After moving higher into the Fed's July 31st policy statement on Wednesday, stock market market prices moved sharply lower on Thursday and then accelerated to the downside on Friday with the "weaker than expected" job's report and Intel's surprise suspension of their dividend to finish with an average weekly loss of -3.22%. Leading the markets lower was the S&P 600 Small Cap Index as it lost -5.53% with everything else losing at least 2% for the week. The semiconductor index (SOX) also got hit hard again as it lost -9.71% and bringing the total loses for this index to almost -21% in the last 3 weeks.

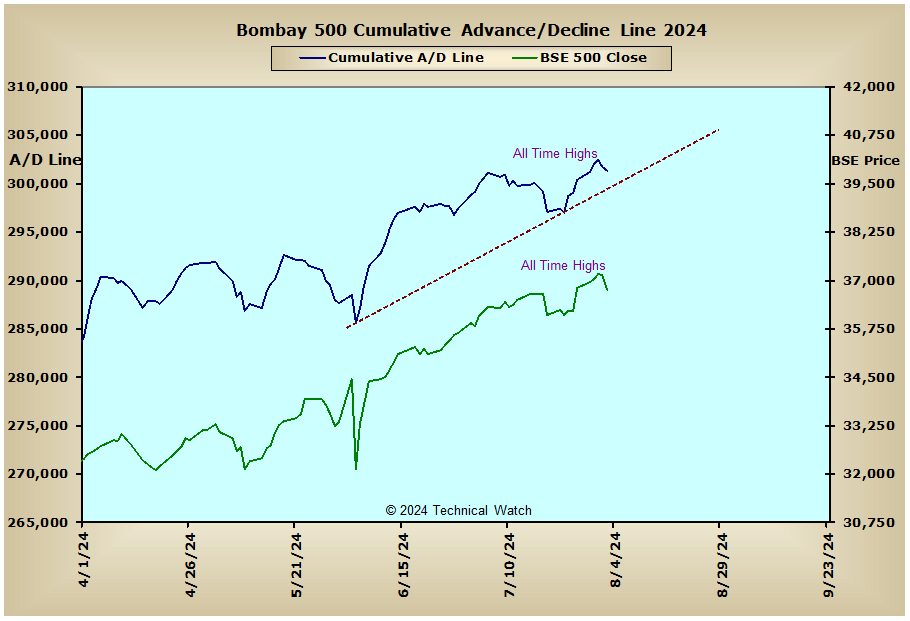

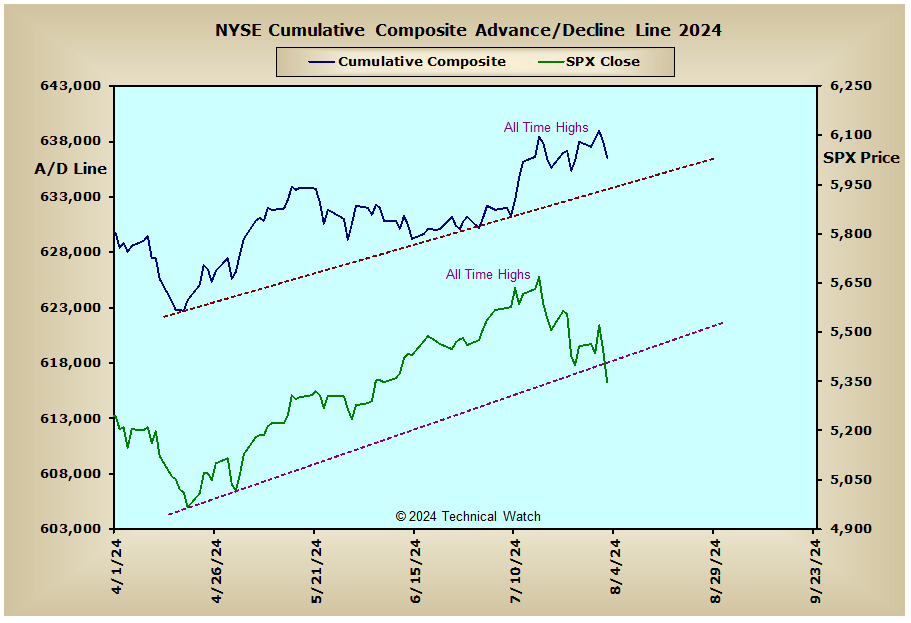

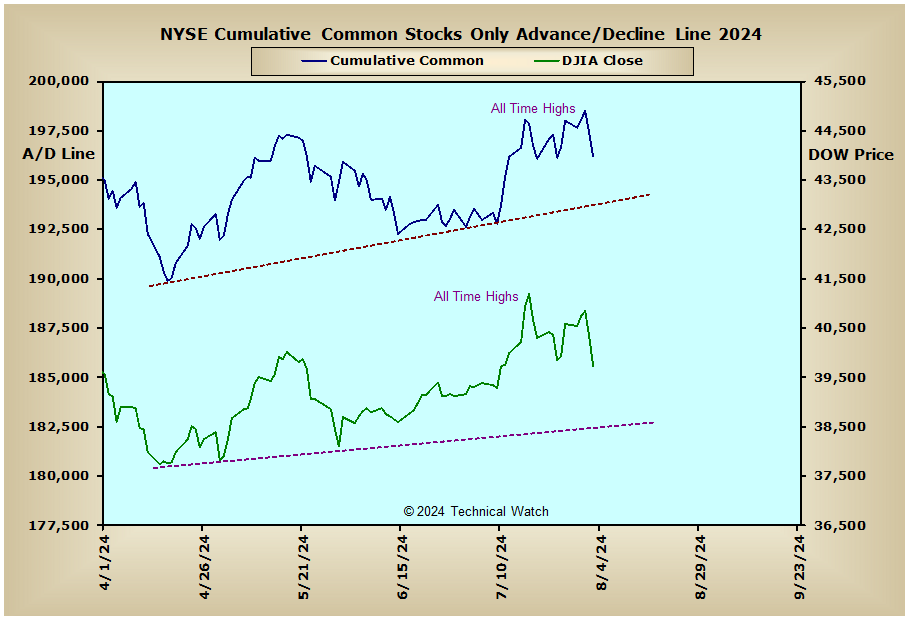

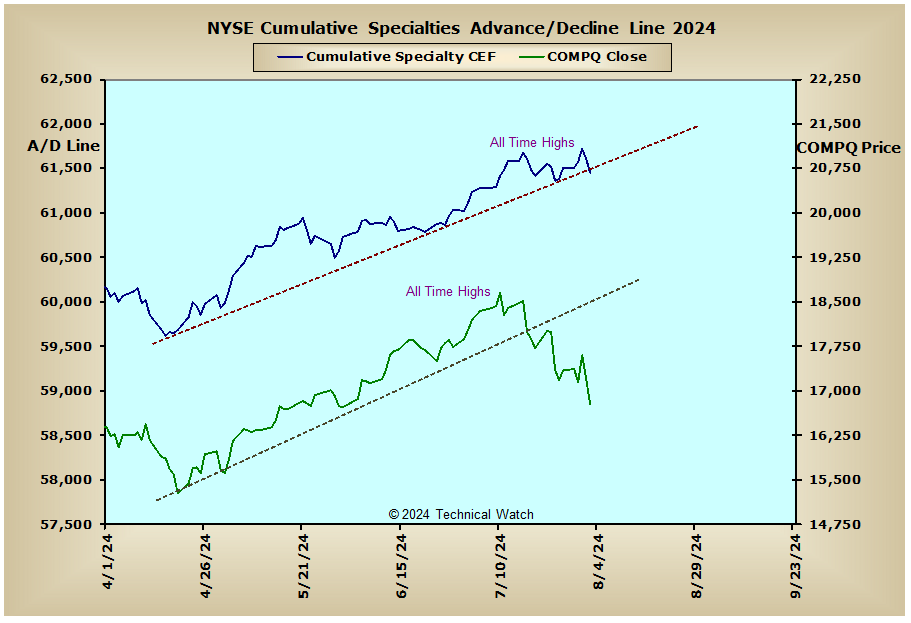

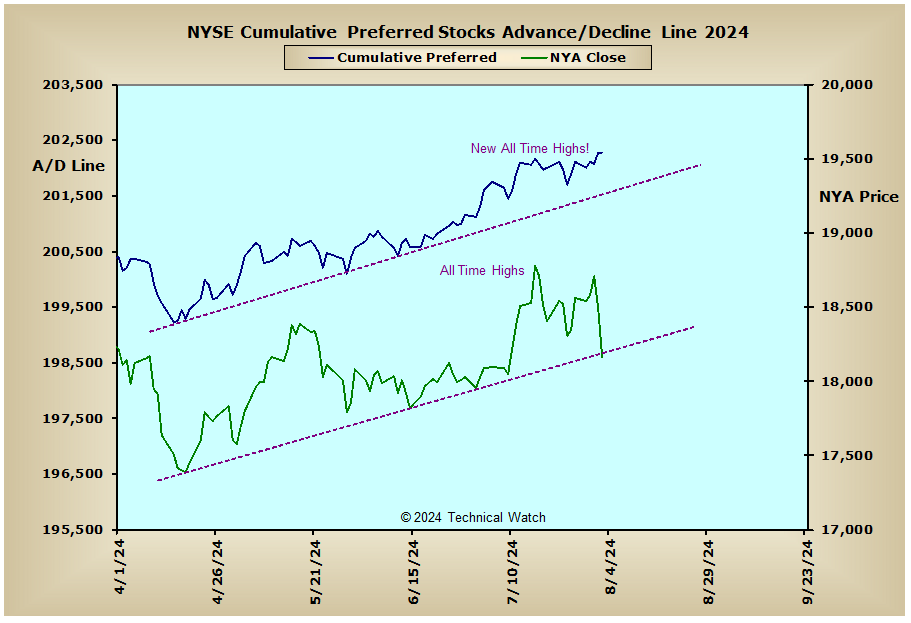

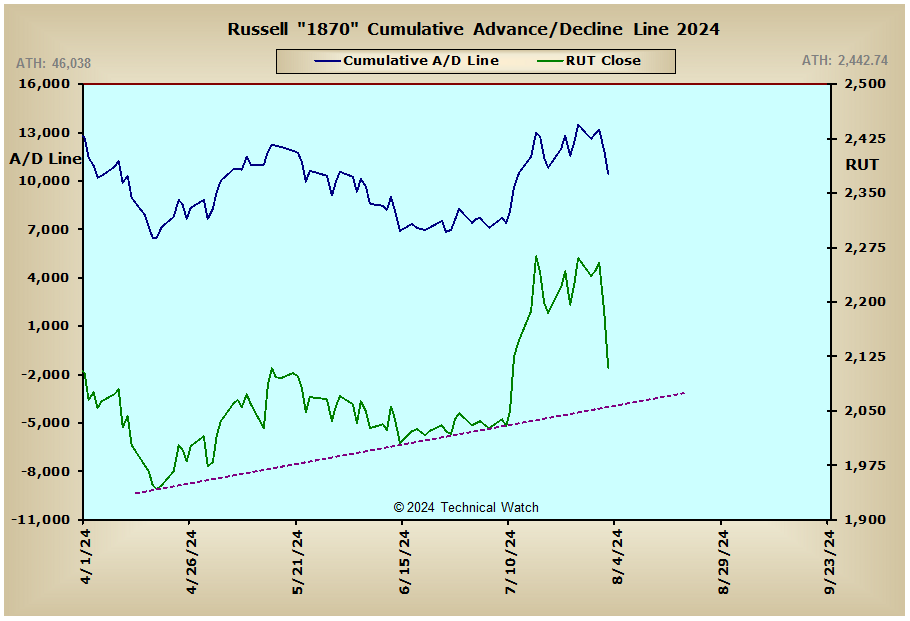

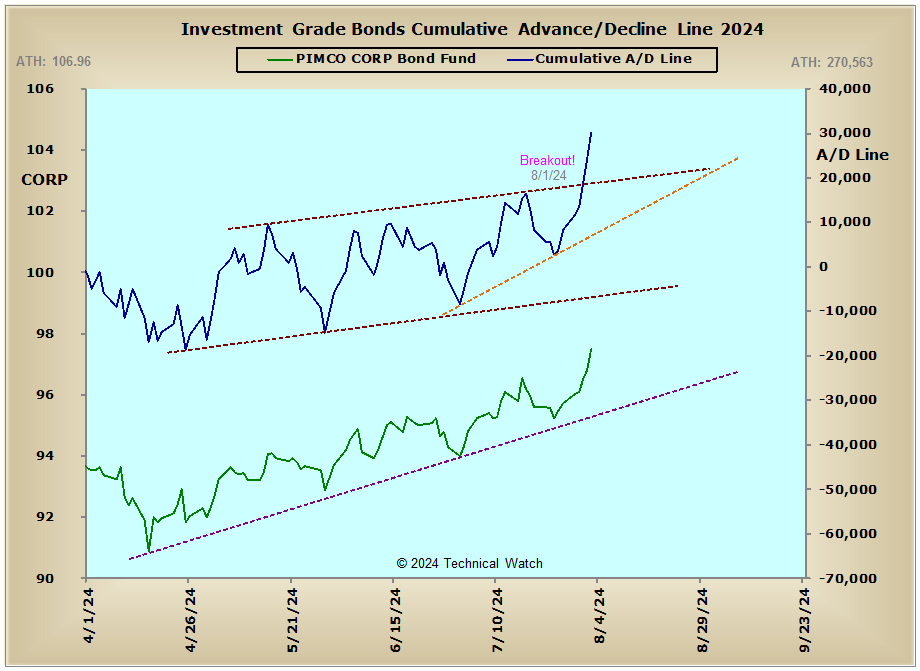

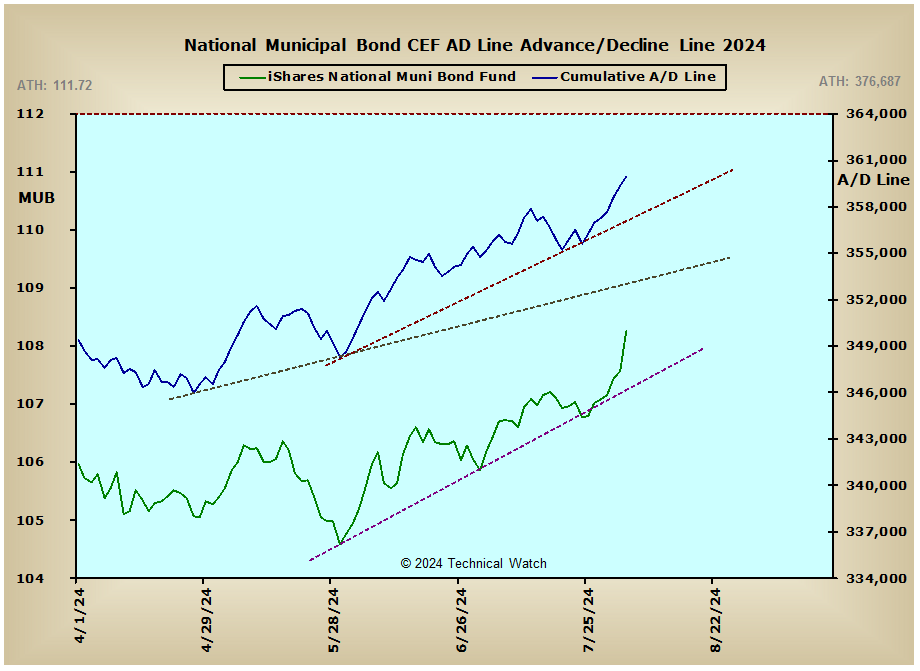

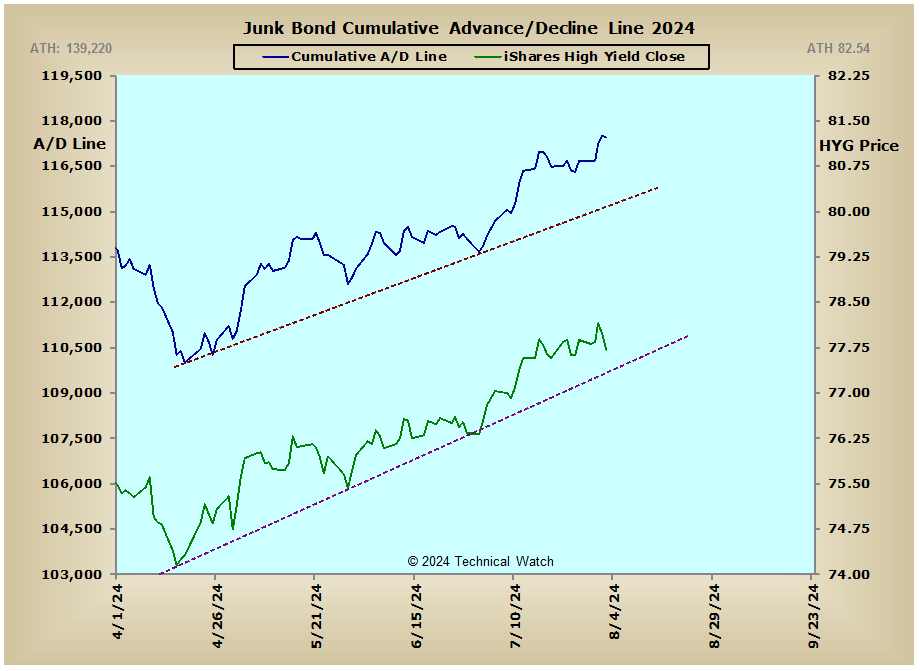

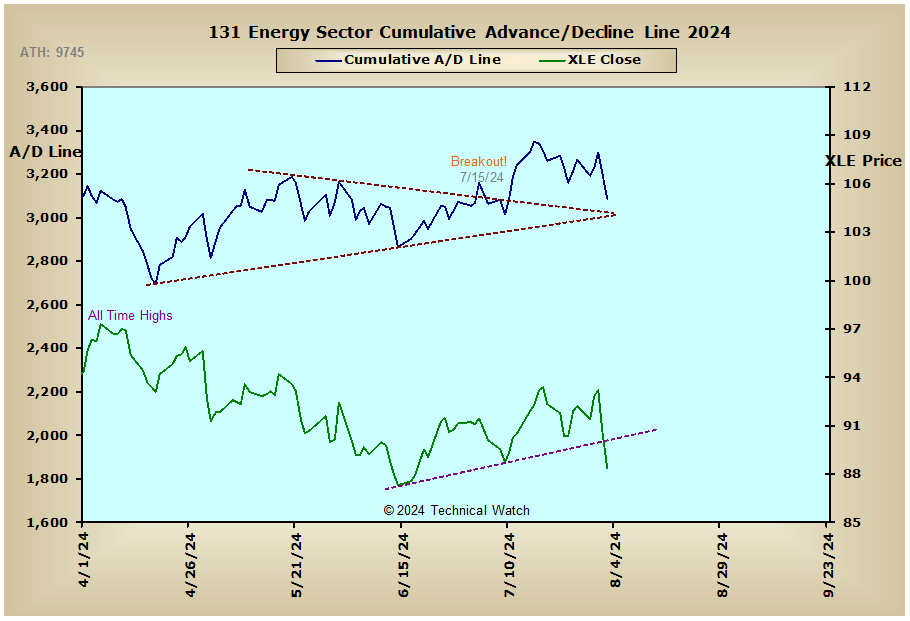

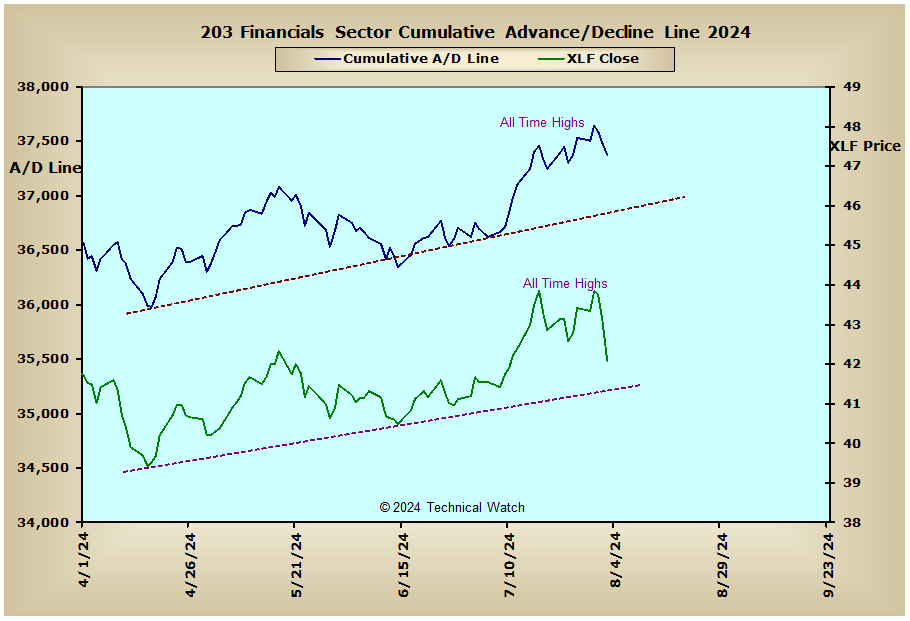

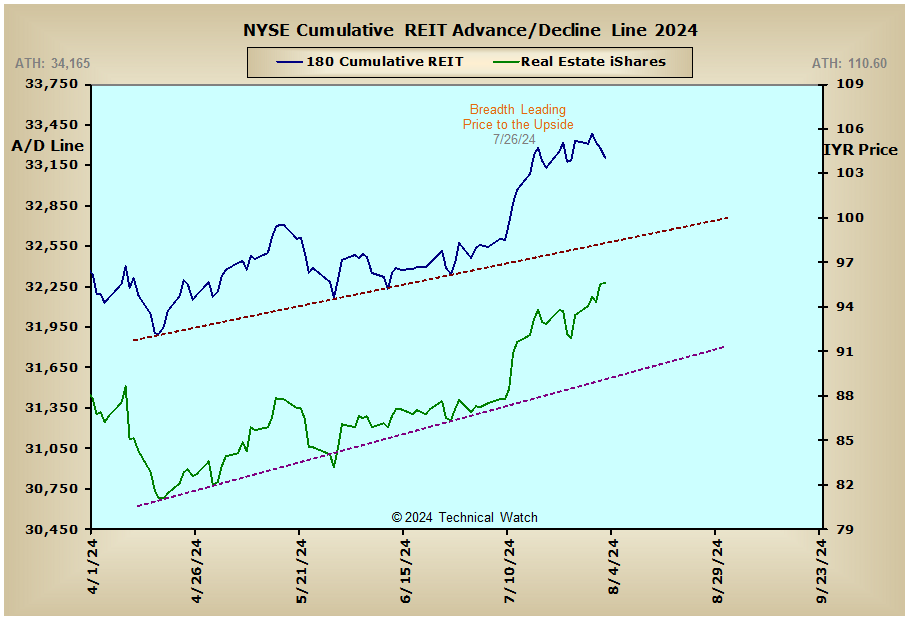

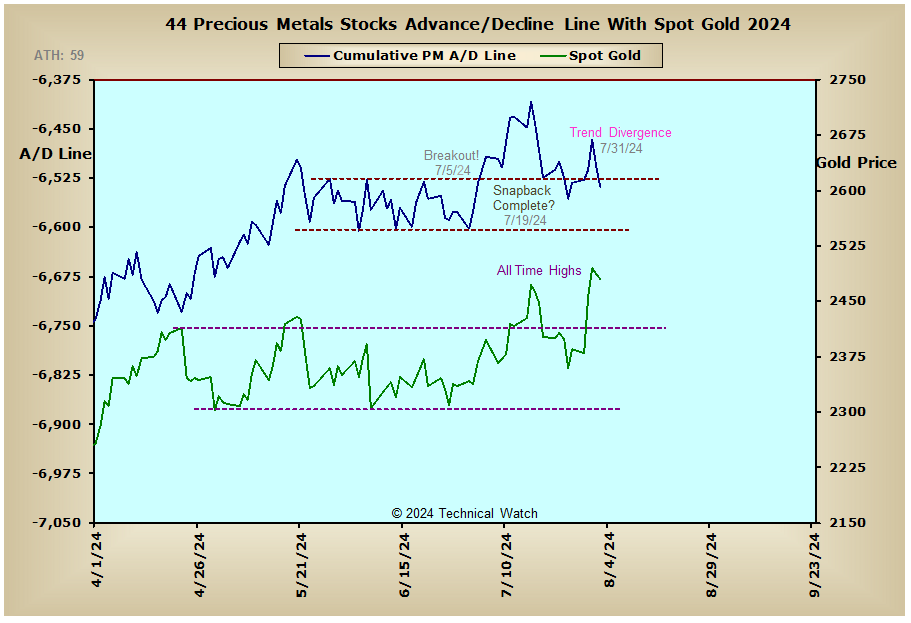

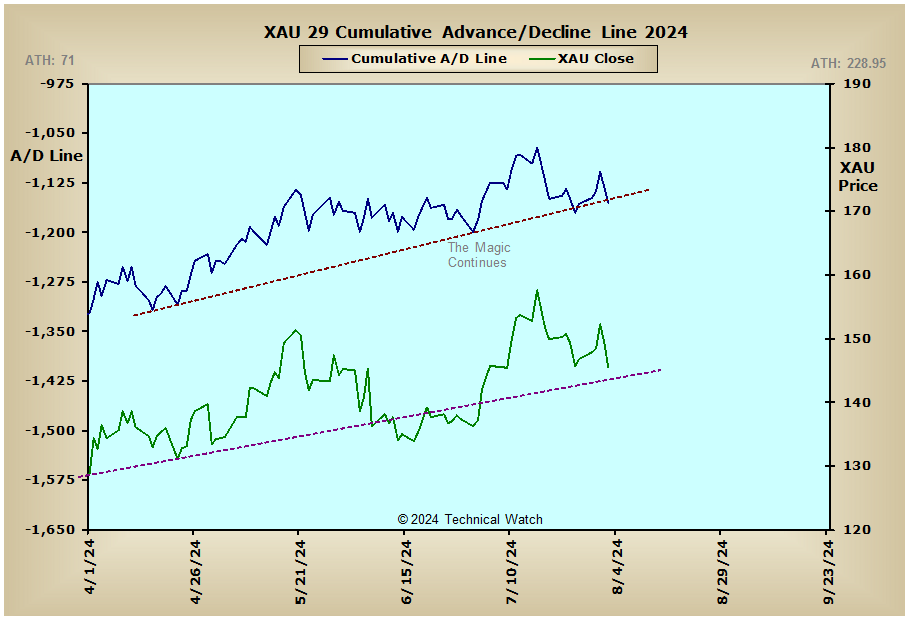

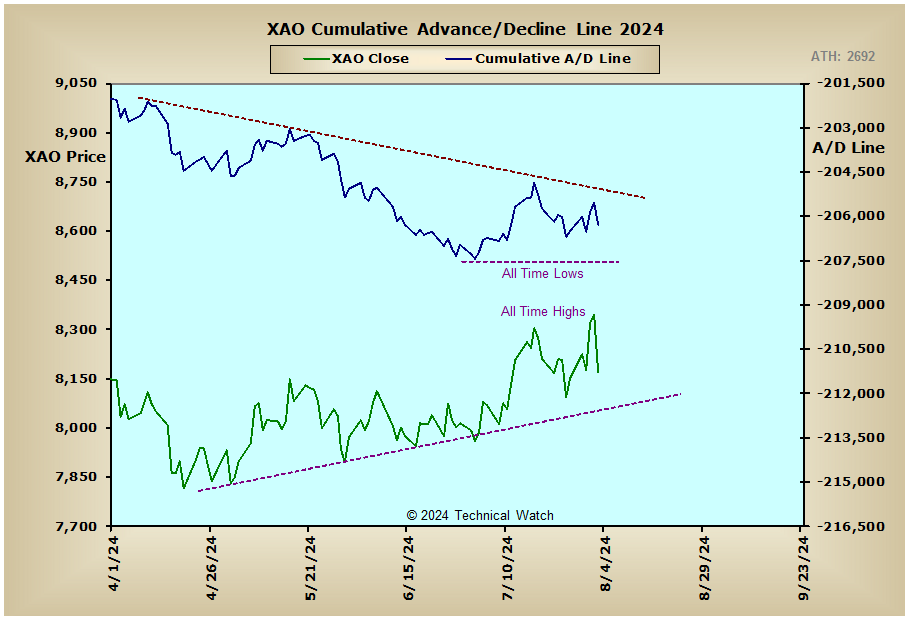

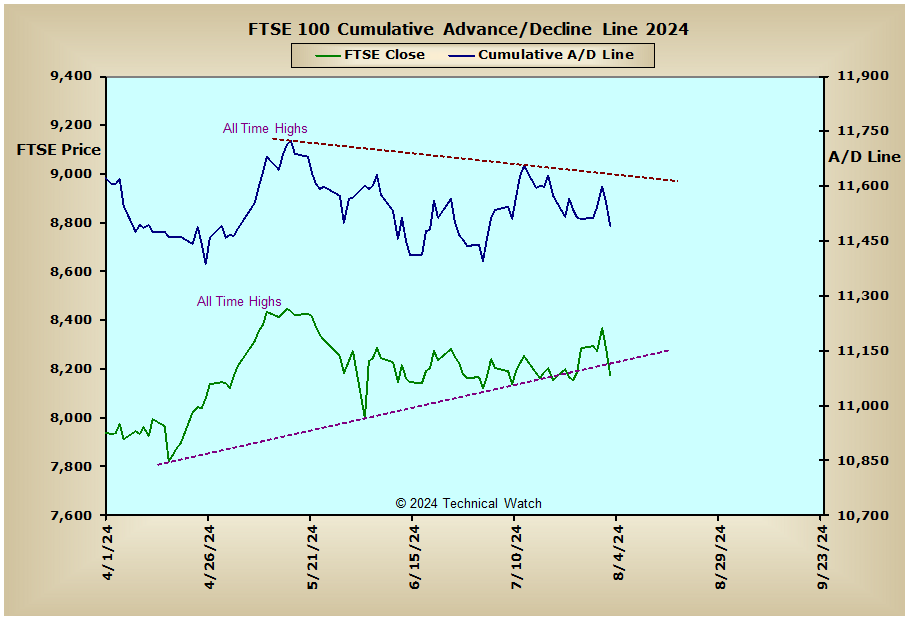

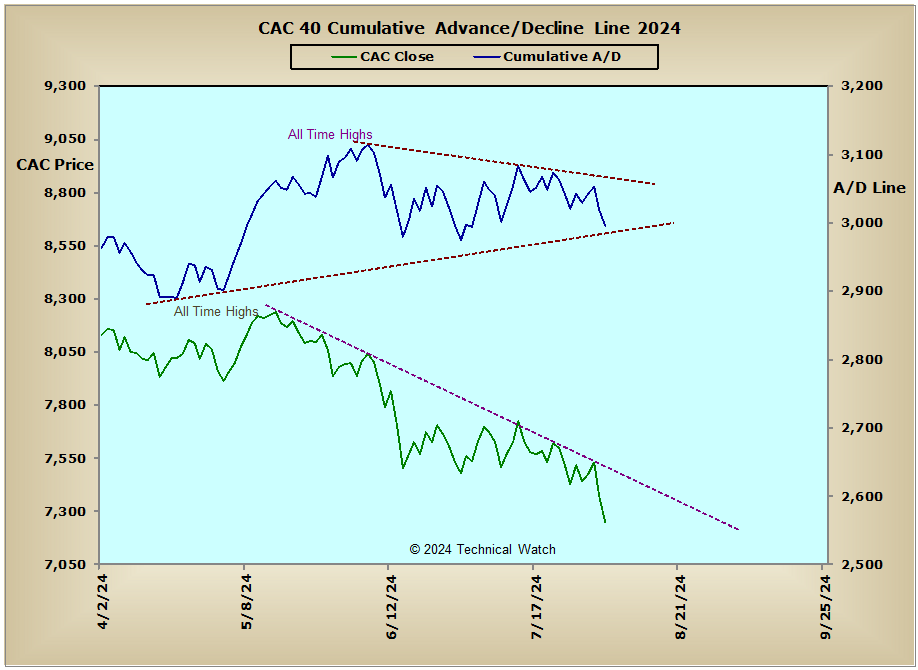

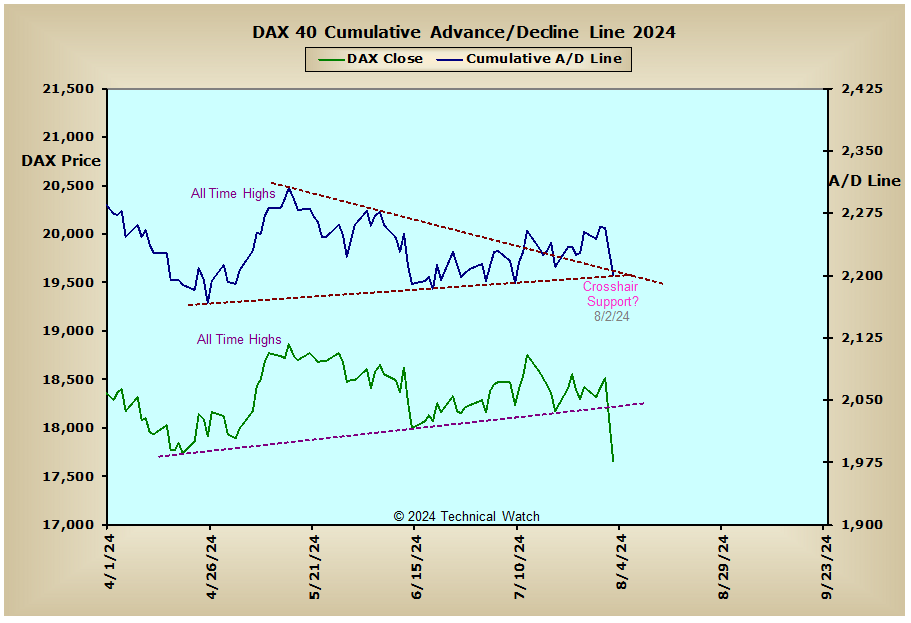

Looking at our usual list of cumulative breadth charts shows that the internals are not that bad at this stage with bottoms above bottoms still controlling their intermediate term patterns. Interest rate sensitive issues exploded to the upside late in the week with the NYSE Bond CEF advance/decline line now 962 net advancing issues away from reaching its all time highs. The Precious Metals advance/decline line provided us with a point of bearish "trend divergence" this past week as the price of gold moved to all time highs. European issues are now starting to sag to the downside as there seems a pick up of cultural instability in the United Kingdom and other continental nations. All of this, of course, is bullish on a contrarian basis, but at the same time, you never really know what might happen with human emotionalism becomes a market related albatross.

So with the BETS also moving sharply lower to a reading of -5 from last week's +35, traders and investors are now forced back to a neutral view of the markets. As we open up the week ahead we see that all of the breadth and volume McClellan Oscillators have now moved back into negative territory with their respective component measures highly mixed. This kind of technical sloppiness is always due to something that would be unexpected where knee-jerk price reactions take place. That said, one can never underestimate human emotion when panic sets in, so the near term waters could be challenging for both traders and investors alike. The NYSE Open 10 TRIN is now deeply "oversold" at 1.26, but on the other hand, the NASDAQ Open 10 TRIN is closer to still being "overbought" at .86. Both the 10 day averages of the CBOE and Equity put/call ratios jumped sharpy higher last week after being at their lowest ratio levels since the August price highs in 2023, while put volatility premiums exploded to the upside to their highest levels since the price lows in early November of 2023. Technically speaking, this all points to an important price low, but with the new found idea that the fad in artificial intelligence stocks may not be as important as once thought, along with a lot of geopolitical instability, this could turn out to be something more closely related to that of a COVID crash scenario as well. In any event, it's now time to become defensive traders and investors and stand aside until the dust settles a bit to allow this bearish ambush run it's course before coming up with a revised trading plan for the rest of the month.

Have a great trading week!

US Equity Markets:

US Interest Rates:

US Sectors:

Precious Metals:

Australia:

England:

France:

Germany:

India: