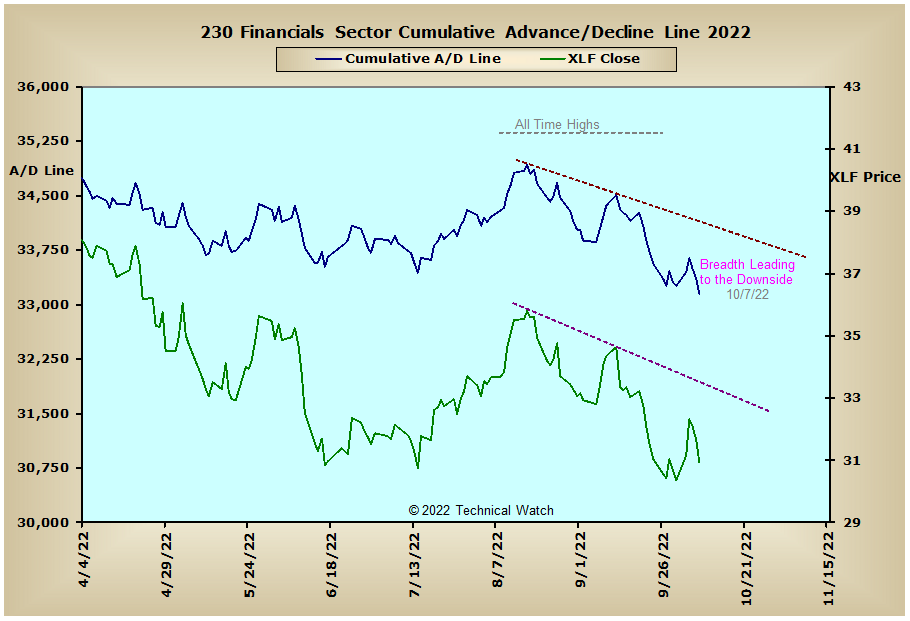

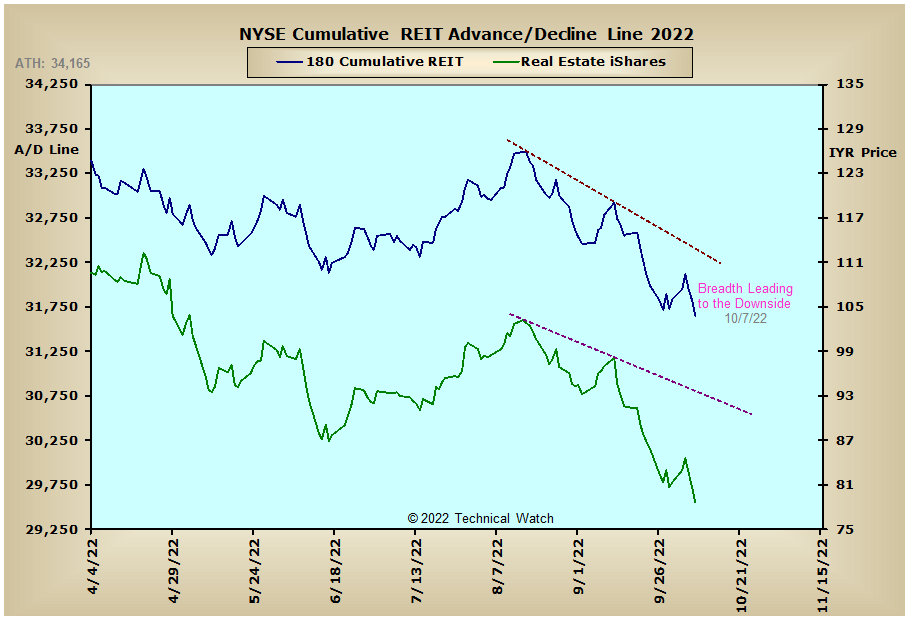

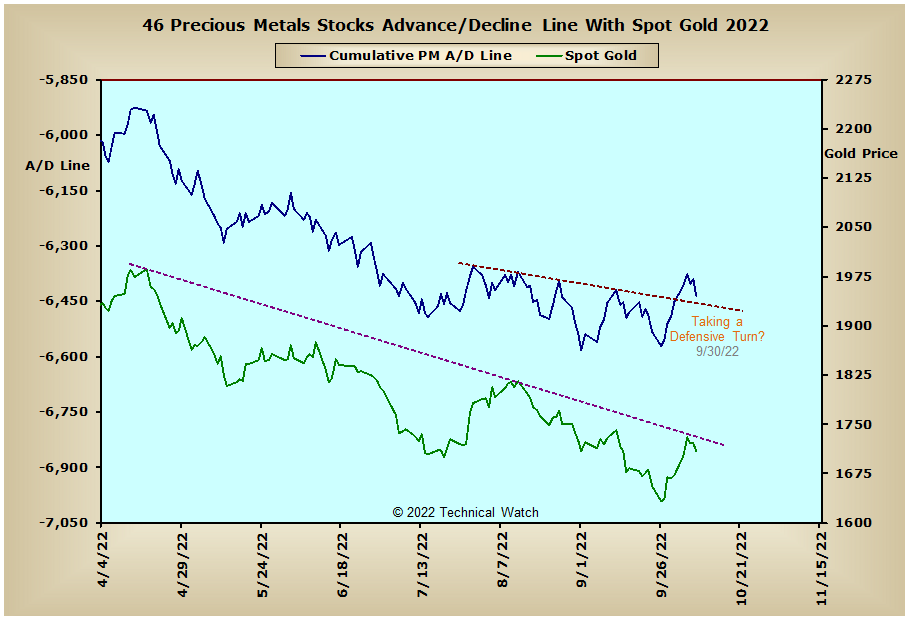

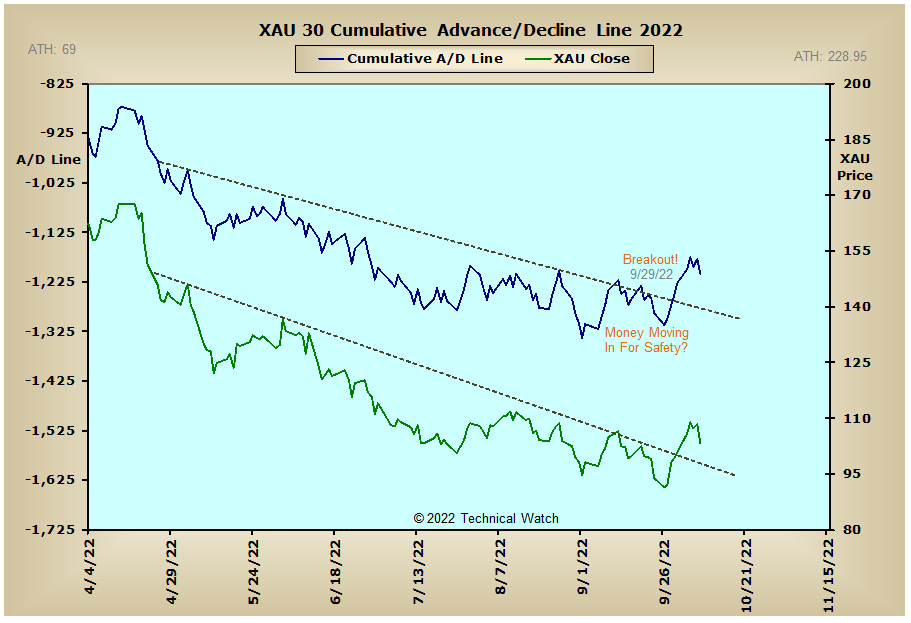

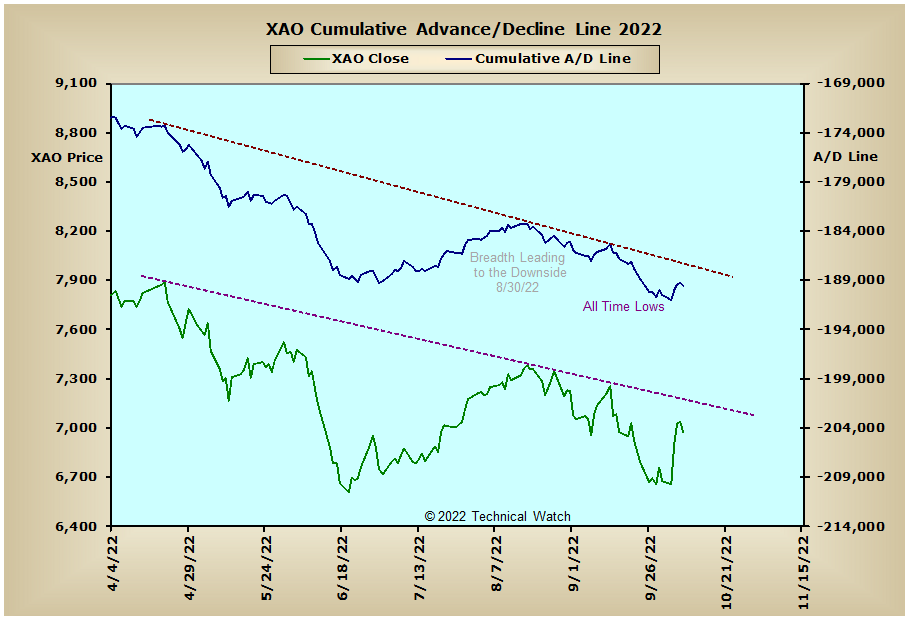

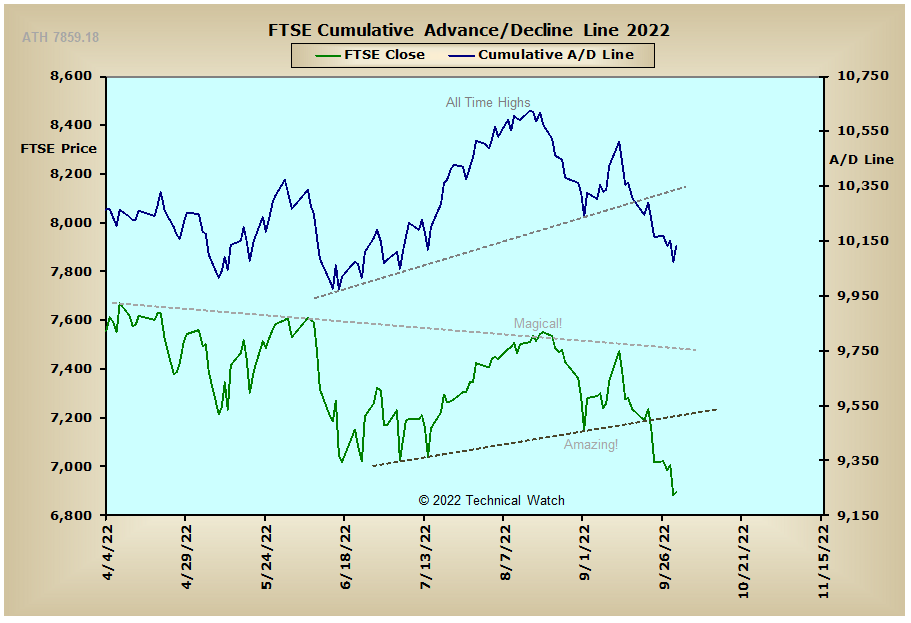

Looking over our usual array of cumulative breadth charts for this week shows that the NYSE Composite, NYSE Specialty CEF, NYSE Preferred Stock and Russell "1987" advance/decline lines all finished with lower lows compared to that of the week before. Also showing continued weakness were the Investment Grade Bonds, NYSE REIT and Financial Sector advance/decline lines as Friday's firm jobs report increased the chances that the FED will now be hiking interest rates by 1% at the November 2nd meeting. Another area of "interest" continues with the Precious Metals advance/decline line where we see that it showed a breakout above its declining tops line last week as the price of gold continues its intermediate trend to the downside. With the likelihood of still higher interest rates acting as Kryptonite to this asset class in general, the odds still favor lower prices for the metals with the current downside price target for gold at $1450 an ounce. International issues continue to trend lower as well with the lone exception of the Bombay advance/decline line which maintains a high degree of buoyancy at this time.

So....with the BETS finishing the week with a reading of -75, traders and investors continue to work with a hostile market environment. As we begin the week ahead, we see that all of the breadth and volume McClellan Summation Indexes are either at or now below their readings of last Monday as the intermediate term trend of money flow continues to show a strong negative bias. On a more distressing point, we see that after Friday's jobs report, the FedWatch Tool moved abruptly from a 66% chance of a 3/4% rate increase on Thursday to a 79% chance of a full 1% move by the Federal Reserve at its upcoming November meeting. With both the PPI (Wednesday) and CPI (Thursday) for September coming up midweek, one would think that any bad news on inflation will collapse any chance by the market bulls to keep things from falling apart...an eerily similar situation to that of October 1987 in many technical and fundamental aspects. On the buyers side of things, both the NYSE (1.15) and NASDAQ (1.03) Open 10 TRIN's were both on the "oversold" side on Friday which, along with the bond market being closed on Monday for Columbus Day, could provide some near term price buoyancy in equities before the inflation numbers are released. Put/Call 10 day option ratios continue to surprise with call buying ramping up with last week's short covering rally on Monday and Tuesday the emotional trigger, while put option premiums continue to rise in what could be one of the great head fakes we've seen in a long time. Wall Street Sentiment readings remain generally flat at this time as many market participants are waiting for more information to work with before making any new commitments. With the longer term trend of market breadth continuing to move to lower lows, however, we continue to be faced with a marketplace that has all the technical and fundamental characteristics of a potential Elliott 3rd wave debacle that could take place over the next two weeks. With all this as a backdrop then, let's again walk along the path of bearish least resistance for what should be another volatile week ahead, while continuing to be disciplined enough in not being emotionally persuaded to lead off in one direction or the other....the trend is your friend until proven otherwise.

Have a great trading week!

US Interest Rates:

US Sectors:

Precious Metals:

Australia:

England:

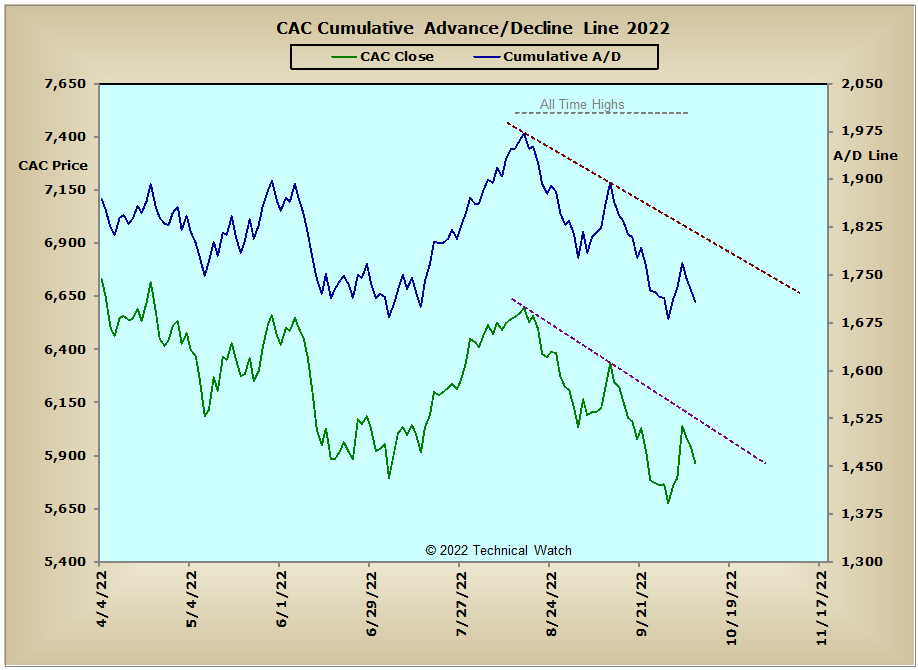

France:

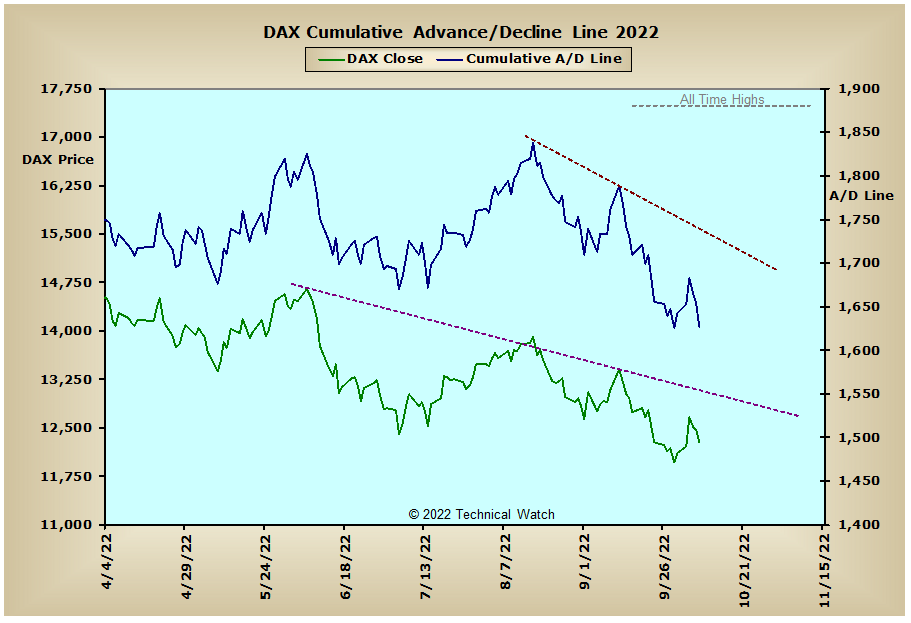

Germany:

India: