I'm seeing something in my charts I have never seen before!

I used Gann, Elliott Wave, FIB and Astrology to come to my possible conclusion: Two possible ~10% crashes, one on August 19th and one on Sept 3rd.

Here is a link to my BLOG with chart.

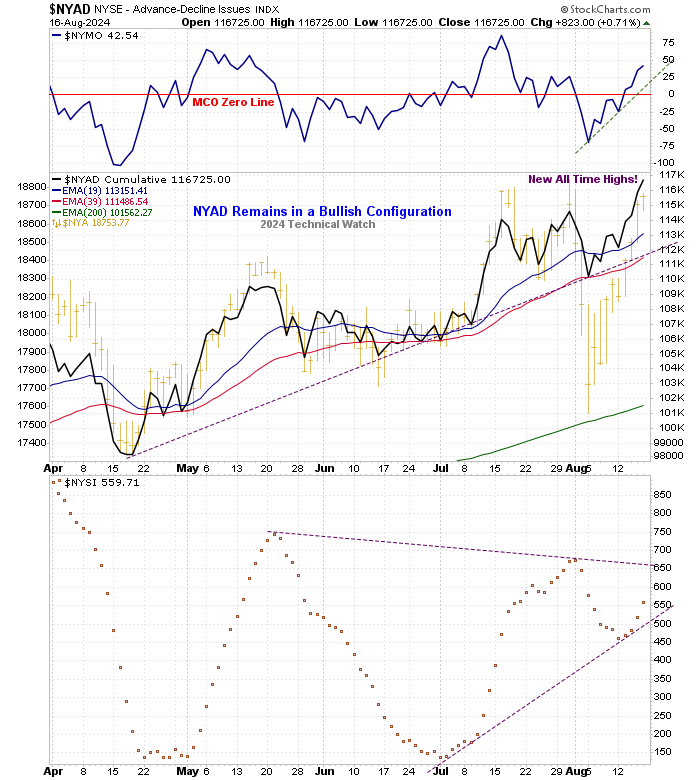

The move off the August 5 low is almost parabolic. You don't see these kinds of moves in bull markets, bear markets, yes.

I don't see this market recovering to new highs this year or even next. I see a hard landing by around November 18 and a possible retest around Dec 24, but no more ~10% daily crashes likely, just an insidious bear market.

Just my 2 cents for what it's worth!

Have fun guys![]()

blu