This month's WWW event turned into a bloodbath for the crash calling bears as October's CPI data ignited equity prices sharply higher on Thursday before concluding another volatile week with an average gain of +5.50%, with the NASDAQ Composite Index finishing just below its 200 week EMA as it jumped +8.10%.

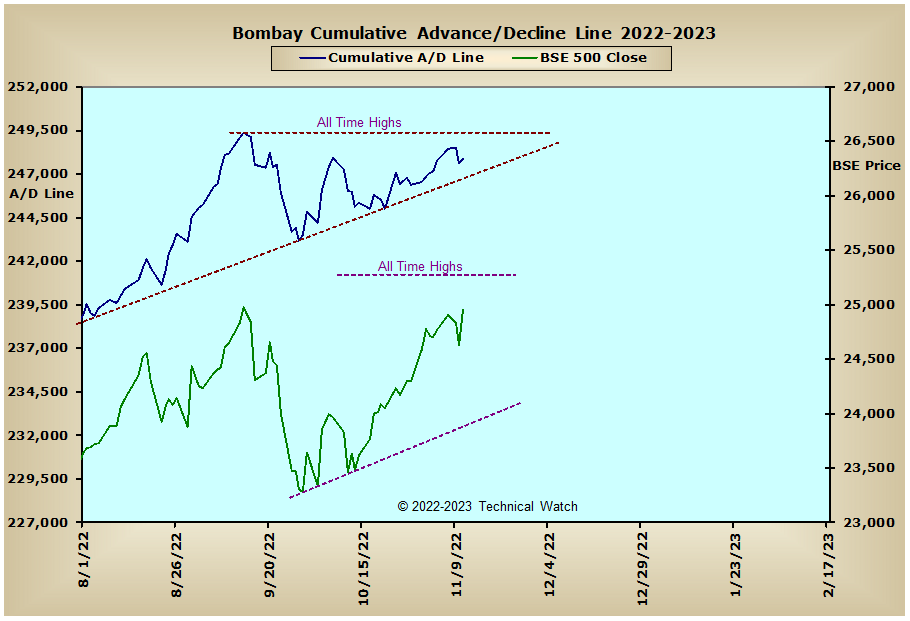

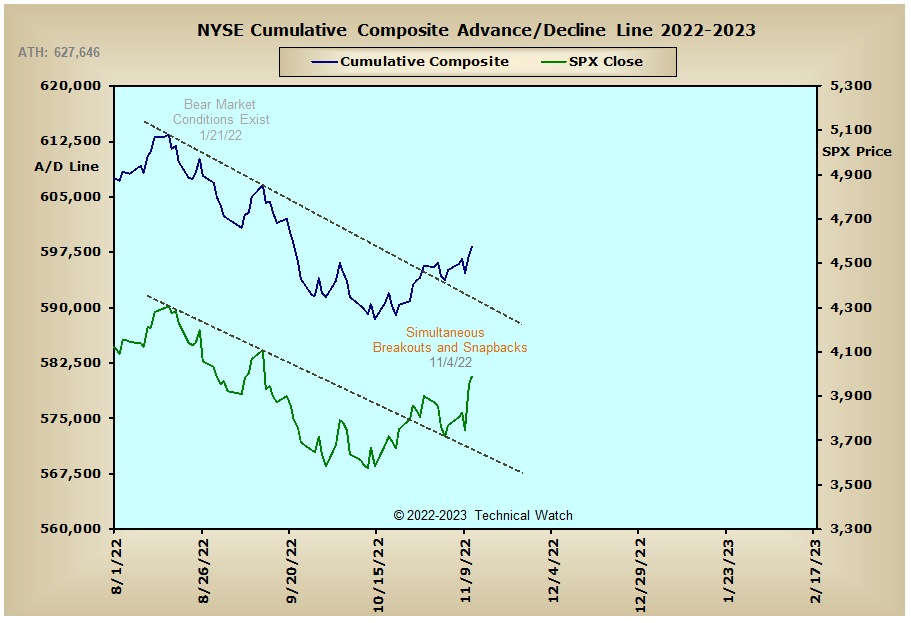

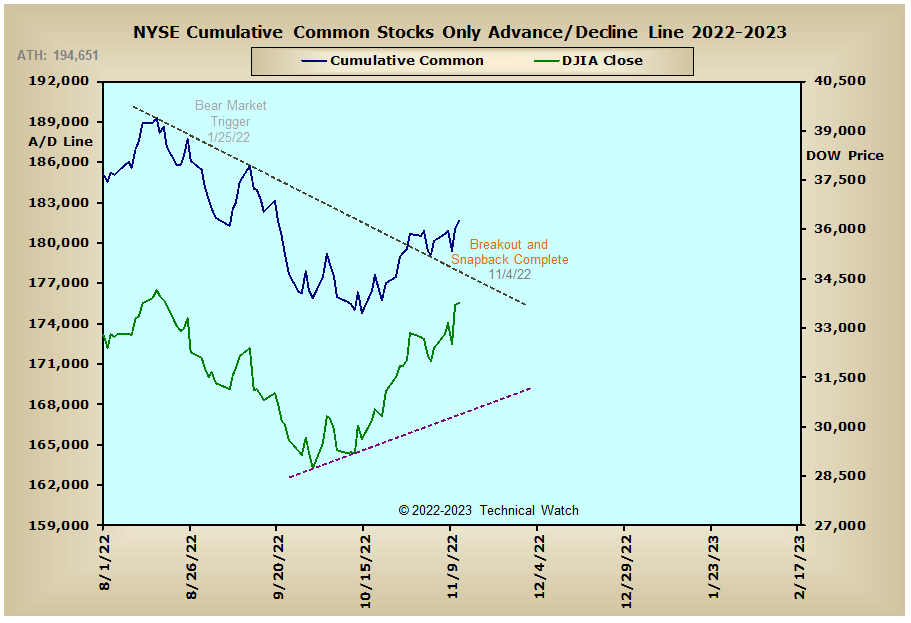

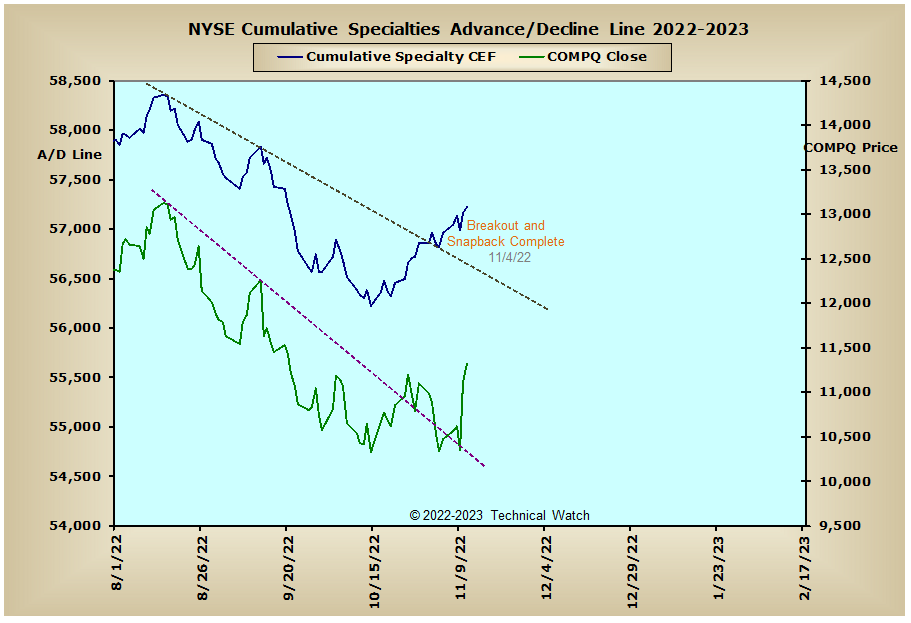

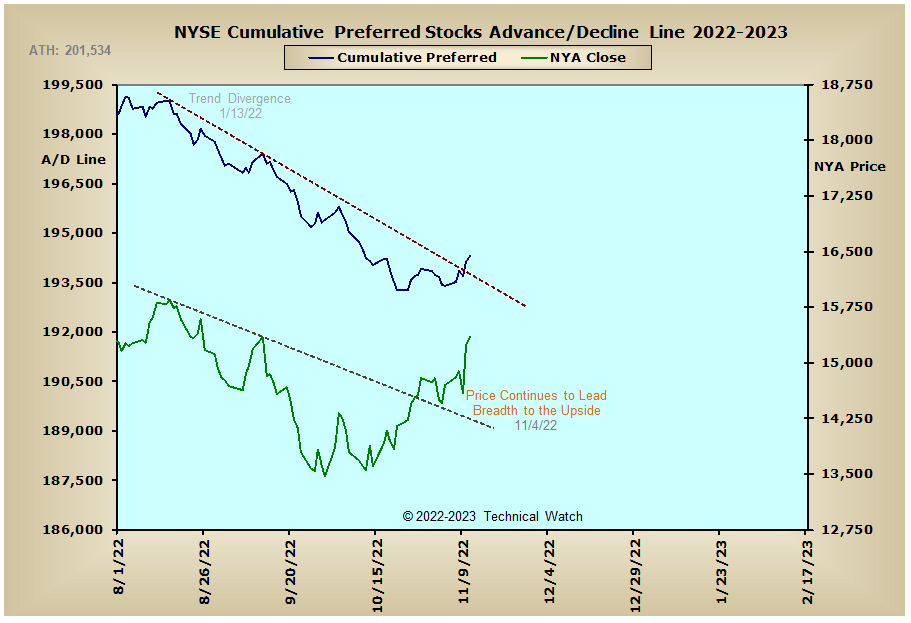

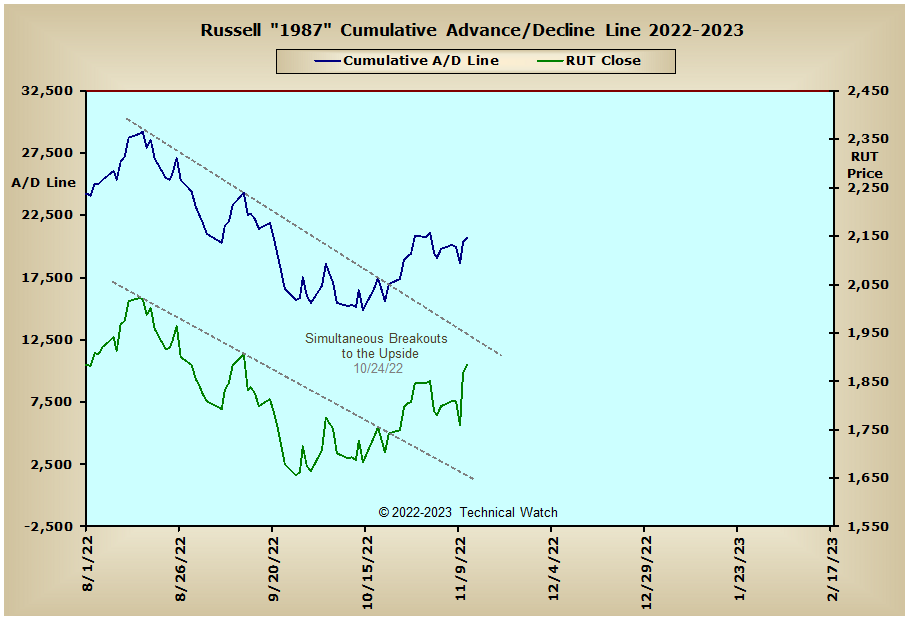

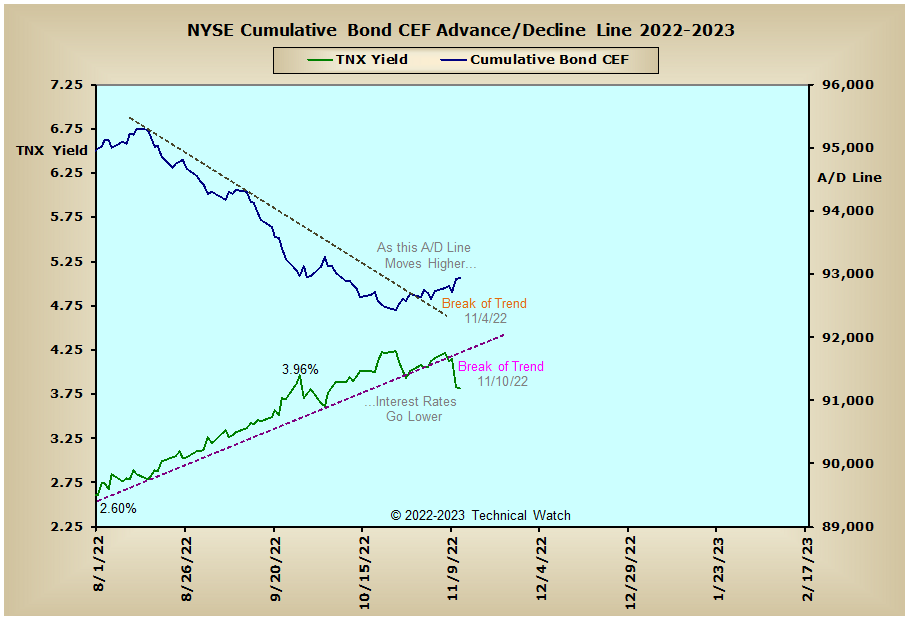

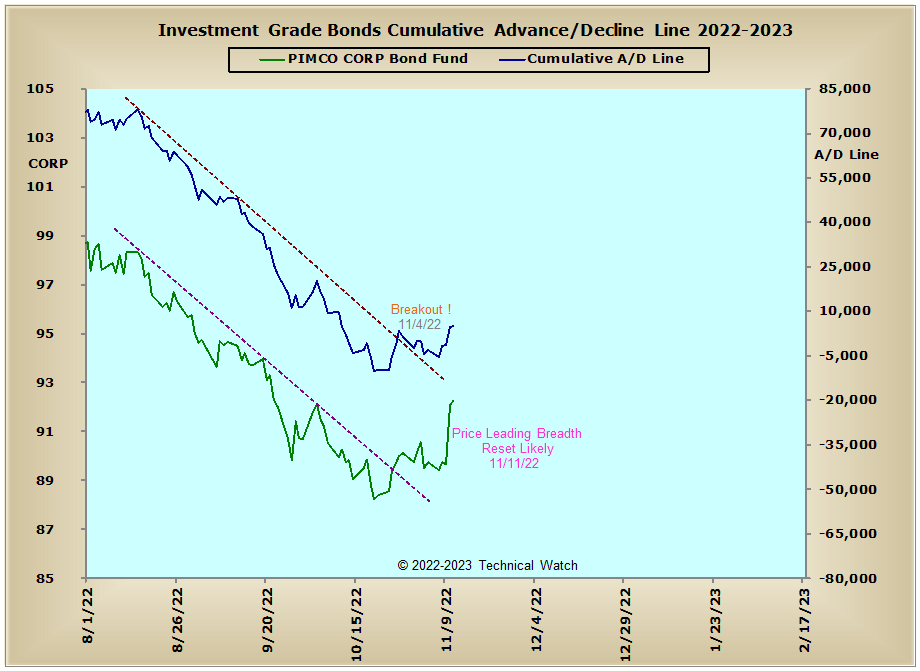

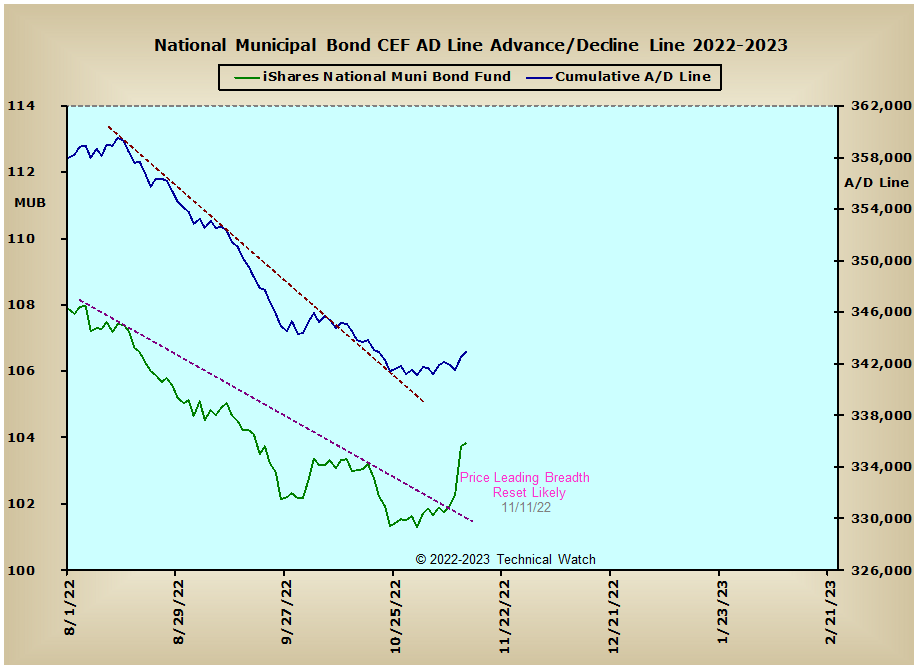

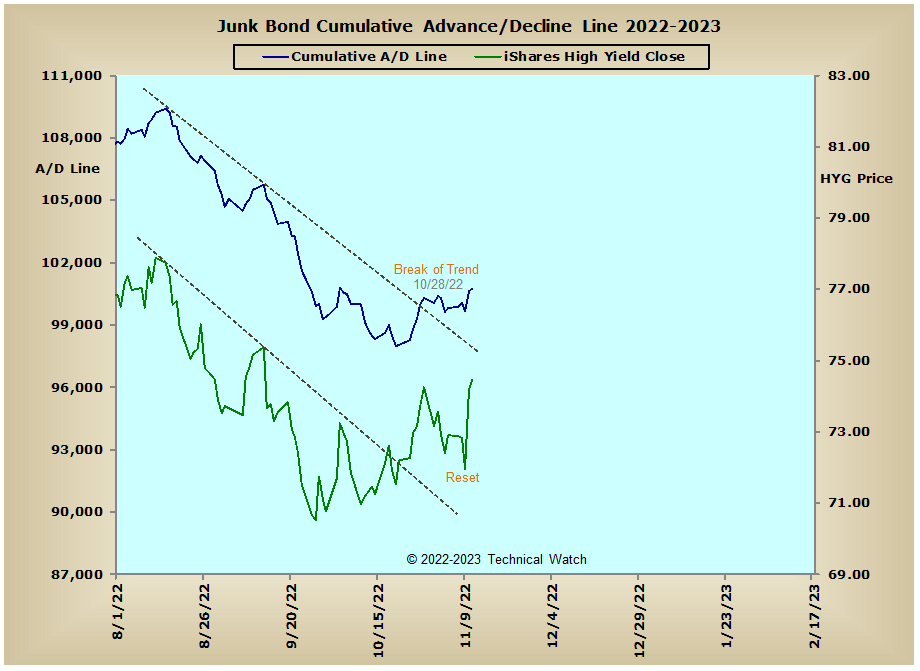

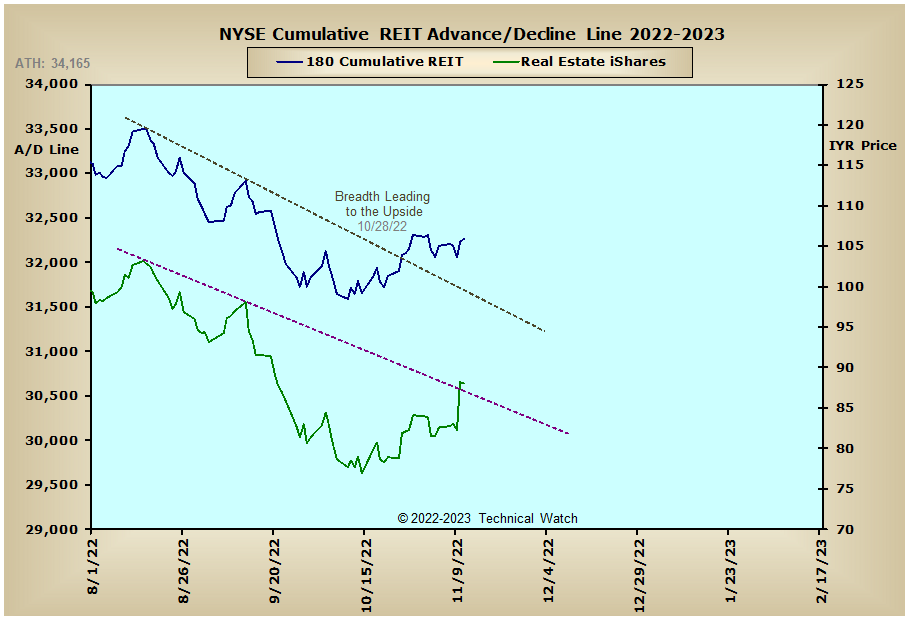

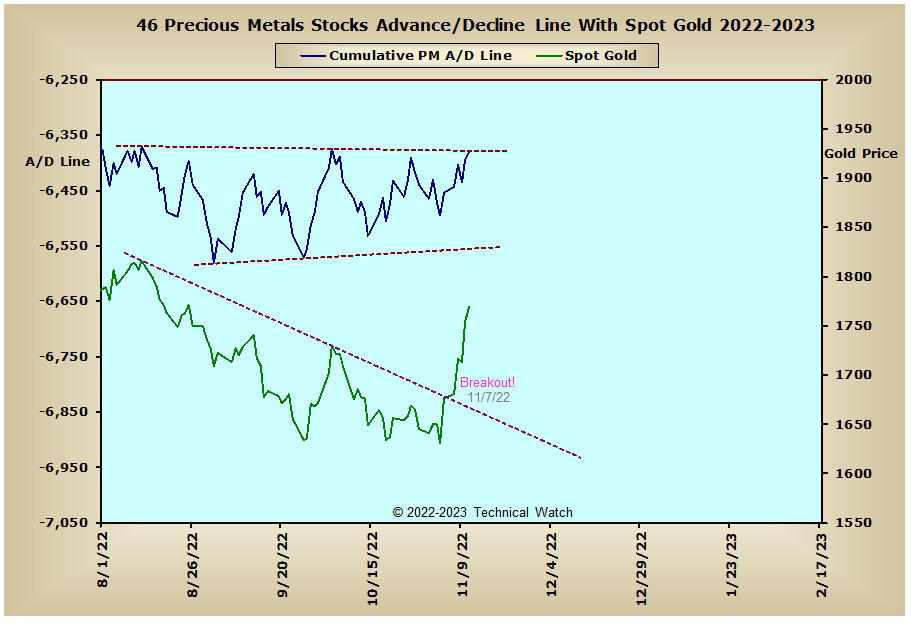

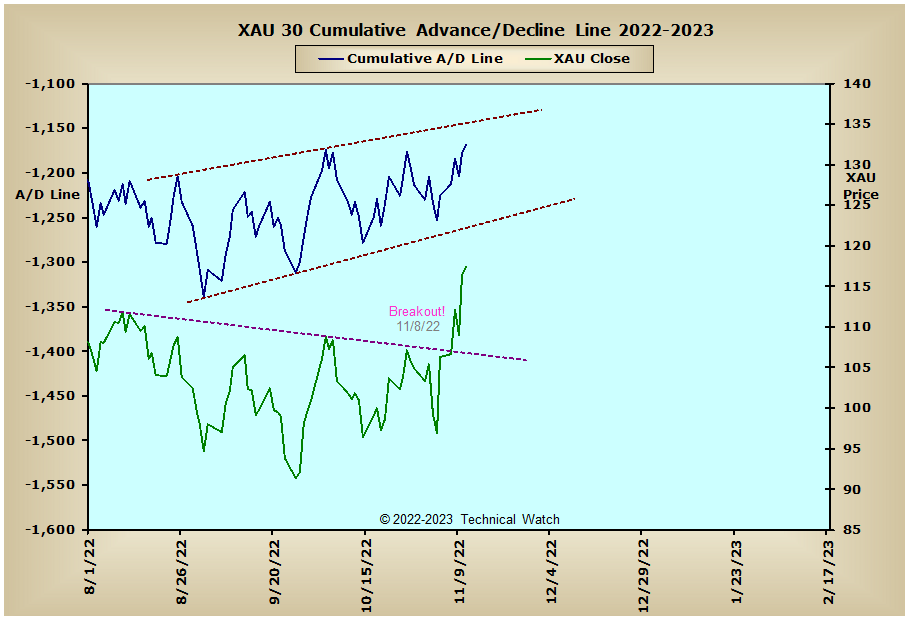

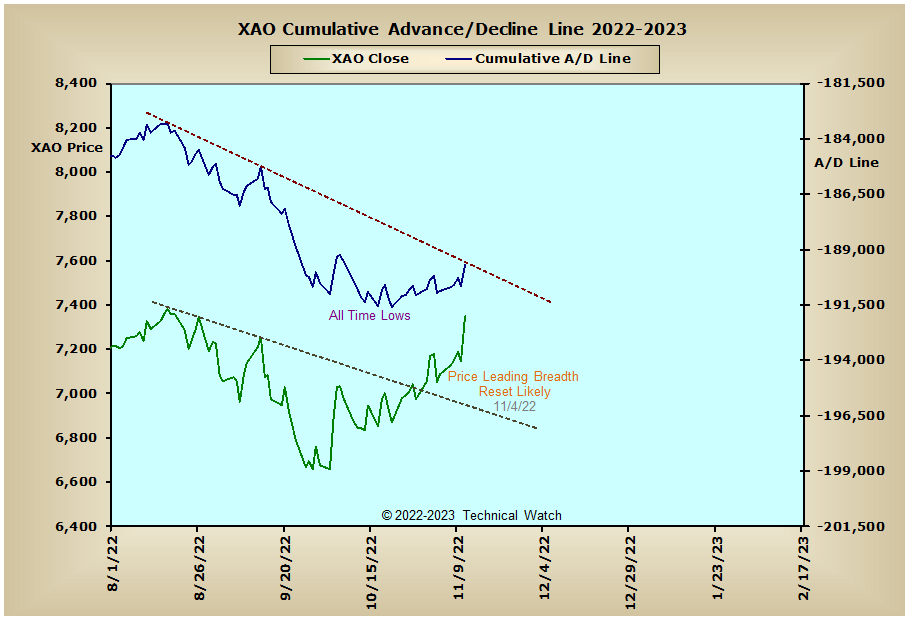

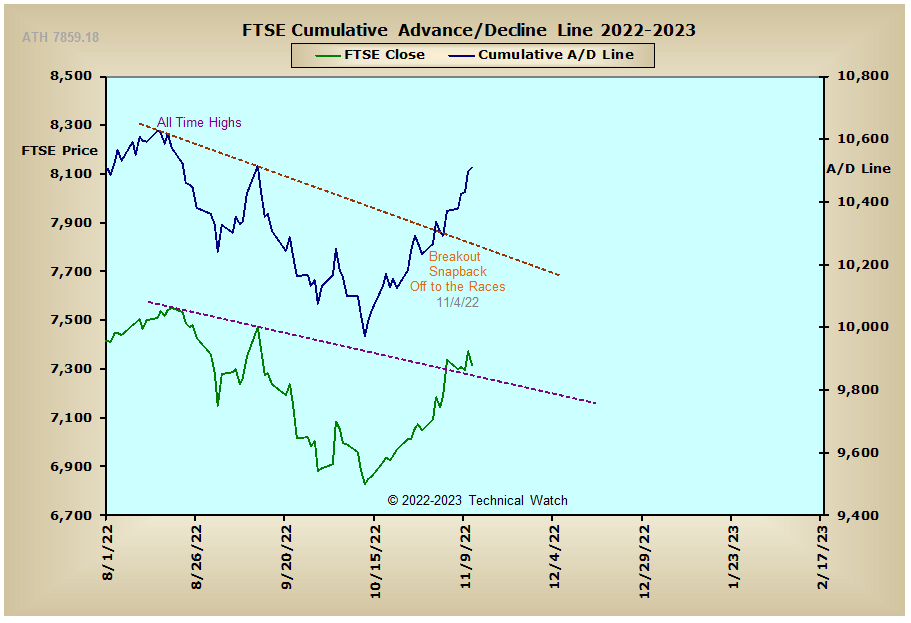

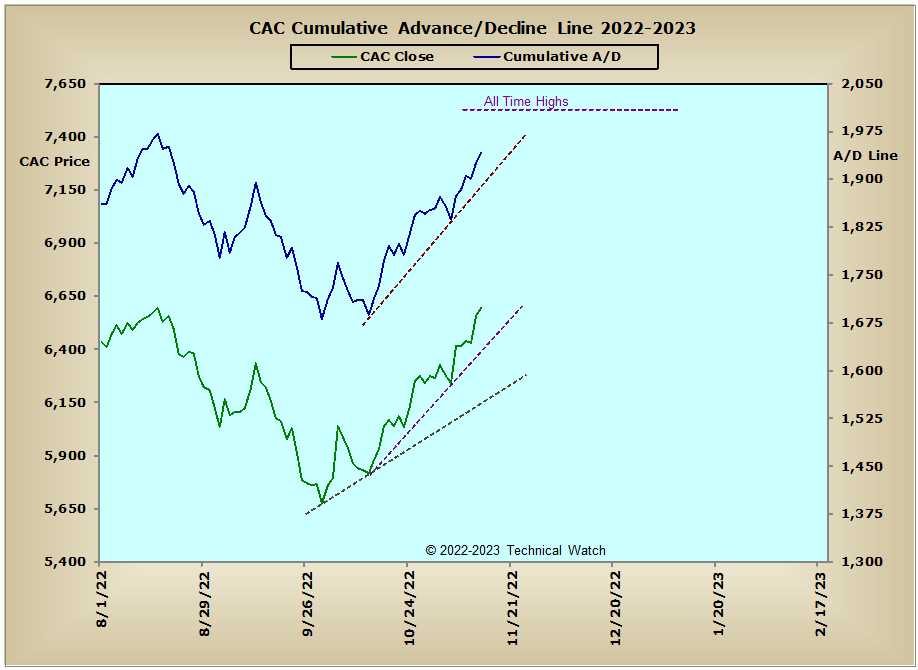

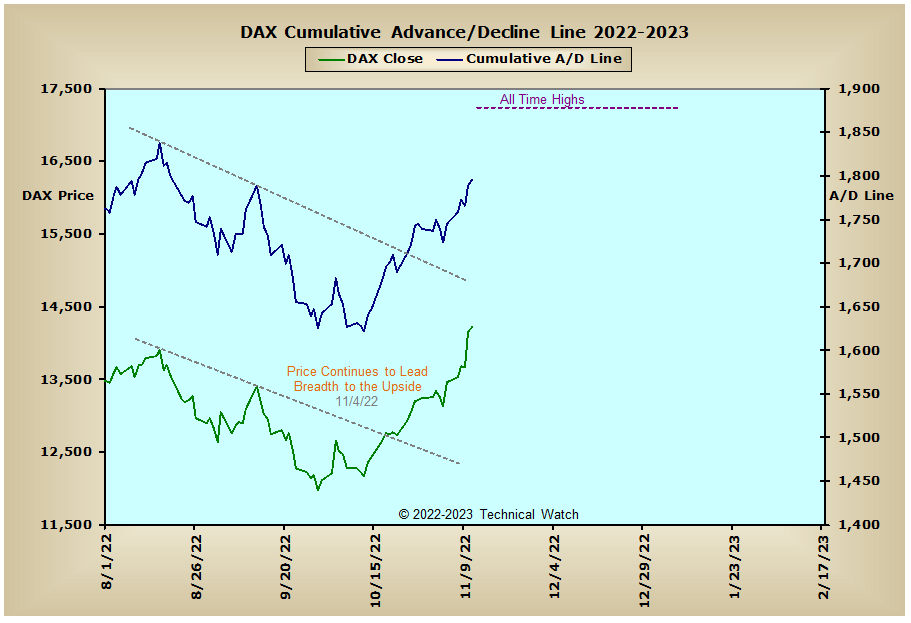

As we review this weeks updated array of cumulative breadth charts continues to show improvement on a wide scale as traders begin to discount a more neutral monetary policy by the Federal Reserve in the upcoming months ahead. That said, current readings in the interest rate sensitive advance/decline lines have been rather restrained in their amplitude which may suggest that this current pause in the larger downtrend in the debt asset class may be only temporary before still higher interest rates are seen sometime in the first half of 2023. Meanwhile, the advance/decline lines of the precious metals asset class appear to be showing a bit more vigor as our anticipated cyclical low for December approaches. Finally, the global community continues to improve as well as the CAC, DAX, FTSE and Bombay advance/decline lines are now all within range of their all time highs.

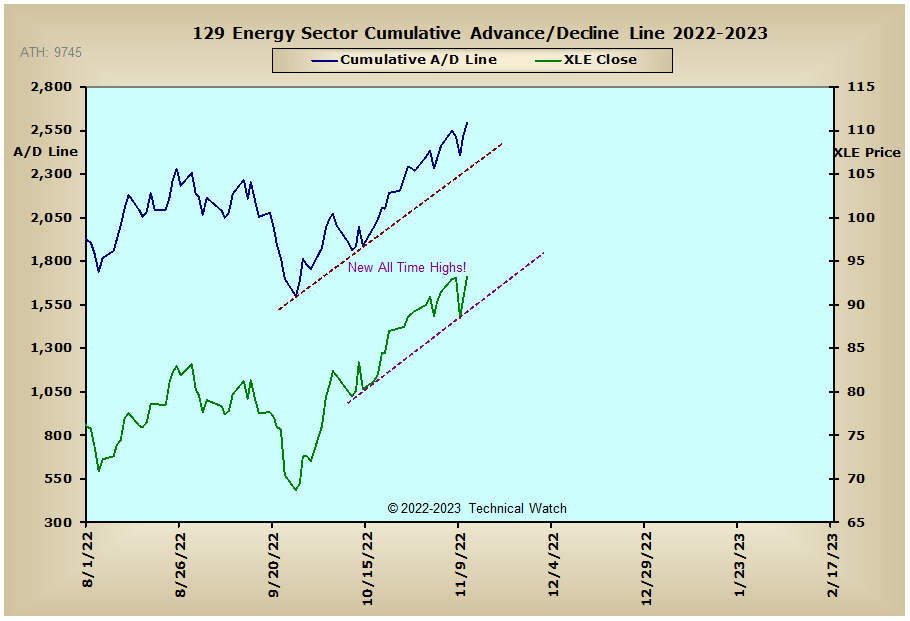

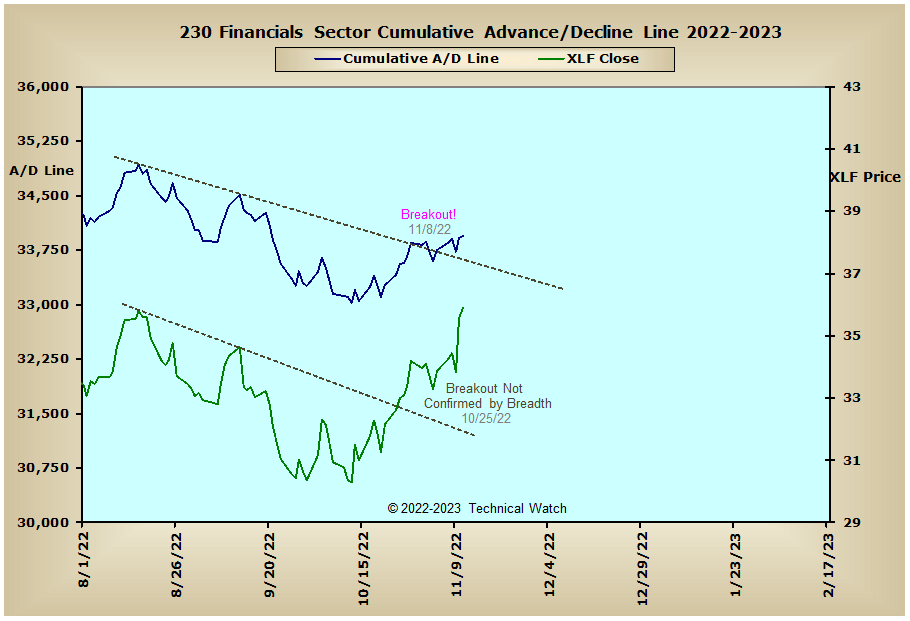

So with the BETS finishing the week at -20, traders and investors are now taking a more neutral view of intermediate term market activity. Although all of the breadth and volume McClellan Oscillators finished on Friday in positive territory, we do note that in several cases that the short term trend of breadth is showing bearish divergences at this time, but this is being balanced with many of the volume MCO's actually improving underlying stability with this past week's sharp reversal to the upside. Because of this, we can now anticipate that the current short term trend of rising equity prices (6 to 8 weeks in duration) will likely continue into the first half of December. After seeing another strong session of capitulated type selling taking place on November 9th (2.50) after that of November 2nd (2.67) in the daily NYSE TRIN, the NYSE Open 10 TRIN continues to be "oversold" as of Friday's close with a reading of 1.11, while the NASDAQ Open 10 TRIN has become neutral at .91. Speculative put buying remains strong on a 10 day average even after being taken to task with Thursday's huge rally and implied volatility premiums continuing to recede. With the Producer Price Index (PPI) for October being released on Tuesday, Retail Sales on Wednesday, and Home Sales on Friday, there will be a lot for market participants to digest as we go into this month's OPEX period on the 18th. With all this in mind then, let's continue to see the markets remain highly volatile for the week ahead, while sitting back a bit in our collective chairs and watching sector rotation as we approach the holiday season.

Have a great trading week!

US Interest Rates:

US Sectors:

Precious Metals:

Australia:

England:

France:

Germany:

India: