Stock market indexes in the United States finished on Friday with a another nice advance for the holiday shortened week as they settled with an average gain of +1.51%, with the NASDAQ Composite Index, once again, bringing up the rear as it was only able to add +.72% to its value.

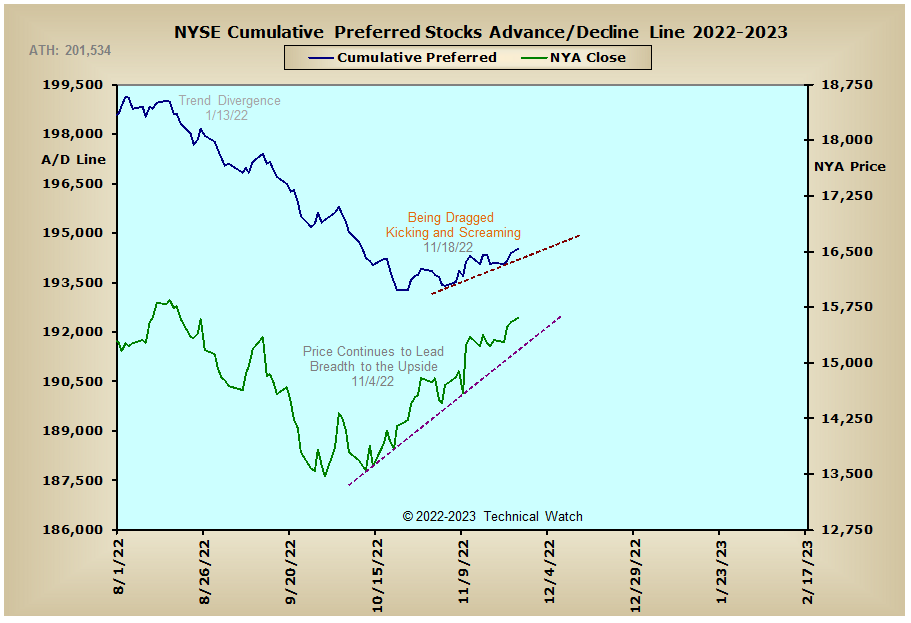

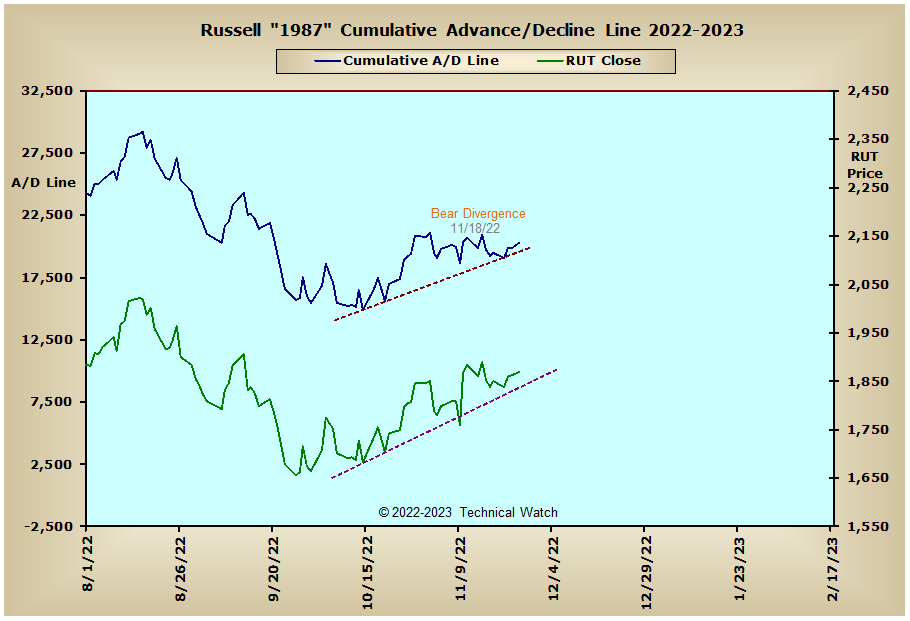

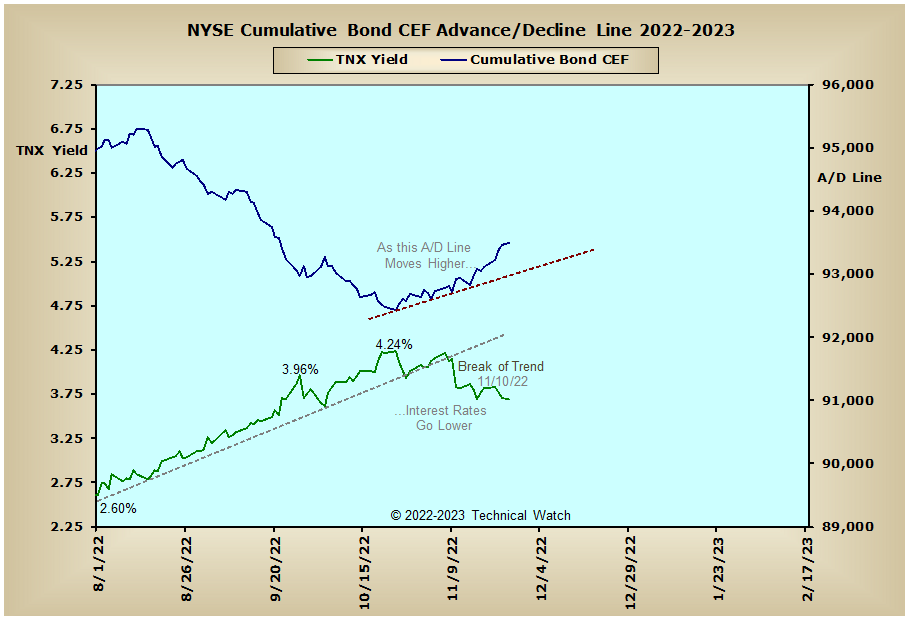

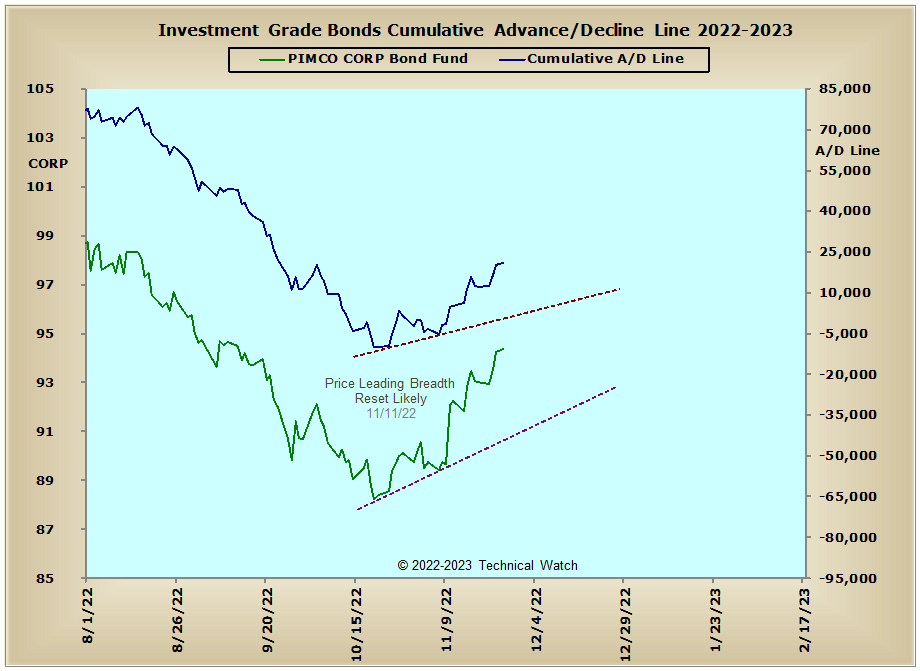

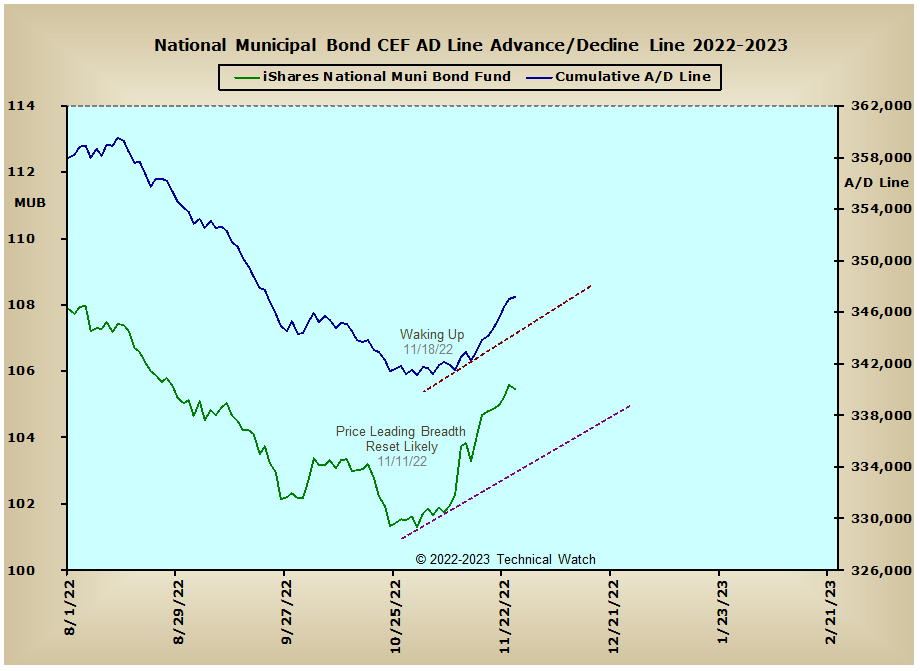

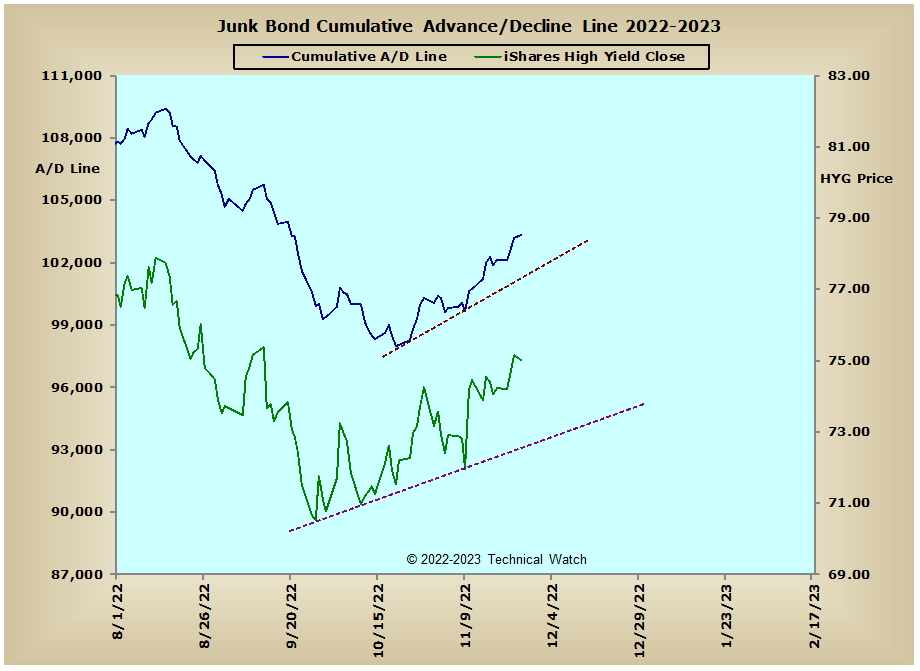

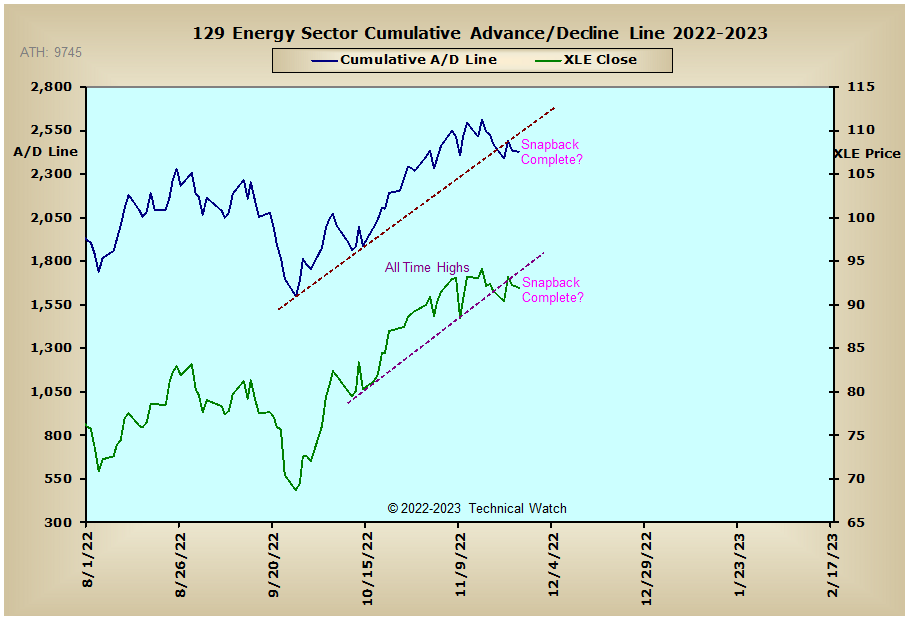

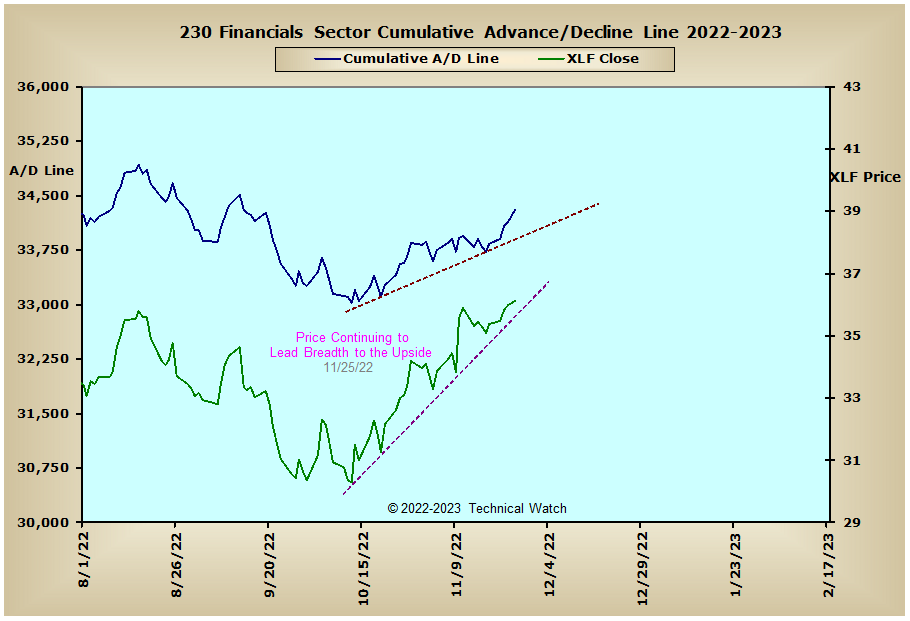

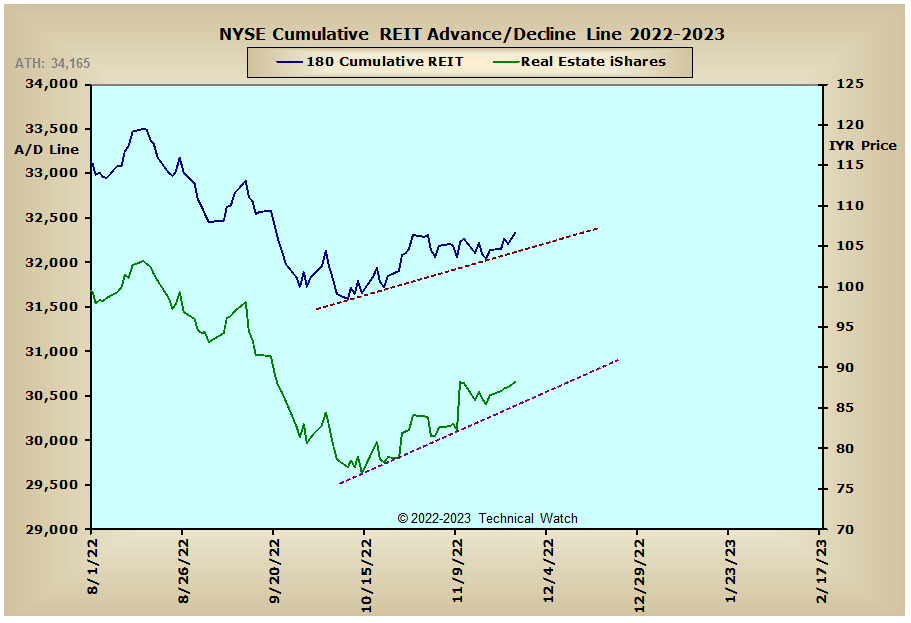

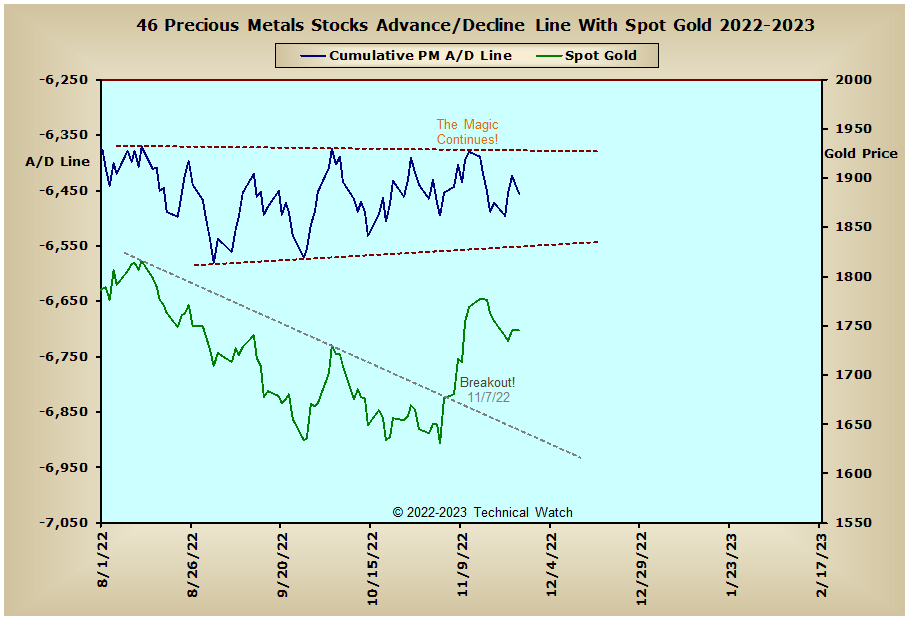

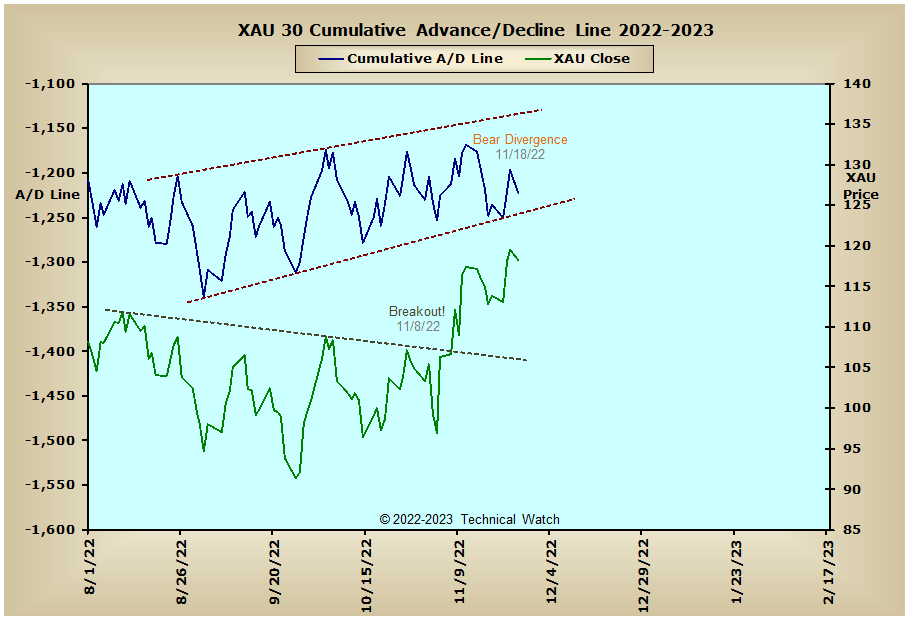

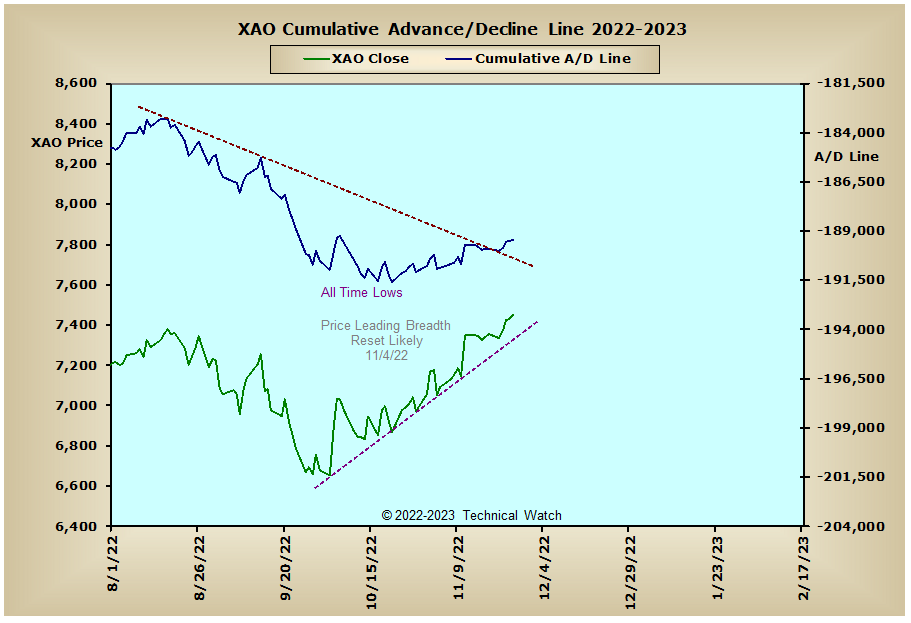

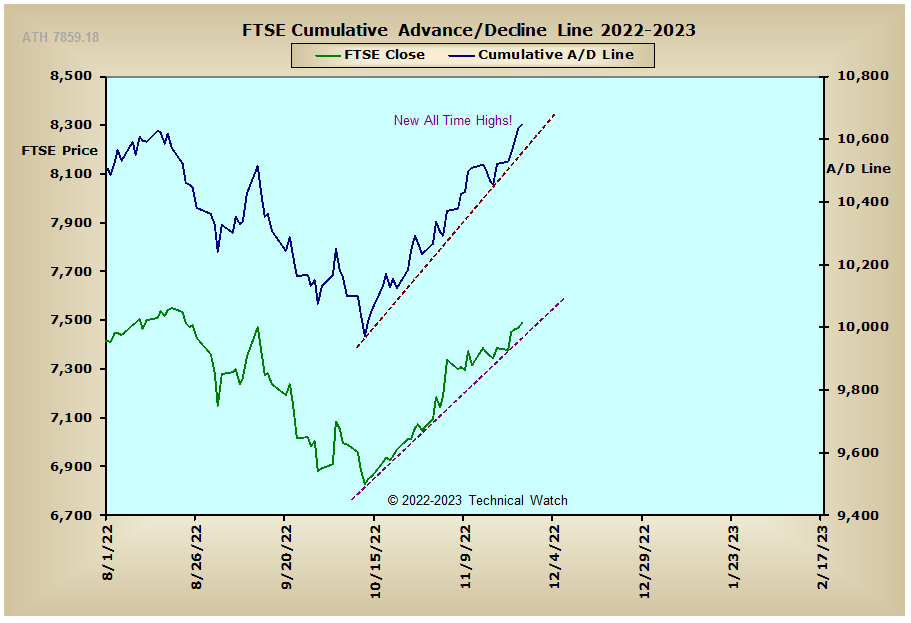

Looking at this week's review of money flow charts shows that nearly all are trending to the upside at this time. This includes the interest rate sensitive issues which are now beginning to show a bit more vigor in this same direction. We did see a break of trend, however, in the Energy Sector advance/decline line with the XLE confirming this potential change of direction. Both the Precious Metals and XAU advance/decline lines continue to be stuck within large channels as we move into a possible tradable bottom for the metals in December. European issues continue to surprise in spite of a myriad of bearish fundamentals as England's FTSE advance/decline line moved to new all time highs on Thursday, while France's CAC advance/decline line is only 9 advancing issues from doing the same as we begin the week ahead.

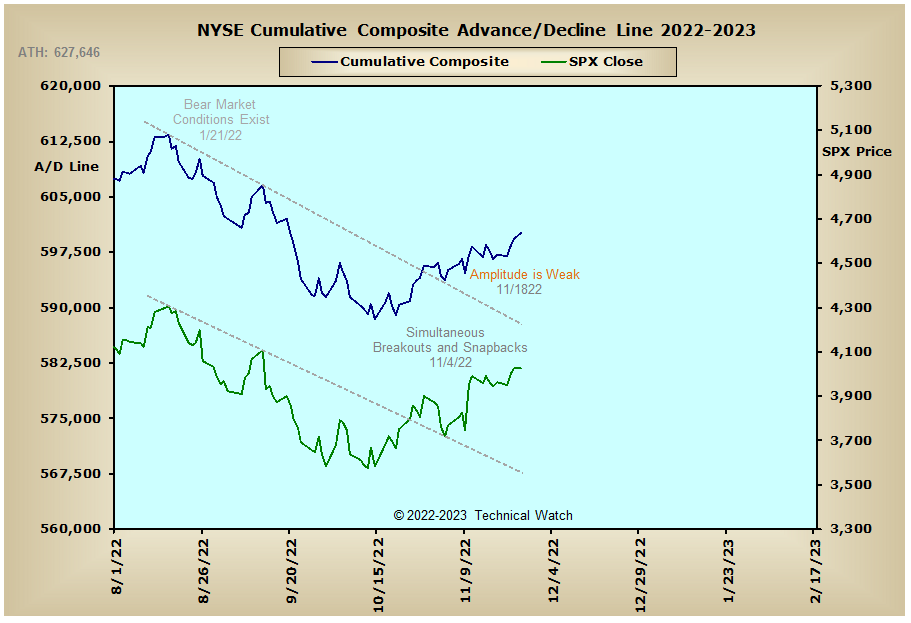

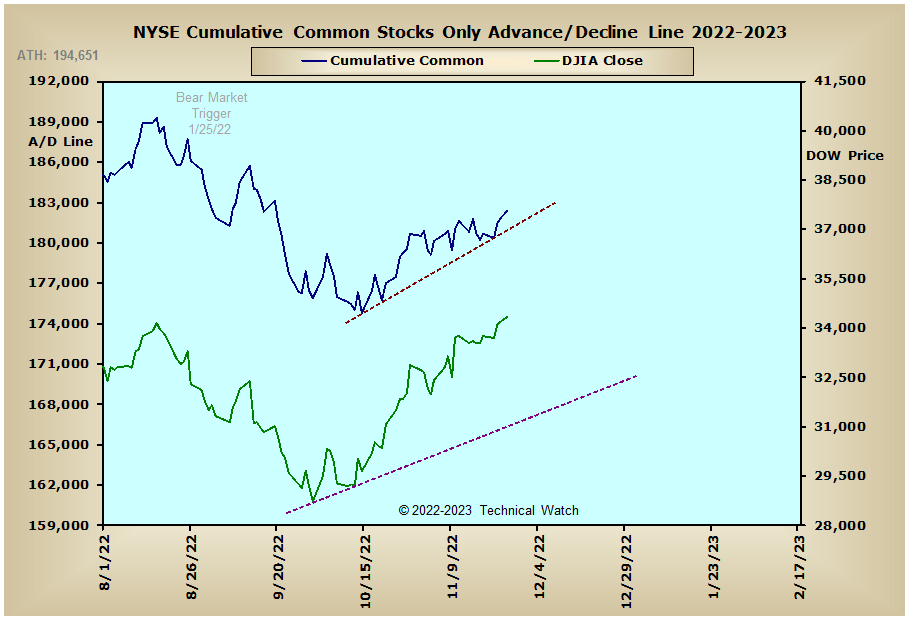

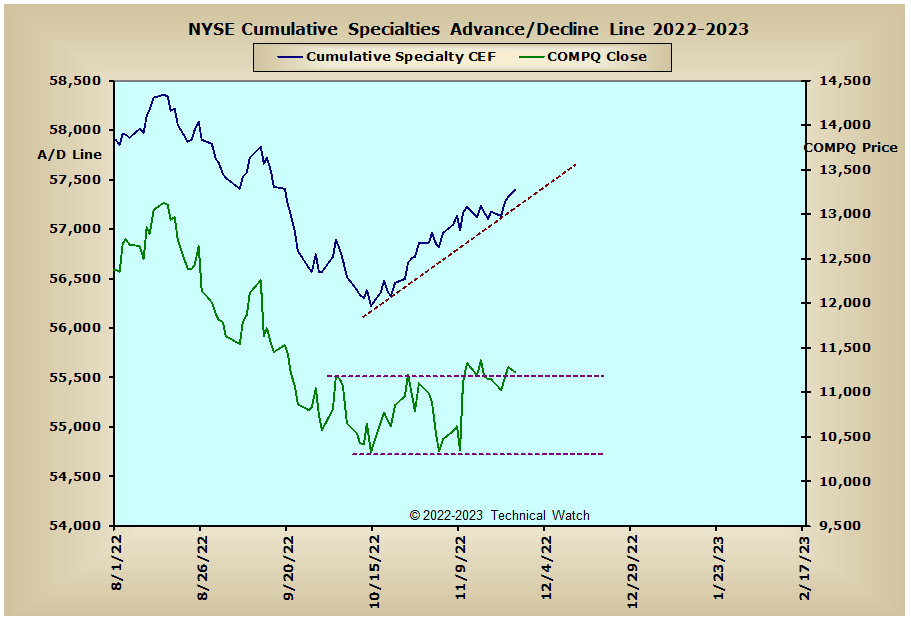

So with the BETS improving a bit to a reading of -40, the trading environment here in the U.S. and Canada remains with a bearish bias, with the biggest technical problem of severe bearish divergence between the BETS and the New York Composite Index. All of the breadth and volume McClellan Oscillators continue their bullish ways with several finding natural support at or just below their zero lines over the last two weeks. All of the breadth McClellan Summation Indexes are now above their respective zero lines, and this should help market prices to remain buoyant as we go into the middle of December. This will likely force both traders and investors to re-consider (capitulate) their bearish outlooks as we go into the 1st quarter of 2023. Both the NYSE (1.11) and NASDAQ (1.12) Open 10 TRIN's remain favorable for the buyers at this time, while the 10 day average of put/call ratios was nearly unchanged from the week before. With a whole slew of economic data being released next week including the 2nd estimate of 3rd quarter GDP, consumer confidence, and November's jobs numbers, there will be plenty of appetizer to chew on for market participants before we move into the main course of both the PPI and CPI data over the following two weeks, and then finishing off with this year's final quarterly OPEX event for dessert on the 16th. With still many internal inconsistencies at this time, both bearish and bullish positions will likely be compromised in one way or another during the trading week ahead. With all this in mind then, let's go ahead and now take a more neutral view of things as the two sides battle it out for control, while continuing to watch sector rotation closely for any clues on which side will eventually win this current battle between future economic expansion and contraction.

Have a great trading week!

US Interest Rates:

US Sectors:

Precious Metals:

Australia:

England:

France:

Germany:

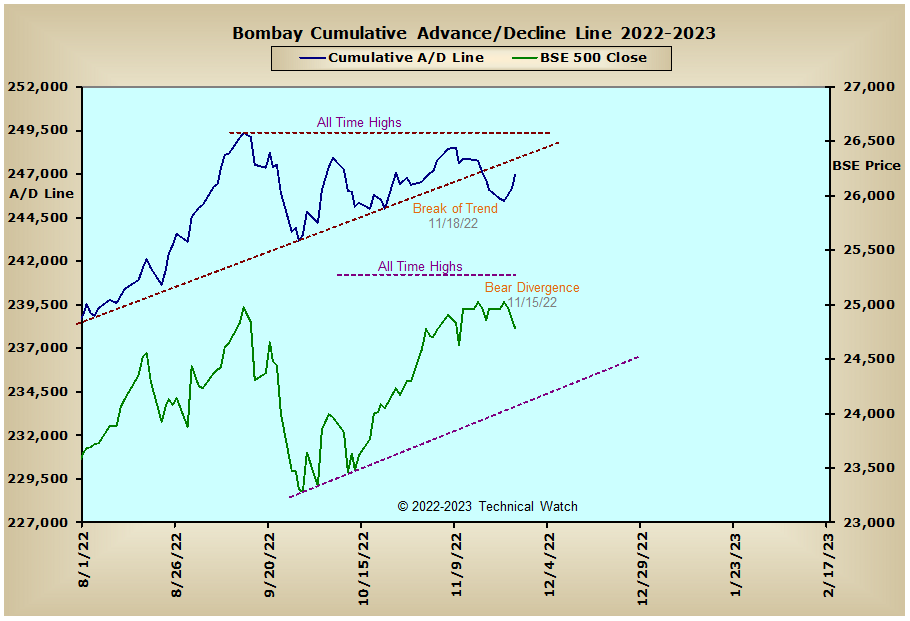

India: