Posted 09 September 2006 - 11:59 AM

Randy,

VERY nice work. One thing that you'll find interesting is looking at the Fully long or Fully short positions, especially with a moving average.

In the years that I've been doing the FF/WSS surveys, I've found that when the sample group is relatively stable, the statistical caveats are pretty meaningless. I look at the same group of voters week after week. They don't change and sans a couple vacations, the number of responses is rather stable. As such (and as Carl Swenlin will attest), I can glean a lot more out of the data than a standard statistical approach would be able to or would predict.

The FF board is similar, but there are some potential problems. One is the "hot hand 'guru'" problem, where one or more of our number who are particularly respected and or have been very right in public for a while sways a number of votes, perhaps making our poll "lean" more than it might otherwise. That said, it's also pretty possible that many in the segment of the market that FF represents are ALSO looking at the same things that make that "hot handed 'guru'" hold a given position. After all, there's very little that's new under the sun, and if someone is using something available to all in multiple TA packages or on multiple sites, then it doesn't really matter that greenie (e.g) has found the holy grail of trading and is sharing it on TT--some other geniuses are doing the same thing elsewhere. IOW, it's pretty likely that TT sentiment, at least when smoothed, fairly consistently measures a certain segment of sentiment.

I also think it has value to look at participation. The mere act of voting, say, "100% Long" says something about sentiment. When a lot of people are voting that way, it says even more. Also, when voting goes way down, it says something as well. What? Well, I have some theories, but I'm not 100% sure I'm reading it right.

Mark

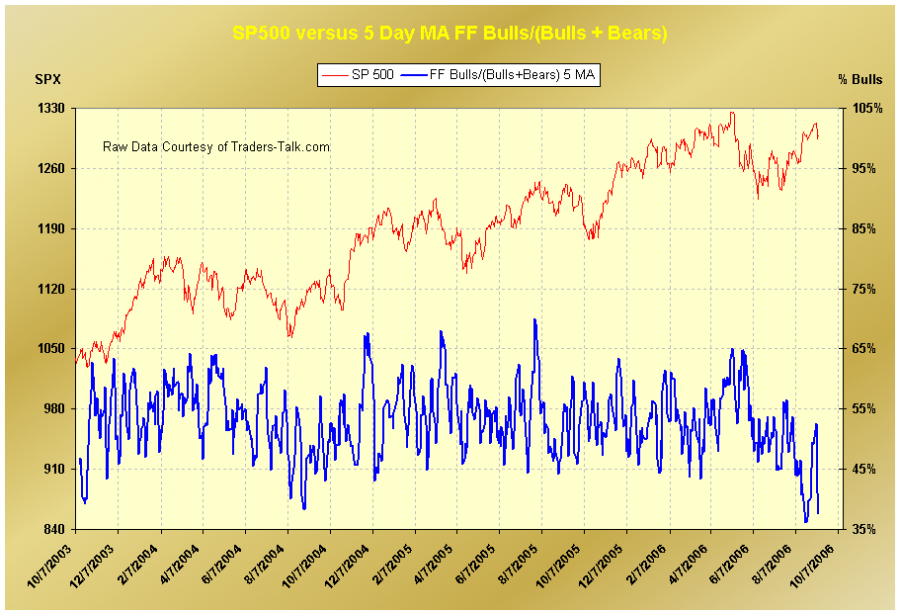

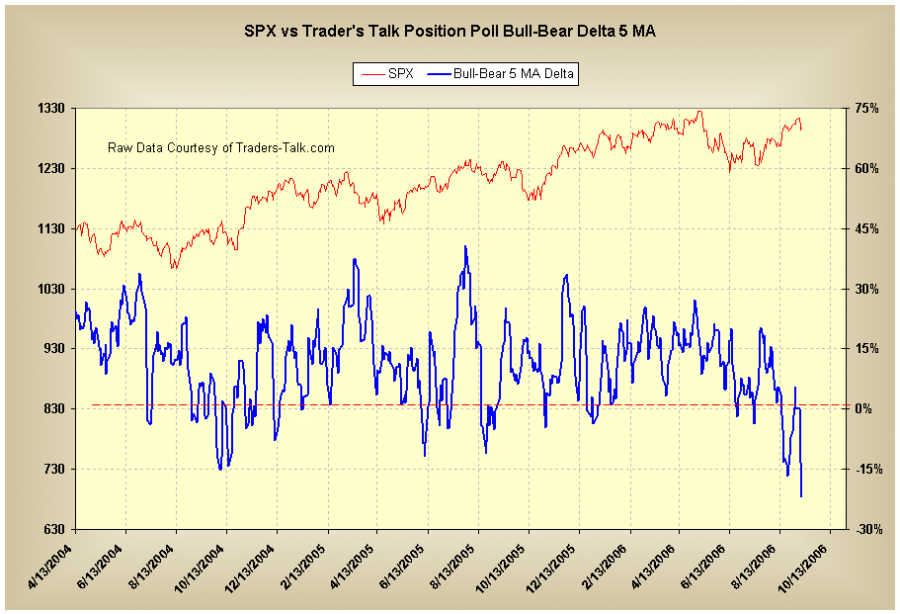

Next is the "Position Poll" results since its inception in the spring of 2004. Partial and Fully long- Partial and Fully short position votes are grouped as bullish or bearish positions respectively. A 5 day SMA of each group is derived, then the blue curve is determined by: Bull 5 day MA - Bear 5 Day MA

Next is the "Position Poll" results since its inception in the spring of 2004. Partial and Fully long- Partial and Fully short position votes are grouped as bullish or bearish positions respectively. A 5 day SMA of each group is derived, then the blue curve is determined by: Bull 5 day MA - Bear 5 Day MA

FWIW

Randy N.

FWIW

Randy N.

This topic is locked

This topic is locked